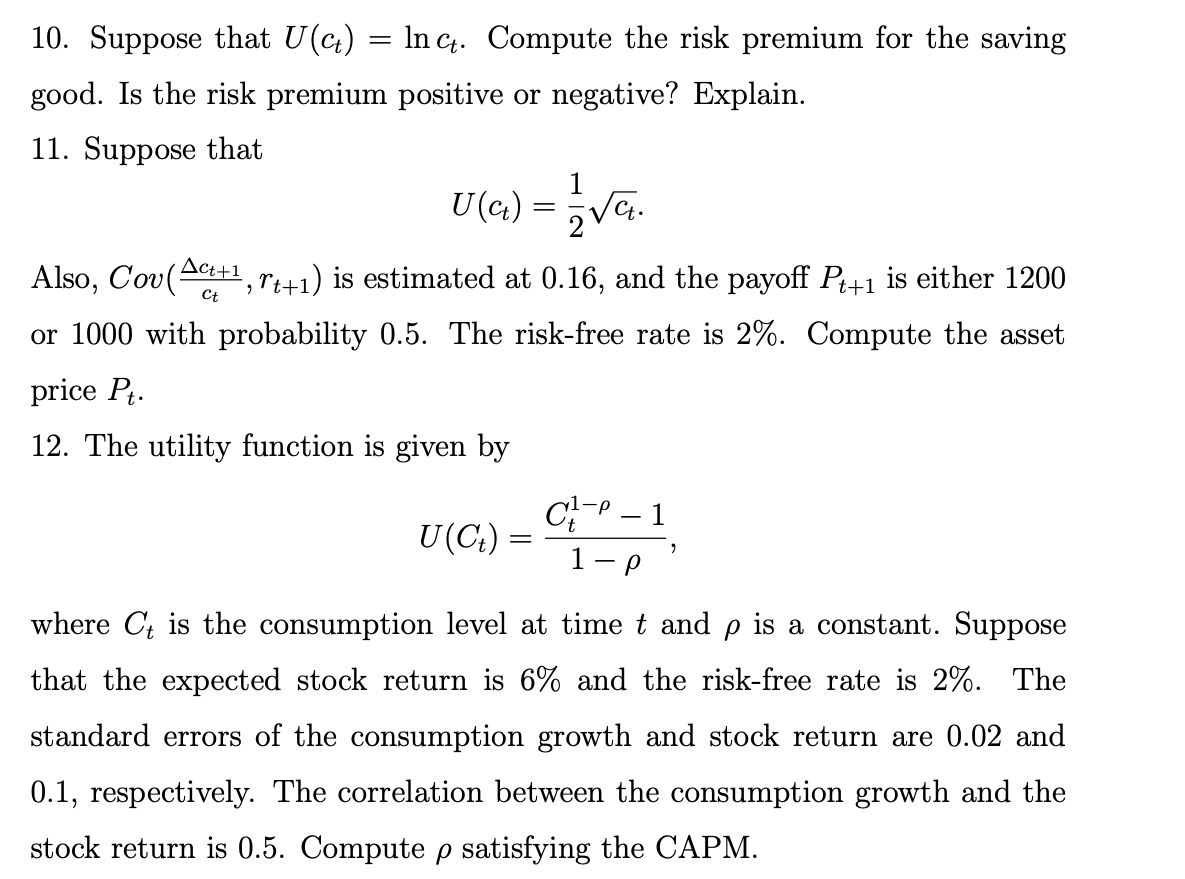

Question: = +1 10. Suppose that U(a) = ln ct. Compute the risk premium for the saving good. Is the risk premium positive or negative? Explain.

= +1 10. Suppose that U(a) = ln ct. Compute the risk premium for the saving good. Is the risk premium positive or negative? Explain. 11. Suppose that U(a) = va. . Also, Cou(Act+1, r4+1) is estimated at 0.16, and the payoff Pz+1 is either 1200 or 1000 with probability 0.5. The risk-free rate is 2%. Compute the asset price Pt. 12. The utility function is given by C] U(Ct) = t1 Ct -P 1 7 1 where Ct is the consumption level at time t and p is a constant. Suppose that the expected stock return is 6% and the risk-free rate is 2%. The standard errors of the consumption growth and stock return are 0.02 and 0.1, respectively. The correlation between the consumption growth and the stock return is 0.5. Compute p satisfying the CAPM. = +1 10. Suppose that U(a) = ln ct. Compute the risk premium for the saving good. Is the risk premium positive or negative? Explain. 11. Suppose that U(a) = va. . Also, Cou(Act+1, r4+1) is estimated at 0.16, and the payoff Pz+1 is either 1200 or 1000 with probability 0.5. The risk-free rate is 2%. Compute the asset price Pt. 12. The utility function is given by C] U(Ct) = t1 Ct -P 1 7 1 where Ct is the consumption level at time t and p is a constant. Suppose that the expected stock return is 6% and the risk-free rate is 2%. The standard errors of the consumption growth and stock return are 0.02 and 0.1, respectively. The correlation between the consumption growth and the stock return is 0.5. Compute p satisfying the CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts