Question: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. What's the future value of an $1,100 quarterly payment for 25 years at 7%

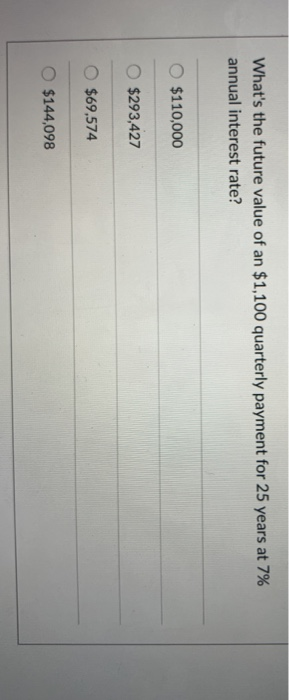

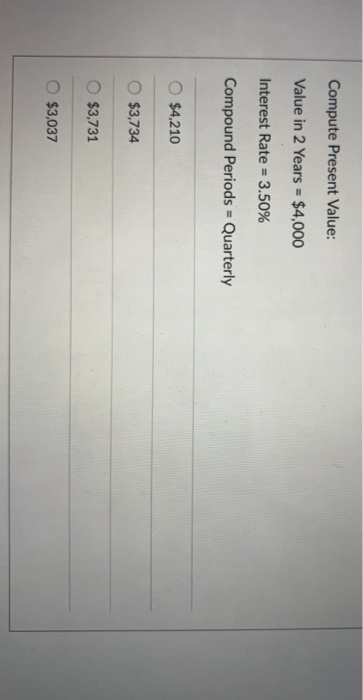

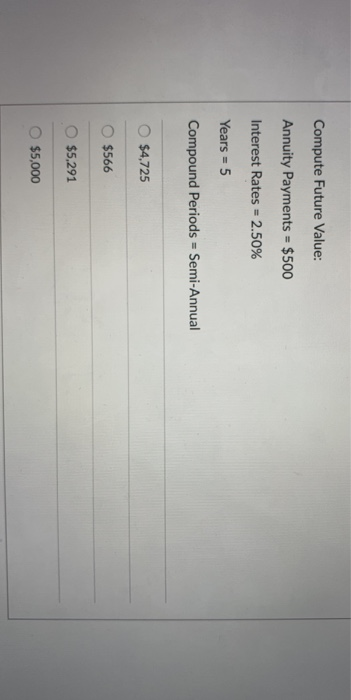

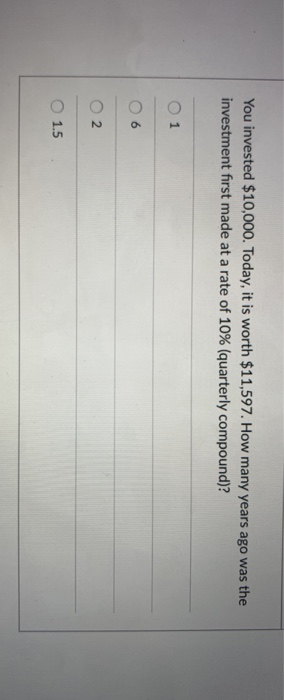

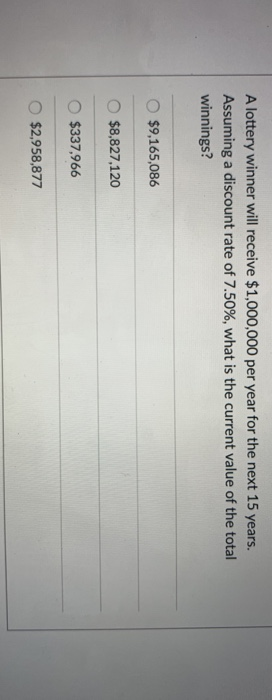

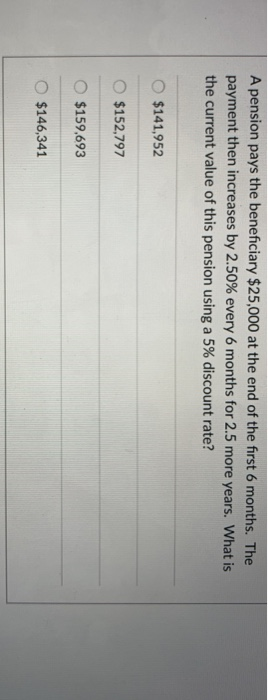

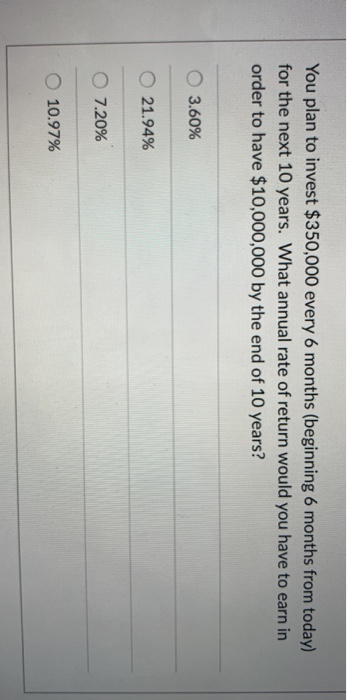

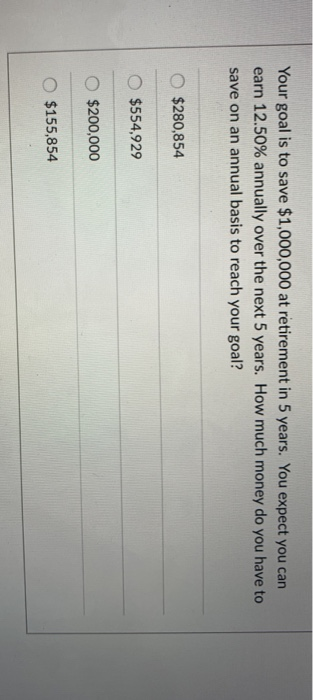

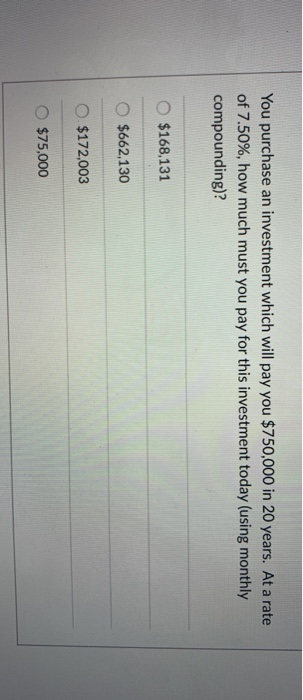

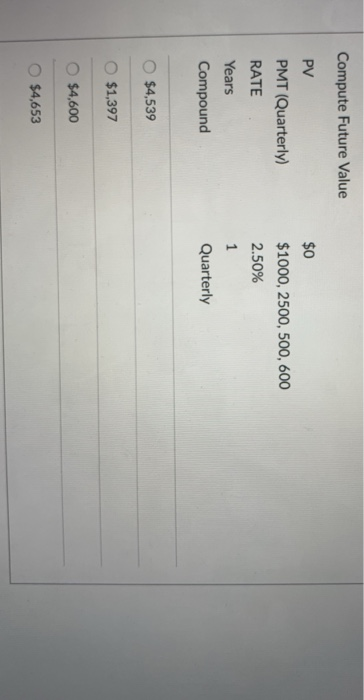

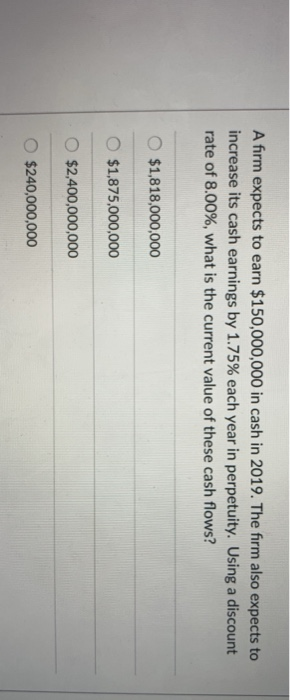

What's the future value of an $1,100 quarterly payment for 25 years at 7% annual interest rate? O $110,000 O $293,427 O $69,574 $144,098 Compute Present Value: Value in 2 Years = $4,000 Interest Rate-3.50% Compound Periods Quarterly O $4,210 o $3.734 O $3,731 O $3,037 Compute Future Value: Annuity Payments $500 Interest Rates-2.50% Years = 5 Compound Periods = Semi-Annual O $4,725 O $566 O$5,291 O $5,000 You invested $10,000. Today, it is worth $11,597. How many years ago was the investment first made at a rate of 10% (quarterly compound? 02 O 1.5 A lottery winner will receive $1,000,000 per year for the next 15 years. Assuming a discount rate of 7.50%, what is the current value of the total winnings? $9,165,086 $8,827,120 O $337,966 o $2,958,877 A pension pays the beneficiary $25,000 at the end of the first 6 months. The payment then increases by 2.50% every 6 months for 2.5 more years. What is the current value of this pension using a 5% discount rate? O$141,952 $152,797 O $159,693 O $146,341 You plan to invest $350,000 every 6 months (beginning 6 months from today) for the next 10 years. What annual rate of return would you have to earn in order to have $10,000,000 by the end of 10 years? 3.60% 0 21.94% 7.20% 0 10.97% Your goal is to save $1,000,000 at retirement in 5 years. You expect you can earn 12.50% annually over the next 5 years. How much money do you have to save on an annual basis to reach your goal? $280,854 O$554,929 $200,000 O $155,854 You purchase an investment which will pay you $750,000 in 20 years. At a rate of 7.50%, how much must you pay for this investment today (using monthly compounding)? O $168,131 $662,130 O $172,003 $75,000 Compute Future Value PV PMT (Quarterly) RATE Years Compound $0 $1000, 2500, 500, 600 2.50% Quarterly O $4,539 O $1,397 O $4,600 o $4,653 A firm expects to earn $150,000,000 in cash in 2019. The firm also expects to increase its cash earnings by 1.75% each year in perpetuity. Using a discount rate of 8.00%, what is the current value of these cash flows? O $1,818,000,000 O $1,875,000,000 O $2,400,000,000 O $240,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts