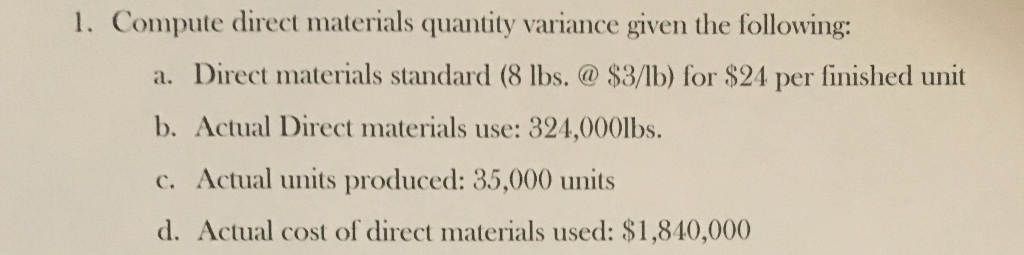

Question: 1. Compute direct materials quantity variance given the following: a. Direct materials standard (8 lbs. $3/lb) for $24 per finished unit b. Actual Direct materials

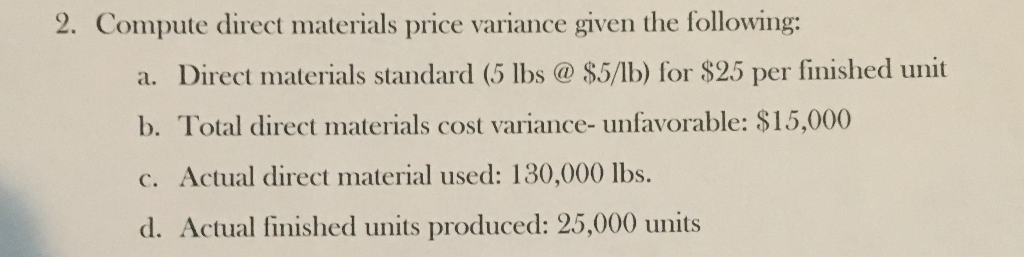

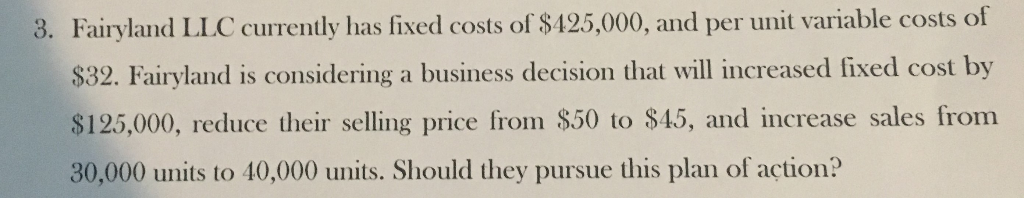

1. Compute direct materials quantity variance given the following: a. Direct materials standard (8 lbs. $3/lb) for $24 per finished unit b. Actual Direct materials use: 324,000lbs. c. Actual units produced: 35,000 units d. Actual cost of direct materials used: $1,840,000 2. Compute direct materials price variance given the following: a. Direct materials standard (5 lbs @ $5/lb) for $25 per finished unit b. Total direct materials cost variance- unfavorable: $15,000 c. Actual direct material used: 130,000 lbs. d. Actual finished units produced: 25,000 units Fairyland LIC currently has fived costs of $125,000, and per unit variable costs of $32. Fairyland is considering a business decision that will increased fixed cost by $125,000, reduce their selling price from $50 to $45, and increase sales from 30,000 units to 40,000 units. Should they pursue this plan of action? 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts