Question: 1 2 3 4 5 Accumulating a growing future sum Personal Finance Problem A retirement home at Deer Trail Estates now costs $147,000. Inflation is

1 2

2

3

3 4

4

5

5

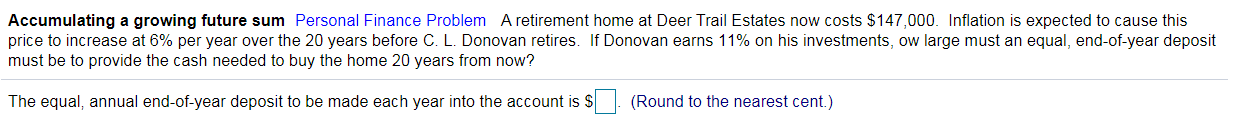

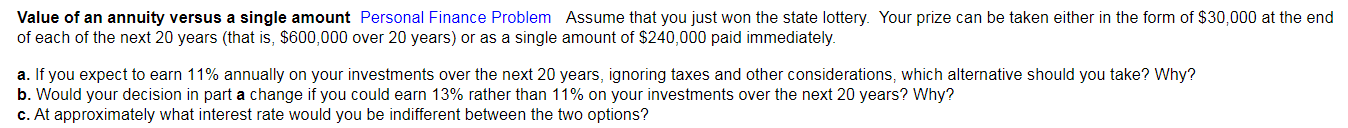

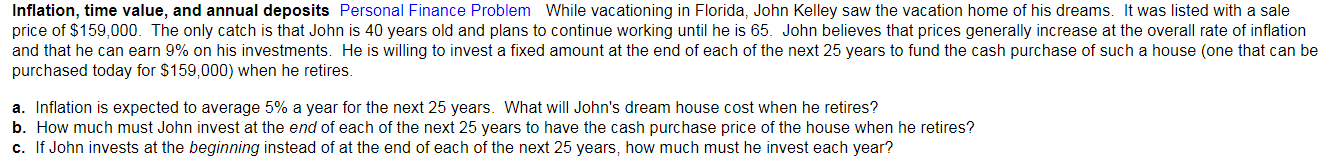

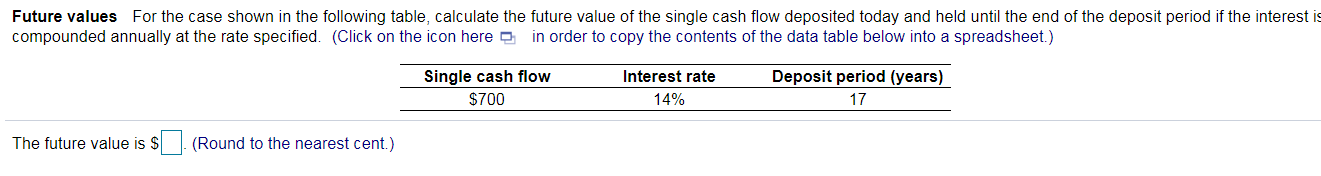

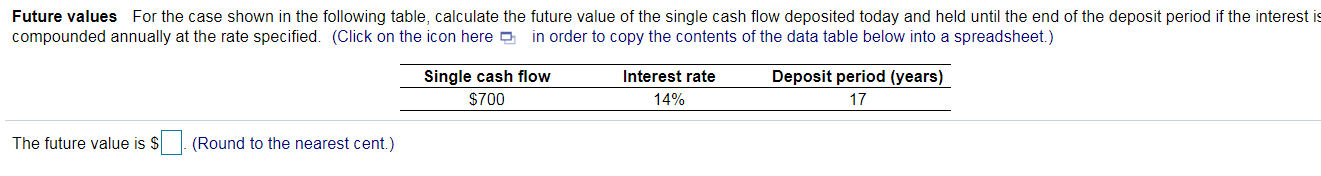

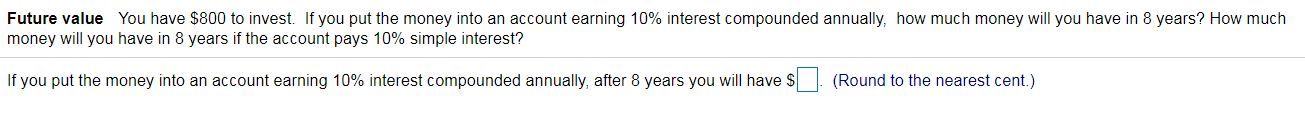

Accumulating a growing future sum Personal Finance Problem A retirement home at Deer Trail Estates now costs $147,000. Inflation is expected to cause this price to increase at 6% per year over the 20 years before C. L. Donovan retires. If Donovan earns 11% on his investments, ow large must an equal, end-of-year deposit must be to provide the cash needed to buy the home 20 years from now? The equal, annual end-of-year deposit to be made each year into the account is S (Round to the nearest cent.) Value of an annuity versus a single amount Personal Finance Problem Assume that you just won the state lottery. Your prize can be taken either in the form of $30,000 at the end of each of the next 20 years (that is, $600,000 over 20 years) or as a single amount of $240,000 paid immediately. a. If you expect to earn 11% annually on your investments over the next 20 years, ignoring taxes and other considerations, which alternative should you take? Why? b. Would your decision in part a change if you could earn 13% rather than 11% on your investments over the next 20 years? Why? c. At approximately what interest rate would you be indifferent between the two options? Inflation, time value, and annual deposits Personal Finance Problem While vacationing in Florida, John Kelley saw the vacation home of his dreams. It was listed with a sale price of $159,000. The only catch is that John is 40 years old and plans to continue working until he is 65. John believes that prices generally increase at the overall rate of inflation and that he can earn 9% on his investments. He is willing to invest a fixed amount at the end of each of the next 25 years to fund the cash purchase of such a house (one that can be purchased today for $159,000) when he retires. a. Inflation is expected to average 5% a year for the next 25 years. What will John's dream house cost when he retires? b. How much must John invest at the end of each of the next 25 years to have the cash purchase price of the house when he retires? c. If John invests at the beginning instead of at the end of each of the next 25 years, how much must he invest each year? Future values For the case shown in the following table, calculate the future value of the single cash flow deposited today and held until the end of the deposit period if the interest is compounded annually at the rate specified. (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Single cash flow $700 Interest rate 14% Deposit period (years) 17 The future value is $. (Round to the nearest cent.) Future values For the case shown in the following table, calculate the future value of the single cash flow deposited today and held until the end of the deposit period if the interest is compounded annually at the rate specified. (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Single cash flow $700 Interest rate 14% Deposit period (years) 17 The future value is $. (Round to the nearest cent.) Future value You have $800 to invest. If you put the money into an account earning 10% interest compounded annually, how much money will you have in 8 years? How much money will you have in 8 years if the account pays 10% simple interest? If you put the money into an account earning 10% interest compounded annually, after 8 years you will have $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts