Question: A developer is proposing to build and operate a 16-unit apartment building. Each unit would rent for $3,250 per month. It is expected that vacancy

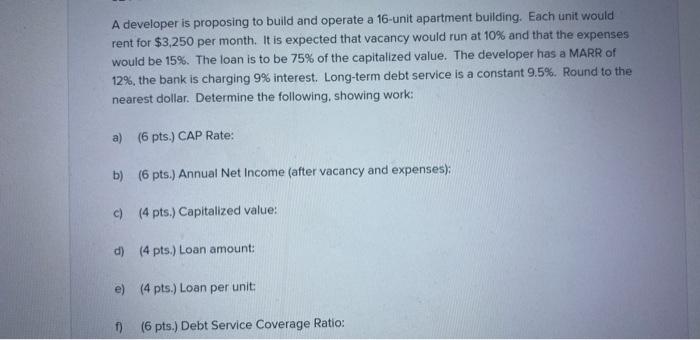

A developer is proposing to build and operate a 16-unit apartment building. Each unit would rent for $3,250 per month. It is expected that vacancy would run at 10% and that the expenses would be 15%. The loan is to be 75% of the capitalized value. The developer has a MARR of 12%, the bank is charging 9% interest. Long-term debt service is a constant 9.5%. Round to the nearest dollar. Determine the following, showing work: a) (6 pts.) CAP Rate: b) (6 pts.) Annual Net Income (after vacancy and expenses): c) (4 pts.) Capitalized value: d) (4 pts.) Loan amount: e) (4 pts.) Loan per unit: 1) (6 pts.) Debt Service Coverage Ratio: A developer is proposing to build and operate a 16-unit apartment building. Each unit would rent for $3,250 per month. It is expected that vacancy would run at 10% and that the expenses would be 15%. The loan is to be 75% of the capitalized value. The developer has a MARR of 12%, the bank is charging 9% interest. Long-term debt service is a constant 9.5%. Round to the nearest dollar. Determine the following, showing work: a) (6 pts.) CAP Rate: b) (6 pts.) Annual Net Income (after vacancy and expenses): c) (4 pts.) Capitalized value: d) (4 pts.) Loan amount: e) (4 pts.) Loan per unit: 1) (6 pts.) Debt Service Coverage Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts