Question: 1. (10 pts) Compute the expected return and the beta ( ) of the following portfolio: 2. (10 pts) The ZYX Corporation has the following

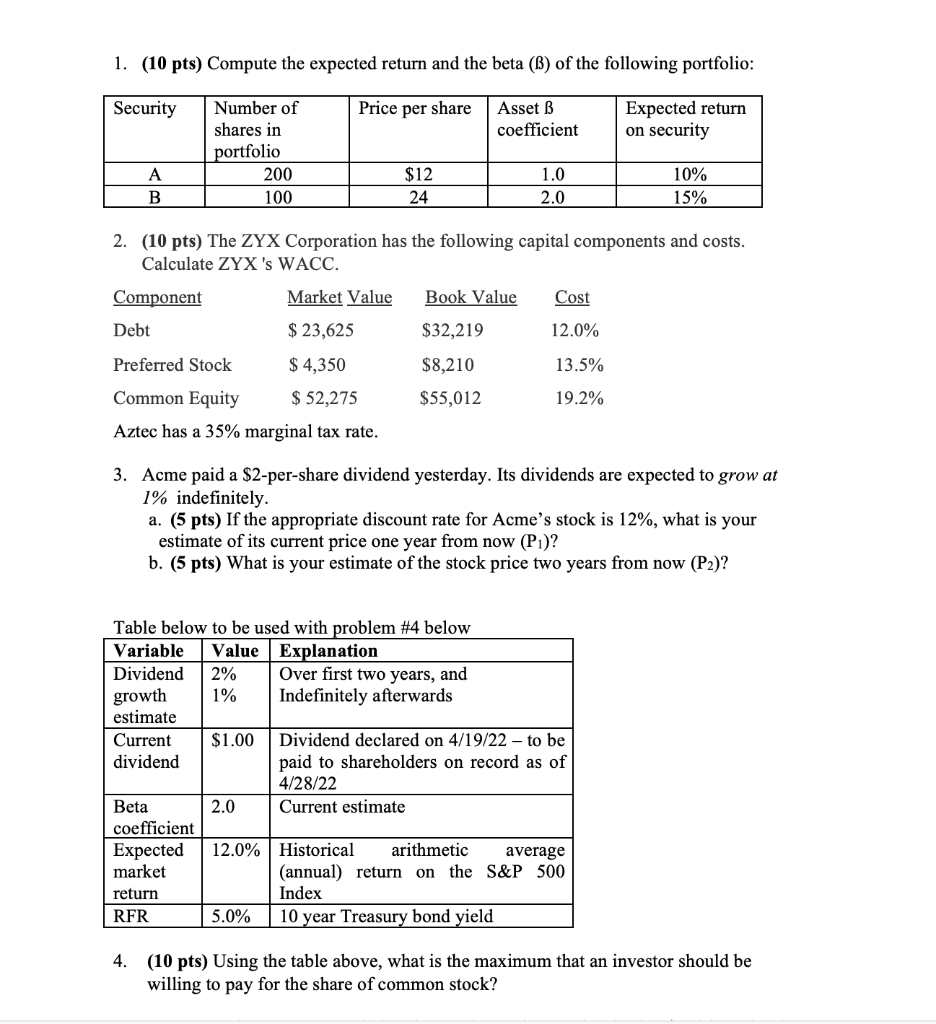

1. (10 pts) Compute the expected return and the beta ( ) of the following portfolio: 2. (10 pts) The ZYX Corporation has the following capital components and costs. Calculate ZYX's WACC. Aztec has a 35% marginal tax rate. 3. Acme paid a \$2-per-share dividend yesterday. Its dividends are expected to grow at 1% indefinitely. a. (5 pts) If the appropriate discount rate for Acme's stock is 12%, what is your estimate of its current price one year from now (P1) ? b. (5 pts) What is your estimate of the stock price two years from now (P2) ? Table below to be used with problem \#4 below 4. (10 pts) Using the table above, what is the maximum that an investor should be willing to pay for the share of common stock? 1. (10 pts) Compute the expected return and the beta ( ) of the following portfolio: 2. (10 pts) The ZYX Corporation has the following capital components and costs. Calculate ZYX's WACC. Aztec has a 35% marginal tax rate. 3. Acme paid a \$2-per-share dividend yesterday. Its dividends are expected to grow at 1% indefinitely. a. (5 pts) If the appropriate discount rate for Acme's stock is 12%, what is your estimate of its current price one year from now (P1) ? b. (5 pts) What is your estimate of the stock price two years from now (P2) ? Table below to be used with problem \#4 below 4. (10 pts) Using the table above, what is the maximum that an investor should be willing to pay for the share of common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts