Question: QUESTION 5 (20 Marks) REQUIRED Answer the questions based on the information supplied. 5.1 REQUIRED Use the information provided below to calculate the following. Where

QUESTION 5 (20 Marks) REQUIRED Answer the questions based on the information supplied.

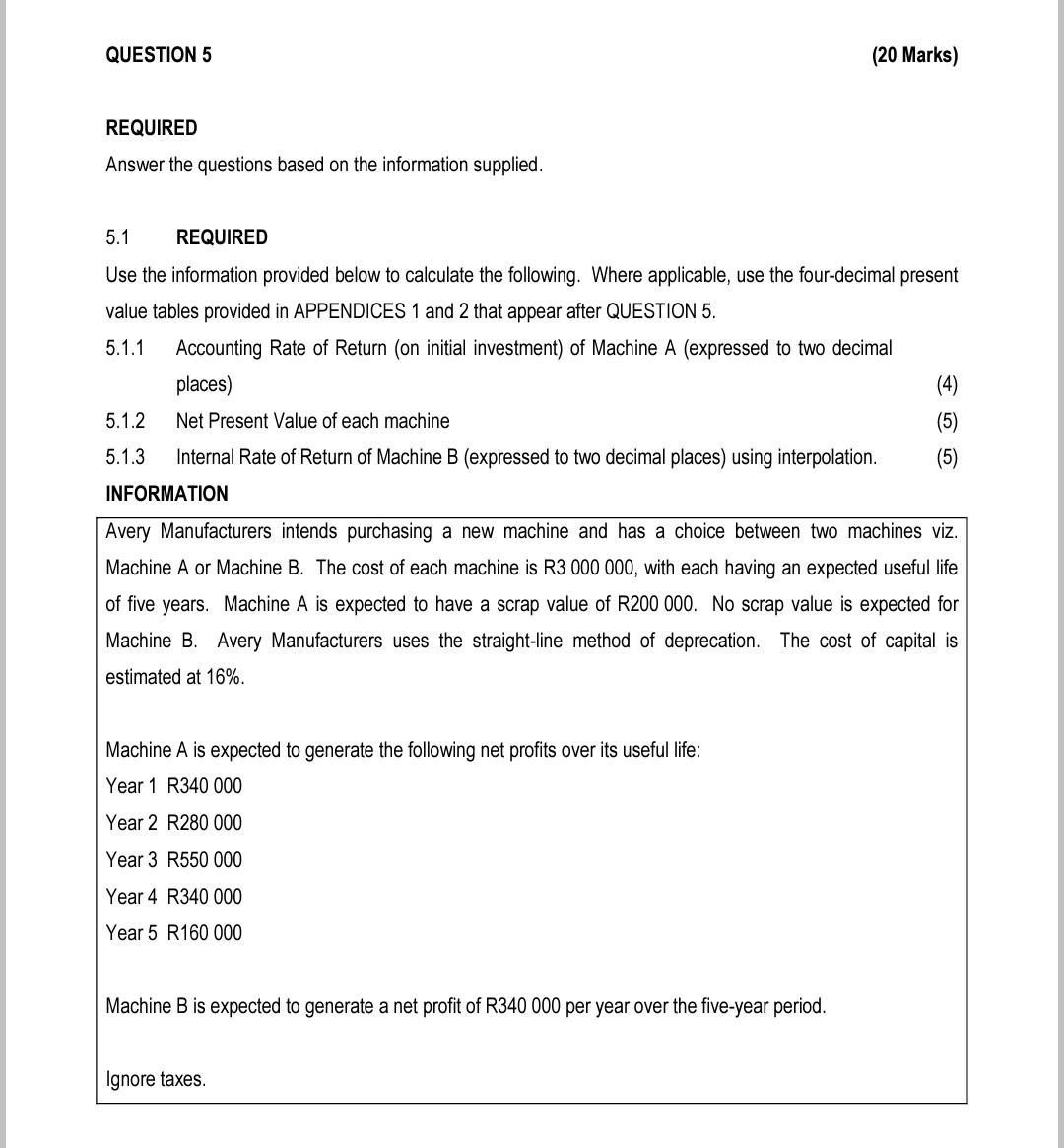

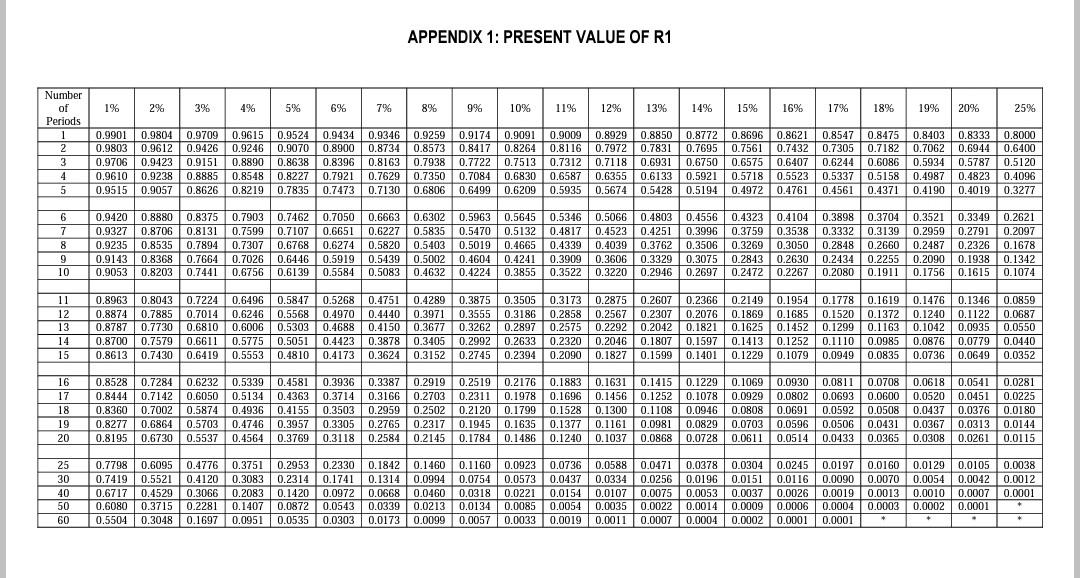

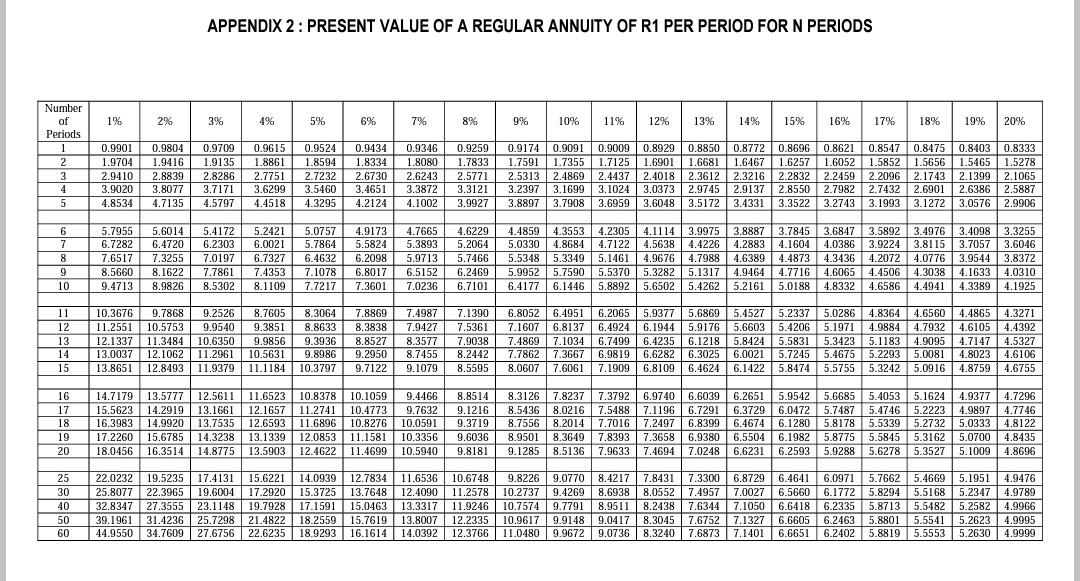

5.1 REQUIRED Use the information provided below to calculate the following. Where applicable, use the four-decimal present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5

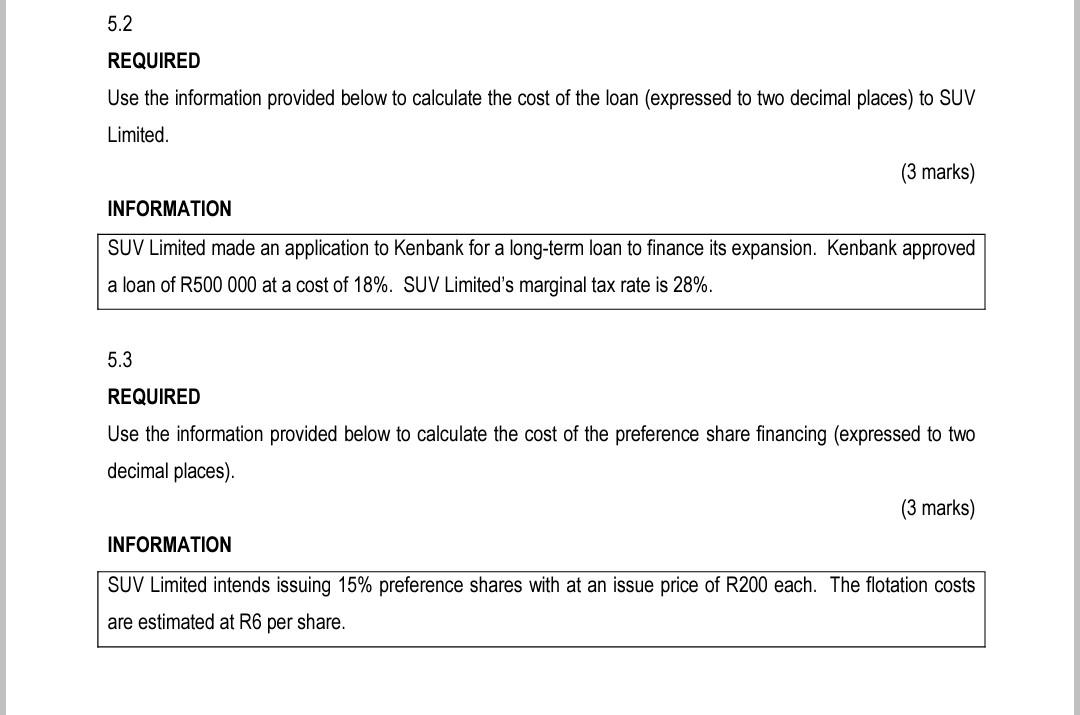

QUESTION 5 (20 Marks) REQUIRED Answer the questions based on the information supplied. 5.1 REQUIRED Use the information provided below to calculate the following. Where applicable, use the four-decimal present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. 5.1.1 Accounting Rate of Return on initial investment) of Machine A (expressed to two decimal places) 5.1.2 Net Present Value of each machine (5) 5.1.3 Internal Rate of Return of Machine B (expressed to two decimal places) using interpolation. (5) INFORMATION Avery Manufacturers intends purchasing a new machine and has a choice between two machines viz. Machine A or Machine B. The cost of each machine is R3 000 000, with each having an expected useful life of five years. Machine A is expected to have a scrap value of R200 000. No scrap value is expected for Machine B. Avery Manufacturers uses the straight-line method of deprecation. The cost of capital is estimated at 16%. Machine A is expected to generate the following net profits over its useful life: Year 1 R340 000 Year 2 R280 000 Year 3 R550 000 Year 4 R340 000 Year 5 R160 000 Machine B is expected to generate a net profit of R340 000 per year over the five-year period. Ignore taxes. 5.2 REQUIRED Use the information provided below to calculate the cost of the loan (expressed to two decimal places) to SUV Limited. (3 marks) INFORMATION SUV Limited made an application to Kenbank for a long-term loan to finance its expansion. Kenbank approved a loan of R500 000 at a cost of 18%. SUV Limited's marginal tax rate is 28%. 5.3 REQUIRED Use the information provided below to calculate the cost of the preference share financing (expressed to two decimal places). (3 marks) INFORMATION SUV Limited intends issuing 15% preference shares with at an issue price of R200 each. The flotation costs are estimated at R6 per share. APPENDIX 1: PRESENT VALUE OF R1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% % 16% 17% 18% 19% 20% 25% Number of Periods 1 2 3 4 5 0.9901 0.9804 0.9709 0.9615 0.9803 0.9612 0.9426 0.9240 0.9706 0.9423 0.9151 0.8890 0.9610 0.9238 0.8885 0.8548 0.9515 0.9057 0.8626 0.8219 0.9524 0.9434 0.9346 0.9259 0.9070 0.8900 0.8734 0.8734 0.8573 0.8638 0.8396 0.8163 0.7938 0.8227 0.7921 0.7629 0.7350 0.7835 0.7473 0.7130 0.6806 0.91740.9091 0.9009 0.8929 0.8850 0.8772 0.8696 0.8621 0.8547 0.8475 0.8403 0.8333 0.8000 0.8417 0.8264 0.8116 0.7972 0.7831 0.7695 0.75610.7432 0.7432 0.7305 0.7182 0.7062 0.6944 0.6400 0.7722 0.7513 0.7312 0.7118 0.6931 0.6750 0.6575 0.6407 0.6244 0.6086 0.5934 0.5787 0.5120 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 0.5718 0.55230.5337 0.5158 0.4987 0.4823 0.4096 0.6499 0.6209 0.5935 0.5674 0.5428 0.51940.4972 0.4761 0.4561 0.4371 0.41900.4019 0.3277 6 6 7 8 0.9420 0.8880 0.8375 0.9327 0.8706 0.8131 0.9235 0.8535 0.7894 0.9143 0.8368 0.7664 0.9053 0.8203 0.7441 0.7903 0.7462 0.7050 0.7050 0.6663 0.6302 0.7599 0.7107 0.6651 0.6227 0.5835 0.7307 0.6768 0.6274 0.5820 0.5403 0.7026 0.6446 0.5919 0.5439 0.5002 0.6756 0.6139 0.55840.5083 0.4632 0.5963 0.56450.5346 0.5066 0.5470 0.5132 0.4817 0.4523 0.5019 0.4665 0.4339 0.4039 0.4604 0.4241 0.3909 0.3606 0.4224 0.3855 0.3522 0.3220 0.4803 0.4251 0.3762 0.3329 0.2946 0.4556 0.4323 0.4104 0.3996 0.3759 0.3538 0.3506 0.3269 0.3050 0.3075 0.2843 0.2630 0.2697 0.2472 0.2267 0.3898 0.3332 0.2848 0.2434 0.2080 0.3704 0.3521 0.3139 0.2959 0.2660 0.2487 0.2255 0.2090 0.1911 0.1756 0.3349 0.2621 0.2791 0.2097 0.2326 0.1678 0.1938 0.1342 0.1615 0.1074 9 10 11 12 13 14 15 0.8963 0.8043 0.8874 0.788 0.8787 0.7730 0.8700 0.7579 0.8613 0.7430 0.7224 0.7014 0.6810 0.6611 0.6419 0.6496 0.5847 0.5268 0.4751 0.4289 0.6246 0.5568 0.4970 0.4440 0.3971 0.6006 0.5303 0.4688 0.4150 0.3677 0.5775 0.5051 0.4423 0.3878 0.3405 0.5553 0.4810 0.4173 0.3624 0.3152 0.3875 0.3505 0.3555 0.3186 0.3262 0.2897 0.2992 0.2633 0.2745 0.2394 0.3173 0.2858 0.2575 0.2320 0.2090 0.2875 0.2567 0.2292 0.2046 0.1827 0.2607 0.2366 0.2149 0.1954 0.2307 0.2076 0.1869 0.1685 0.2042 0.18210.1625 0.1452 0.1807 0.1597 0.1413 0.1252 0.1599 0.1401 0.1229 0.1079 0.1778 0.1520 0.1299 0.1110 0.0949 0.1619 0.1476 0.1346 0.1372 0.1240 0.1122 0.1163 0.1042 0.0935 0.0985 0.0876 0.0779 0.0835 0.0736 0.0649 0.0859 0.0687 0.0550 0.0440 0.0352 16 17 18 19 20 0.8528 0.7284 0.6232 0.8444 0.7142 0.6050 0.8360 0.7002 0.7002 0.5874 0.8277 0.6864 0.5703 0.8195 0.6730 0.5537 0.5339 0.4581 0.3936 0.5134 0.4363 0.3714 0.4936 0.4155 0.3503 0.4746 0.3957 0.3305 0.4564 0.3769 0.3118 0.3387 0.2919 0.3166 0.2703 0.2959 0.2502 0.2765 0.2317 0.2584 0.2145 0.2519 0.2176 0.2311 0.1978 0.2120 0.1799 0.1945 0.1635 0.1784 0.1486 0.1883 0.1631 0.1415 0.1229 0.1069 0.0930 0.1696 0.1456 0.1252 0.1078 0.0929 0.0802 0.1528 0.1300 0.1108 0.0946 0.0808 0.0691 0.1377 0.1161 0.0981 0.08290.0703 0.0596 0.1240 0.1037 0.0868 0.0728 0.0611 0.0514 0.0811 0.0708 0.0618 0.0541 0.0693 0.0600 0,0520 0.0451 0.0592 0.0508 0.0437 0.0376 0.0506 0.0431 0.0367 0.0313 0.0433 0.0365 0.0308 0.0261 0.0281 0.0225 0.0180 0.0144 0.0115 25 30 40 50 60 0.7798 0.6095 0.7419 0.5521 0.6717 0.4529 0.6080 0.3715 0.5504 0,3048 0.4776 0.4120 0.3066 0.2281 0.1697 0.3751 0.3083 0.2083 0.1407 0.0951 0.2953 0.2330 0.1842 0.1460 0.2314 0.1741 0.1314 0.0994 0.1420 0.0972 0.0668 0.0460 0.0872 0.0543 0.0339 0.0213 0.0535 0.0303 0.0173 0.0173 0.0099 0.1160 0.0923 0.0736 0.0754 0.0573 0.0437 0.0318 0.0221 0.0154 0.0134 0.0085 0.0054 0.0057 0.0033 0.0019 0.0588 0.0334 0.0107 0.0035 0.0011 0.0471 0.0256 0.0075 0.0022 0.0007 0.0378 0.0304 0.0245 0.0197 0.0160 0.0129 0.0196 0.0151 0.0116 0.0090 0.0070 0.0054 0.0053 0.0037 0.0026 0.0019 0.0013 0.0010 0.0014 0.0009 0.0006 0.0004 0.0003 0.0002 0.0004 0.0002 0.0001 0.0001 0.0105 0.0042 0.0007 0.0001 0.0038 0.0012 0.0001 + APPENDIX 2: PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS 1% 2% 3% 4% 5% 6% 7% 8% % 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% Number of Periods 1 2 3 4 5 0.9804 1.9416 0.9901 1.9704 2.9410 3.9020 4.8534 2.8839 0.9709 1.9135 2.8286 3.7171 4.5797 0.9615 1.8861 2.7751 3.6299 4.4518 0.9524 1.8594 2.7232 3.5460 4.3295 0.9434 1.8334 2.6730 3.4651 4.2124 0.9346 1.8080 2.6243 3.3872 4.1002 0.9259 1.7833 2.5771 3.3121 3.9927 0.9174 0.9091 0.90090.8929 0.8850 0.8772 0.8696 0.8621 0.8547 0.8475 0.8403 0.8333 1.7591 1.7355 1.7125 1.6901 1.6681 1.6467 1.6257 1.6052 1.5852 1.5656 1.5465 1.5278 2.5313 2.4869 2.4437 2.40182.3612 2.3216 2.2832 2.2459 2.2096 2.1743 2.1399 2.1065 3.2397 3.1699 3.1024 3.0373 2.9745 2.9137 2.8550 2.79822.7432 2.6901 2.6386 2.5887 3.8897 3.7908 3.6959 3.6048 3.5172 3.4331 3.3522 3.2743 3.1993 3.1272 3.0576 2.9906 3.8077 4.7135 6 7 8 9 10 5.7955 6.7282 7.6517 8.5660 9.4713 5.6014 6.4720 7.3255 8.1622 8.9826 5.4172 6.2303 7.0197 7.7861 8.5302 5.2421 6.0021 6.7327 7.4353 8.1109 5.0757 5.7864 6.4632 7.1078 7.7217 4.9173 5.5824 6.2098 6.8017 7.3601 4.7665 5.3893 5.9713 6.5152 7.0236 4.6220 5.2064 5.7466 6.2469 6.7101 4.4859 4.3553 4.2305 4.11143.9975 3.8887 5.0330 4.8684 4.7122 4.5638 4.4226 4.2883 5.5348 5.3349 5.1461 4.9676 4.7988 4.6389 5.9952 5.7590 5.5370 5.3282 5.1317 5.13174.9464 6.4177 6.1446 5.8892 5.6502 5.4262 5.42625.2161 3.7845 3.68473.5892 3.4976 4.1604 4.0386 3.9224 3.8115 4.4873 4.3436 4.2072 4.0776 4.7716 4.6065 4.45064.3038 5.0188 4.8332 4.6586 4.4941 3.4098 3.3255 3.70573,6046 3.9544 3.8372 4.1633 4.0310 4.3389 4.1925 11 12 13 14 15 10.3676 11.2551 12.1337 13.0037 13.8651 9.7868 10.5753 11.3484 12.106Z 12.8493 9.2526 9.9540 10.6350 11.2961 11.9379 8.7605 9.3851 9.9856 10.5631 11.1184 8.3064 8.8633 9.3936 9.8986 10.3797 7.8869 8.3838 8.8527 9.2950 9.7122 7.4987 7.9427 8.3577 8.7455 9.1079 7.1390 7.5361 7.9038 8.2442 8.5595 6.8052 6.4951 7.1607 6.8137 7.4869 7.1034 7.78627.3667 8.0607 7.6061 6.2065 6.4924 6.7499 6.9819 7.1909 5.9377 5.6869 6.1944 5.9176 6.4235 6.1218 6.6282 6.3025 6.8109 6.4624 5.45275.2337 5.6603 5.4206 5.8424 5.5831 6.0021 5.7245 6.1422 5.8474 5.0286 4.8364 4.6560 5.1971 4.9884 4.7932 5.3423 5.11834.9095 5.4675 5.2293 5.0081 5.5755 5.3242 5.0916 4.4865 4.6105 4.7147 4.8023 4.8759 4.3271 4.4392 4.5327 4.6106 4.6755 16 17 18 19 20 14.7179 15.5623 16.3983 17.2260 18.0456 13.577712.5611 14.2919 13.1661 14.9920 13.7535 15.6785 14.3238 16.3514 14.8775 11.6523 10.8378 10.1059 12.1657 11.2741 10.4773 12.6593 11.6896 10.8276 13.1339 12.085311.1581 13.5903 12.4622 11.4699 9.4466 9.7632 10.0591 10.3356 10.5940 8.8514 9.1216 9.3719 9.6036 9.8181 8.3126 7.8237 7.3792 6.9740 6.60396,2651 5.9542 8.5436 8.0216 7.54887.1196 6.7291 6.37296.0472 8.7556 8.2014 7.7016 7.2497 6.8399 6.46746.1280 8.9501 8.3649 7.8393 7.3658 6.9380 6.5504 6.1982 9.1285 8.5136 7.9633 7.4694 7.0248 6.6231 6.2593 5.6685 5.4053 5.1624 5.7487 5.4746 5.2223 5.8178 5.5339 5.2732 5.8775 5.5845 5.3162 5.9288 5.6278 5.3527 4.9377 4.7296 4.9897 4.7746 5.0333 4.8122 5.0700 4.8435 5.1009 4.8696 25 30 40 50 60 22.0232 25.8077 32.8347 39.1961 44.9550 19.5235 17.4131 15.6221 22.3965 19.600417.2920 27.3555 23.1148 19.7928 31.4236 25.7298 21.4822 34.7609 27.6756 22.6235 14.0939 12.7834 11.6536 10.6748 15.3725 13.7648 12.4090 11.2578 17.1591 15.0463 13.3317 11.9246 18.2559 15.7619 13,8007 12.2335 18.9293 16.1614 14.0392 12.3766 9.8226 9.0770 8.4217 7.8431 7.3300 6.8729 6.4641 6.0971 5.7662 5.4669 5.1951 4.9476 10.2737 9.4269 8.6938 8.0552 7.4957 7.0027 6.5660 6.1772 5.8294 5.8294 5.5168 5.2347 4.9789 10.75749.7791 8.9511 8.2438 7.6344 7.10506.6418 6.2335 5.8713 5.5482 5.2582 4.9966 10.9617 9.9148 9.0417 8.3045 7.6752 7.1327 6.66056.2463 5.8801 5.5541 5.2623 5.26234.9995 11.0480 9.9672 9.0736 8.3240 7.6873 7.1401 6.6651 6.2402 5.8819 5.5553 5.2630 4.9999

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts