Question: ------------------------------------------------------------------------------------------------------------------------------- Accumulating a growing future sum Personal Finance Problem A retirement home at Deer Trail Estates now costs $148,000. Inflation is expected to cause this

-------------------------------------------------------------------------------------------------------------------------------

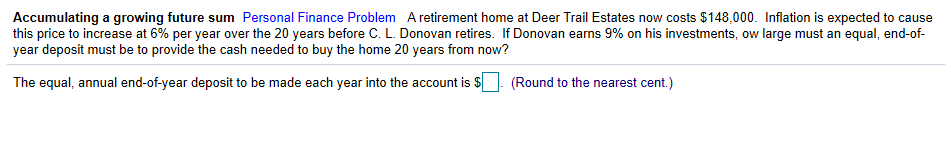

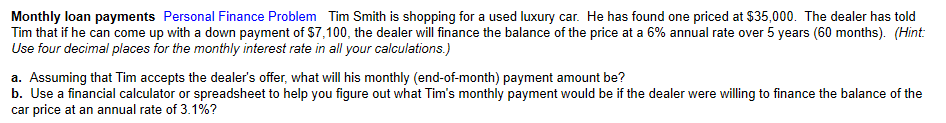

Accumulating a growing future sum Personal Finance Problem A retirement home at Deer Trail Estates now costs $148,000. Inflation is expected to cause this price to increase at 6% per year over the 20 years before C. L. Donovan retires. If Donovan earns 9% on his investments, ow large must an equal, end-of- year deposit must be to provide the cash needed to buy the home 20 years from now? The equal, annual end-of-year deposit to be made each year into the account is $ . (Round to the nearest cent.) Monthly loan payments Personal Finance Problem Tim Smith is shopping for a used luxury car. He has found one priced at $35,000. The dealer has told Tim that if he can come up with a down payment of $7,100, the dealer will finance the balance of the price at a 6% annual rate over 5 years (60 months). (Hint: Use four decimal places for the monthly interest rate in all your calculations.) a. Assuming that Tim accepts the dealer's offer, what will his monthly (end-of-month) payment amount be? b. Use a financial calculator or spreadsheet to help you figure out what Tim's monthly payment would be if the dealer were willing to finance the balance of the car price at an annual rate of 3.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts