Question: 1. 2. 3. 4. 5. 6. 7. Assuming semiannual compounding, what is the price of a zero coupon bond with 9 years to maturity paying

1.

2.

2.

3.

3.

4.

4.

5.

5. 6.

6.

7.

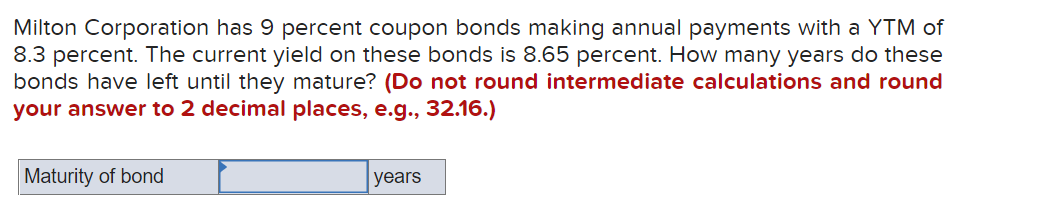

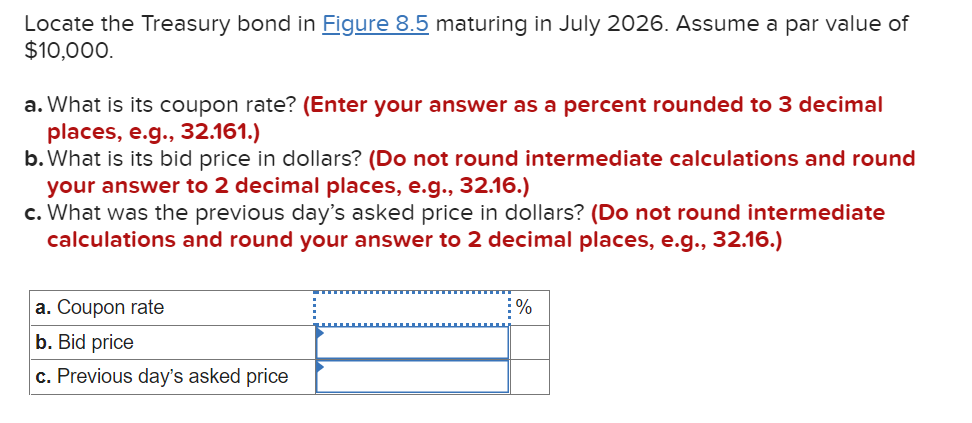

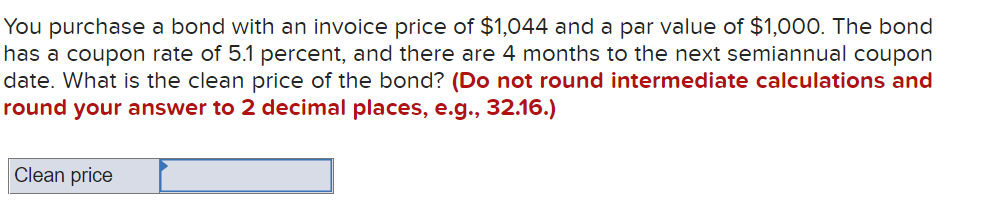

7.

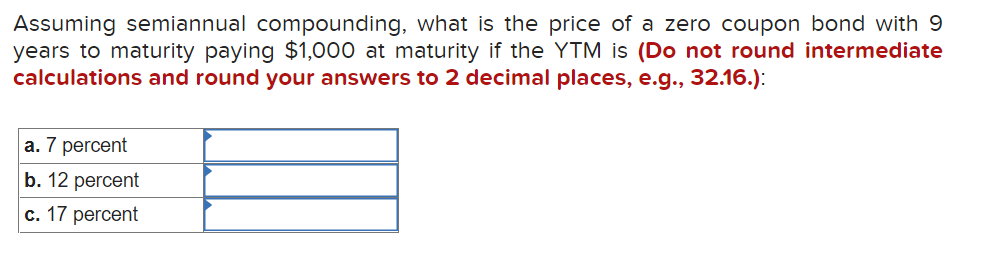

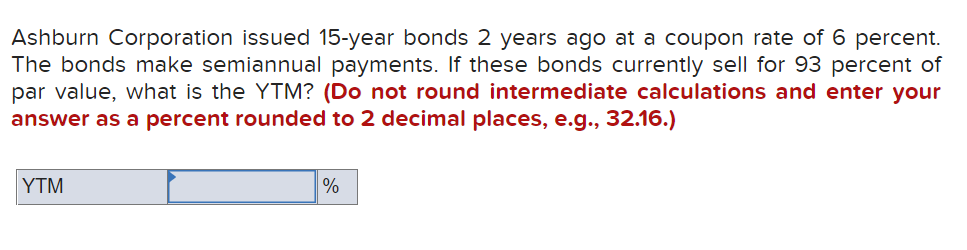

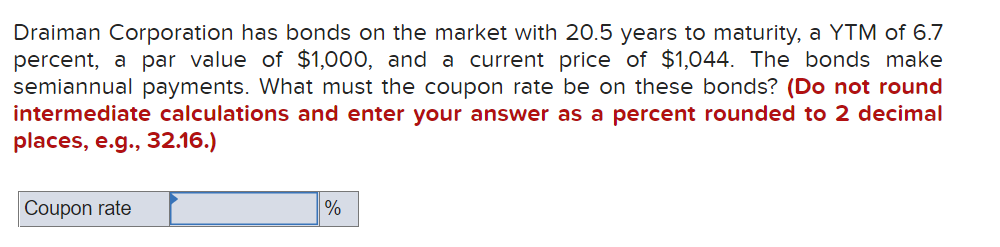

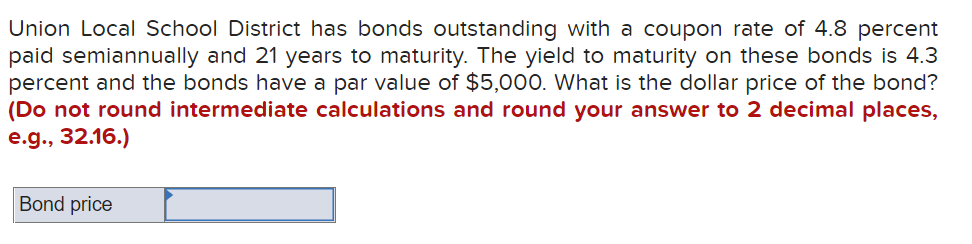

Assuming semiannual compounding, what is the price of a zero coupon bond with 9 years to maturity paying $1,000 at maturity if the YTM is (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Ashburn Corporation issued 15-year bonds 2 years ago at a coupon rate of 6 percent. The bonds make semiannual payments. If these bonds currently sell for 93 percent of par value, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Draiman Corporation has bonds on the market with 20.5 years to maturity, a YTM of 6.7 percent, a par value of $1,000, and a current price of $1,044. The bonds make semiannual payments. What must the coupon rate be on these bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Union Local School District has bonds outstanding with a coupon rate of 4.8 percent paid semiannually and 21 years to maturity. The yield to maturity on these bonds is 4.3 percent and the bonds have a par value of $5,000. What is the dollar price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Milton Corporation has 9 percent coupon bonds making annual payments with a YTM of 8.3 percent. The current yield on these bonds is 8.65 percent. How many years do these bonds have left until they mature? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Locate the Treasury bond in Figure 8.5 maturing in July 2026. Assume a par value of $10,000. a. What is its coupon rate? (Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is its bid price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What was the previous day's asked price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) You purchase a bond with an invoice price of $1,044 and a par value of $1,000. The bond has a coupon rate of 5.1 percent, and there are 4 months to the next semiannual coupon date. What is the clean price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Clean price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts