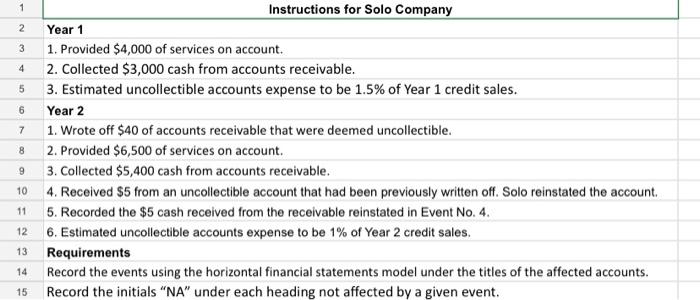

Question: 1 2 3 4 5 6 7 8 Instructions for Solo Company Year 1 1. Provided $4,000 of services on account. 2. Collected $3,000 cash

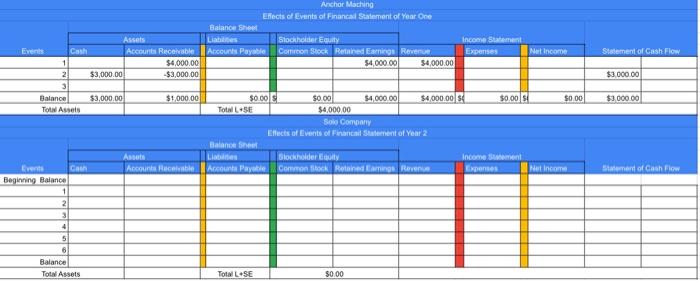

1 2 3 4 5 6 7 8 Instructions for Solo Company Year 1 1. Provided $4,000 of services on account. 2. Collected $3,000 cash from accounts receivable. 3. Estimated uncollectible accounts expense to be 1.5% of Year 1 credit sales. Year 2 1. Wrote off $40 of accounts receivable that were deemed uncollectible. 2. Provided $6,500 of services on account. 3. Collected $5,400 cash from accounts receivable. 4. Received $5 from an uncollectible account that had been previously written off. Solo reinstated the account 5. Recorded the $5 cash received from the receivable reinstated in Event No. 4. 6. Estimated uncollectible accounts expense to be 1% of Year 2 credit sales. Requirements Record the events using the horizontal financial statements model under the titles of the affected accounts. Record the initials "NA" under each heading not affected by a given event. 9 10 11 12 13 14 15 Anchor Maching Effects of Events of Financal Statement of Year One Balance Short Liabits Stockhol Euty Arcounts Payable Common Stock Retained Earnings Revenue 54.000.00 $4,000.00 Income Statement Expenses Cast Net Income Statement of Cash Flow Assets Accounts Receivable $4,000.00 $3,000.00 $3,000.00 $3000.00 2 3 Balance Tot Ausets $3,000.00 $1.000.00 $0.00 $ $0.00 $3000.00 $0.00 $ $0.00 $4,000.00 $4,000.00 TotalLSE $4,000.00 Solo Company Effects of Events of Financial Statement of Year 2 Balance She Lionen Stockholdery Account Payable common stock Retained kaming Rene Asta Accounts Receivable Income tamen Expenses Net Income Statement of Cash Flow Cash Beginning Balance 2 3 4 5 Balance Total Assets Total L.SE 5000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts