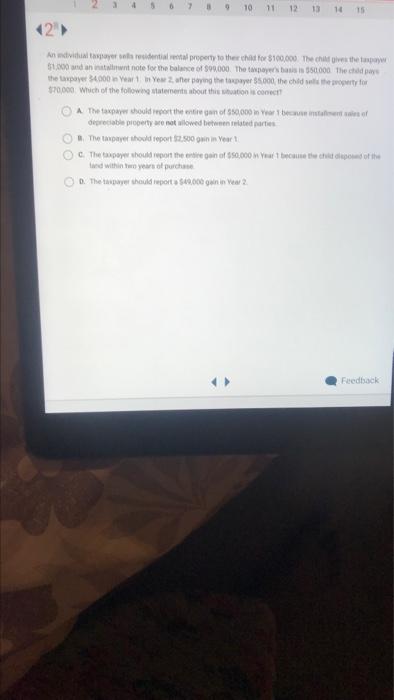

Question: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 12 An individual taxpayer sells residential rental property to their

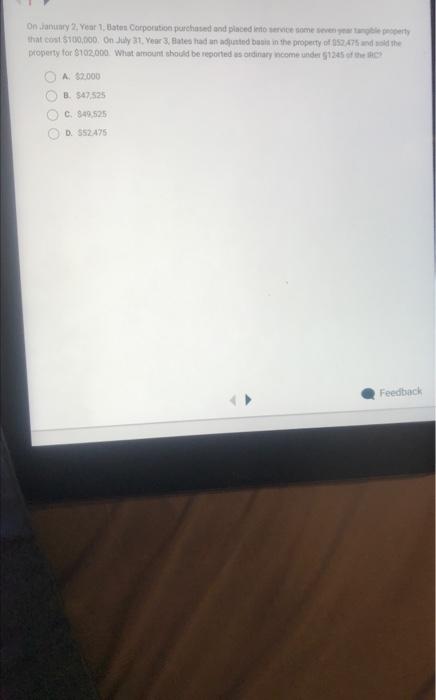

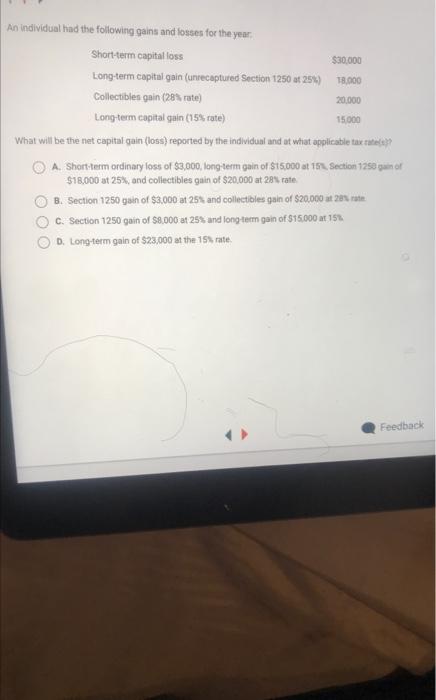

deprociable picoenty we not allowed betemen ielated parties Ind within tero years of purchase. A. 82000 B. 547525 c. 849,525 D. 552475 An individual had the following gains and loseses for the year: What will be the net capital gain (loss) reported by the individual and at what applicable tax rateis? A. Shortterm ordinary loss of $3,000, long-term gain of $15,000 at 15 . Section 125 gain of $18,000 at 25%, and collectibles gain of $20,000 at 2 . 1 rate. B. Section 1250 gain of $3.000 at 25$ and collectibles gain of $20.000 at 26s rate C. Section 1250 gain of $8.000 at 25% and longterm gain of $15.000 at 15% D. Long-term gain of $23,000 at the 152 rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts