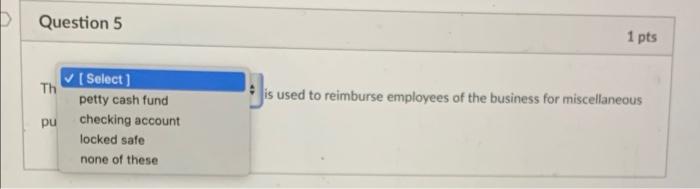

Question: 1. 2. 3. 4. 5. Question 5 1 pts The Select] is used to reimburse employees of the business for miscellaneous purchases. D Question 5

![1. 2. 3. 4. 5. Question 5 1 pts The Select]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671883ffa1d48_903671883ff40044.jpg)

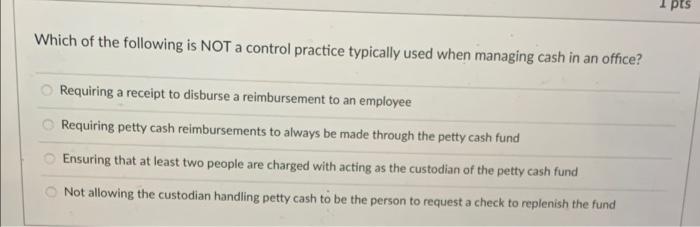

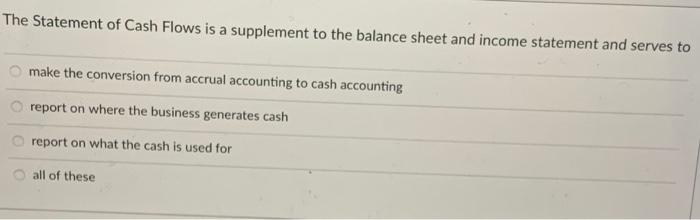

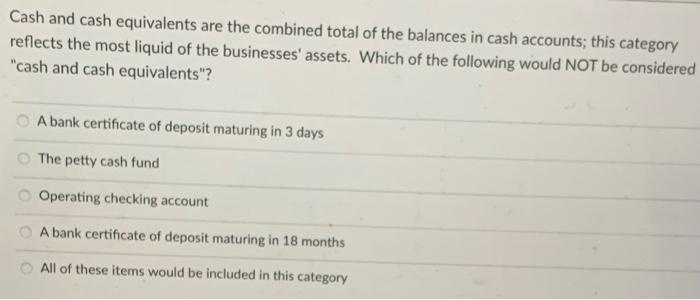

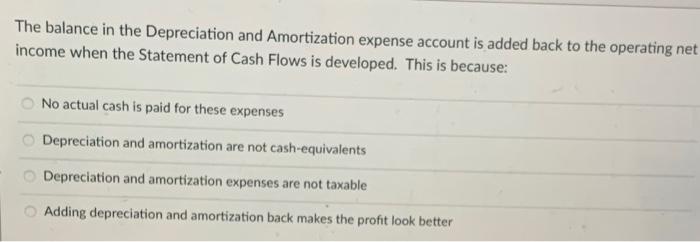

Question 5 1 pts The Select] is used to reimburse employees of the business for miscellaneous purchases. D Question 5 1 pts Th is is used to reimburse employees of the business for miscellaneous pu [ Select) petty cash fund checking account locked safe none of these I pts Which of the following is NOT a control practice typically used when managing cash in an office? Requiring a receipt to disburse a reimbursement to an employee Requiring petty cash reimbursements to always be made through the petty cash fund Ensuring that at least two people are charged with acting as the custodian of the petty cash fund Not allowing the custodian handling petty cash to be the person to request a check to replenish the fund The Statement of Cash Flows is a supplement to the balance sheet and income statement and serves to make the conversion from accrual accounting to cash accounting report on where the business generates cash report on what the cash is used for oc all of these Cash and cash equivalents are the combined total of the balances in cash accounts; this category reflects the most liquid of the businesses' assets. Which of the following would NOT be considered "cash and cash equivalents"? A bank certificate of deposit maturing in 3 days The petty cash fund Operating checking account A bank certificate of deposit maturing in 18 months All of these items would be included in this category The balance in the Depreciation and Amortization expense account is added back to the operating net income when the Statement of Cash Flows is developed. This is because: No actual cash is paid for these expenses Depreciation and amortization are not cash-equivalents Depreciation and amortization expenses are not taxable Adding depreciation and amortization back makes the profit look better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts