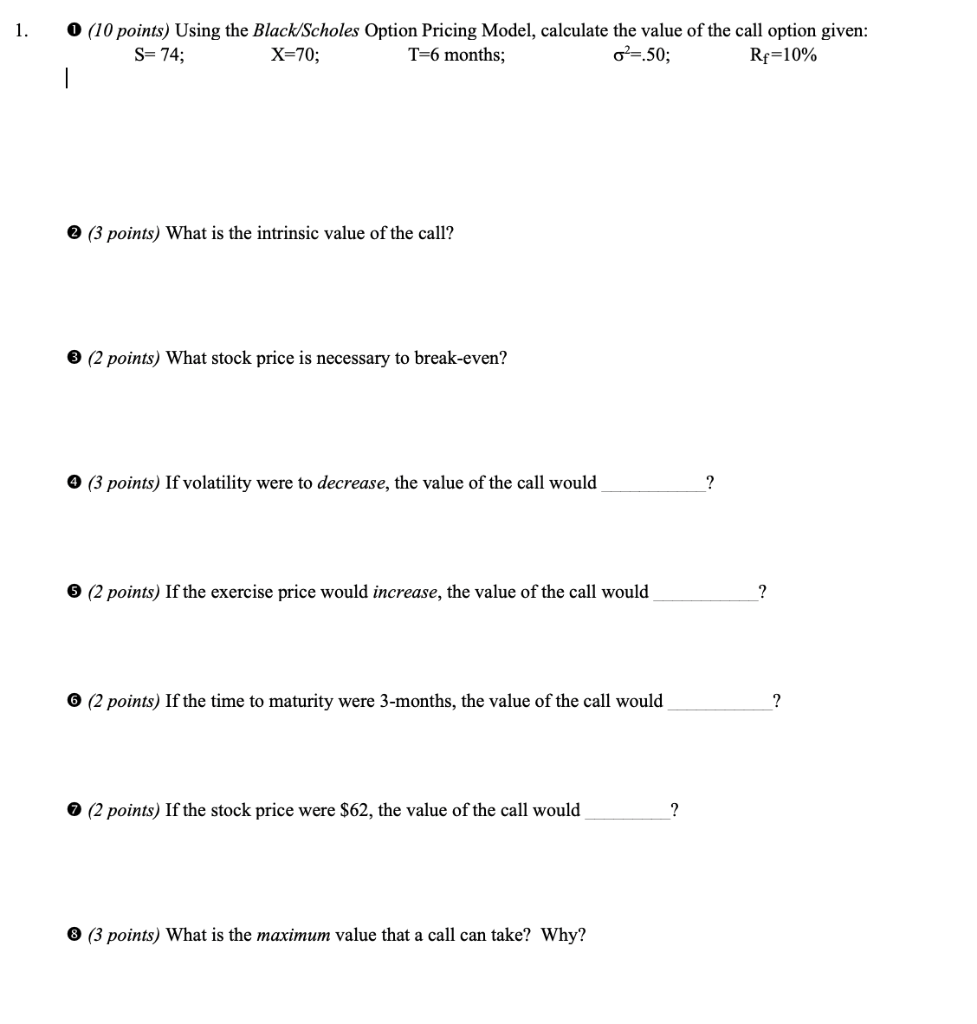

Question: (1) (10 points) Using the Black/Scholes Option Pricing Model, calculate the value of the call option given: S=74; X=70;T=6 months; 2=.50 Rf=10% (2) (3 points)

(1) (10 points) Using the Black/Scholes Option Pricing Model, calculate the value of the call option given: S=74; X=70;T=6 months; 2=.50 Rf=10% (2) (3 points) What is the intrinsic value of the call? (3) (2 points) What stock price is necessary to break-even? 4 (3 points) If volatility were to decrease, the value of the call would (5 (2 points) If the exercise price would increase, the value of the call would ? 6 (2 points) If the time to maturity were 3-months, the value of the call would ? 77 (2 points) If the stock price were $62, the value of the call would ? 8 (3 points) What is the maximum value that a call can take? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts