Question: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. A board of directors with a higher concentration of independent directors that receive

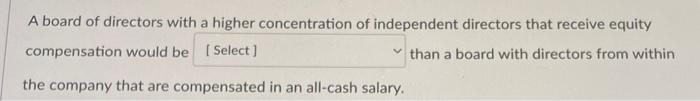

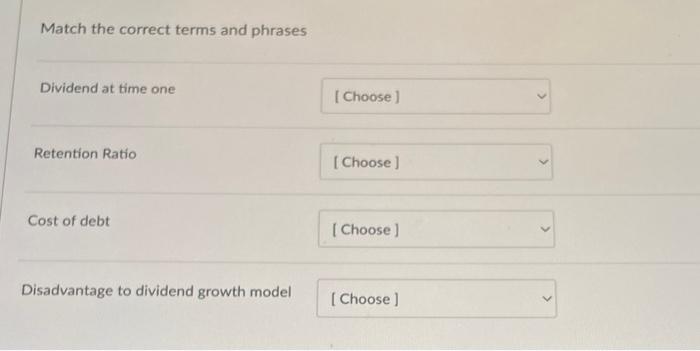

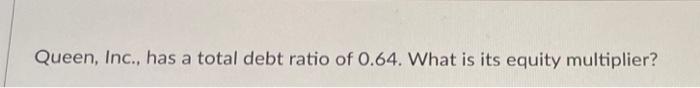

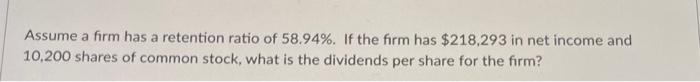

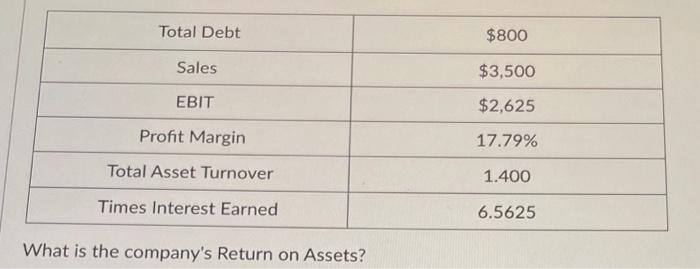

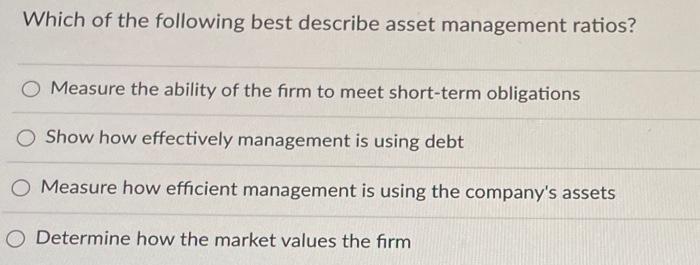

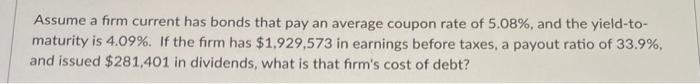

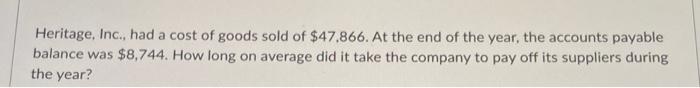

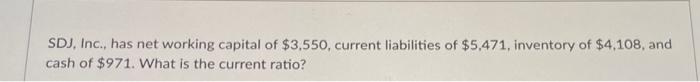

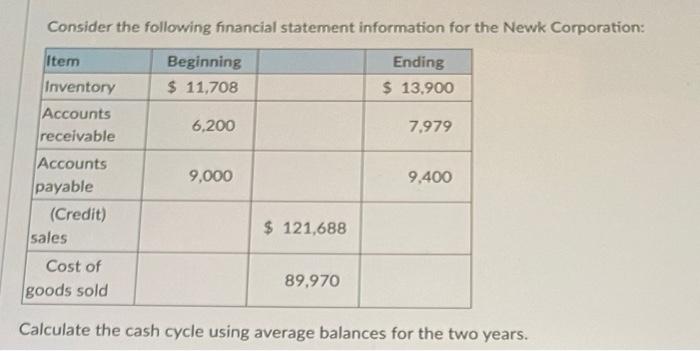

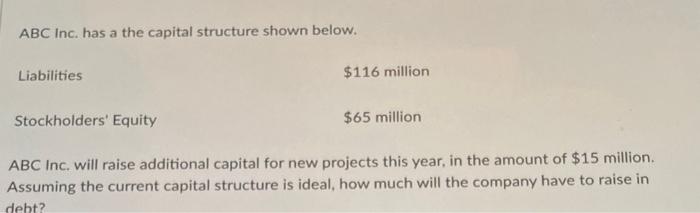

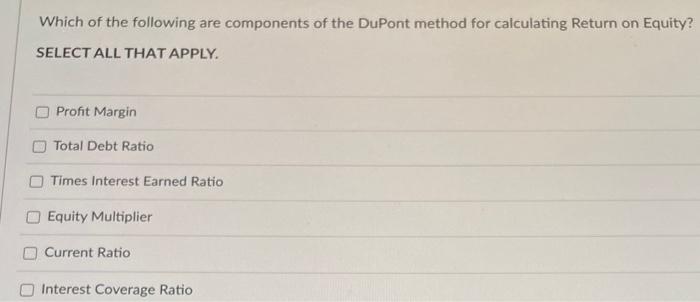

A board of directors with a higher concentration of independent directors that receive equity compensation would be than a board with directors from within the company that are compensated in an all-cash salary. Match the correct terms and phrases Dividend at time one Retention Ratio Cost of debt Disadvantage to dividend growth model Queen, Inc., has a total debt ratio of 0.64 . What is its equity multiplier? Assume a firm has a retention ratio of 58.94%. If the firm has $218,293 in net income and 10,200 shares of common stock, what is the dividends per share for the firm? What is the company's Return on Assets? Which of the following best describe asset management ratios? Measure the ability of the firm to meet short-term obligations Show how effectively management is using debt Measure how efficient management is using the company's assets Determine how the market values the firm Assume a firm current has bonds that pay an average coupon rate of 5.08%, and the yield-tomaturity is 4.09%. If the firm has $1,929,573 in earnings before taxes, a payout ratio of 33.9%, and issued $281,401 in dividends, what is that firm's cost of debt? Heritage, Inc., had a cost of goods sold of $47.866. At the end of the year, the accounts payable balance was $8,744. How long on average did it take the company to pay off its suppliers during the year? SDJ, Inc., has net working capital of $3,550, current liabilities of $5,471, inventory of $4,108, and cash of $971. What is the current ratio? Consider the following financial statement information for the Newk Corporation: Calculate the cash cycle using average balances for the two years. ABC Inc. has a the capital structure shown below. Liabilities $116million Stockholders' Equity $65million ABC Inc. will raise additional capital for new projects this year, in the amount of $15 million. Assuming the current capital structure is ideal, how much will the company have to raise in Which of the following are components of the DuPont method for calculating Return on Equity? SELECT ALL THAT APPLY. Profit Margin Total Debt Ratio Times Interest Earned Ratio Equity Multiplier Current Ratio Interest Coverage Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts