Question: please show workings Question 1: Transfer pricing XY plc has two divisions: Division X and Division Y. Division X manufactures intermediate products which can be

please show workings

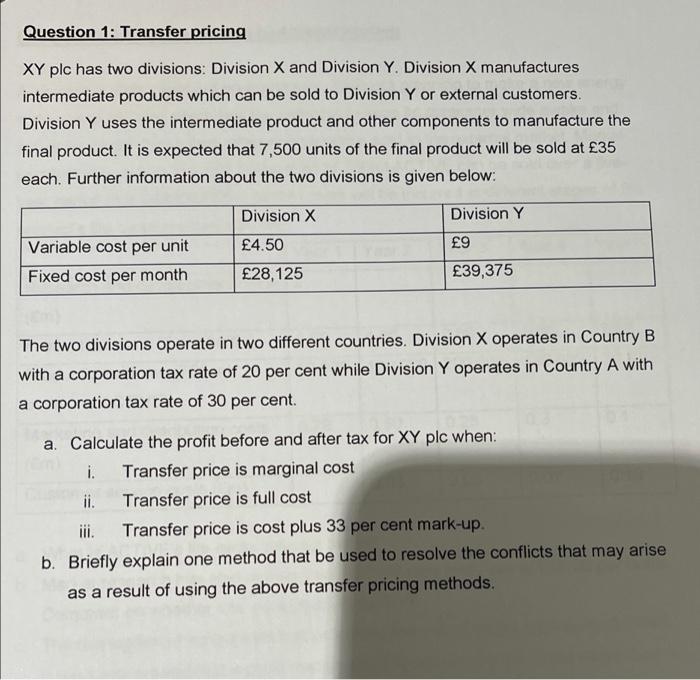

please show workings Question 1: Transfer pricing XY plc has two divisions: Division X and Division Y. Division X manufactures intermediate products which can be sold to Division Y or external customers. Division Y uses the intermediate product and other components to manufacture the final product. It is expected that 7,500 units of the final product will be sold at 35 each. Further information about the two divisions is given below: Division X Division Y 4.50 9 Variable cost per unit Fixed cost per month 28,125 39,375 The two divisions operate in two different countries. Division X operates in Country B with a corporation tax rate of 20 per cent while Division Y operates in Country A with a corporation tax rate of 30 per cent. a. Calculate the profit before and after tax for XY plc when: i. Transfer price is marginal cost ii. Transfer price is full cost iii. Transfer price is cost plus 33 per cent mark-up. b. Briefly explain one method that be used to resolve the conflicts that may arise as a result of using the above transfer pricing methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts