Question: 1. (10 pts.) A developer is proposing to build and operate a 6-store strip mall. Each unit would rent for $3,500 per month. It is

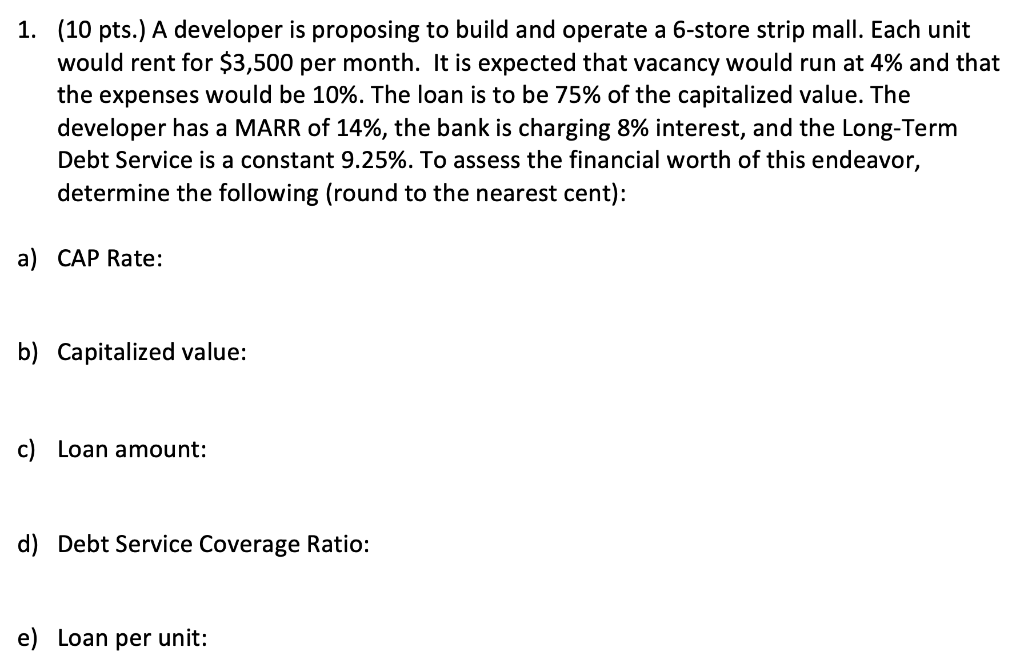

1. (10 pts.) A developer is proposing to build and operate a 6-store strip mall. Each unit would rent for $3,500 per month. It is expected that vacancy would run at 4% and that the expenses would be 10%. The loan is to be 75% of the capitalized value. The developer has a MARR of 14%, the bank is charging 8% interest, and the Long-Term Debt Service is a constant 9.25%. To assess the financial worth of this endeavor, determine the following (round to the nearest cent): a) CAP Rate: b) Capitalized value: c) Loan amount: d) Debt Service Coverage Ratio: e) Loan per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts