Question: 1 ( 2 0 2 5 Spring ) Question 6 , P 7 - 1 8 ( static ) HW score: 7 5 % ,

Spring

Question Pstatic

HW score: of points

Part of

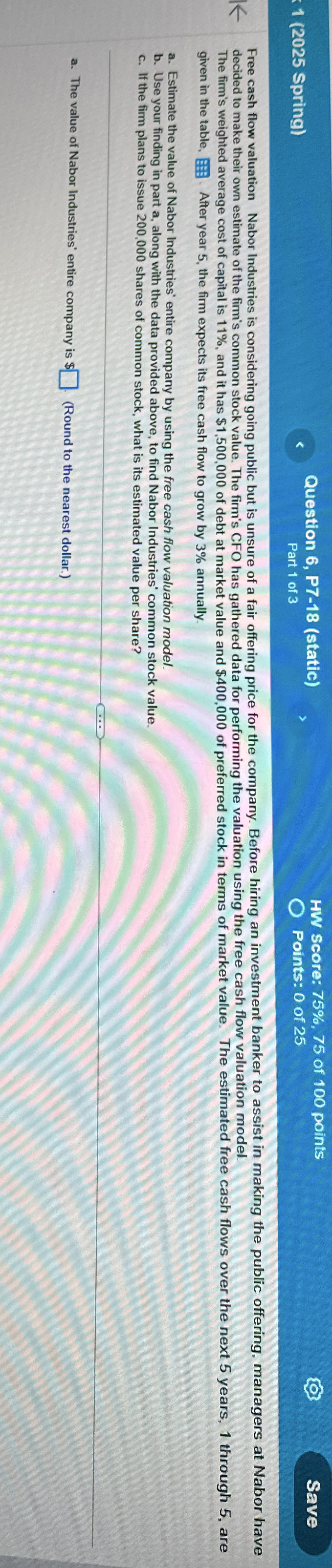

Points: of decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model. given in the table, After year the firm expects its free cash flow to grow by annually.

a Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model.

b Use your finding in part a along with the data provided above, to find Nabor Industries' common stock value.

c If the firm plans to issue shares of common stock, what is its estimated value per share?

a The value of Nabor Industries' entire company is $ Round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock