Question: #'s 1, 2, 3, 4 & 5 Question 1 3 pts The interest earned on which of the bond is exempt from federal and state

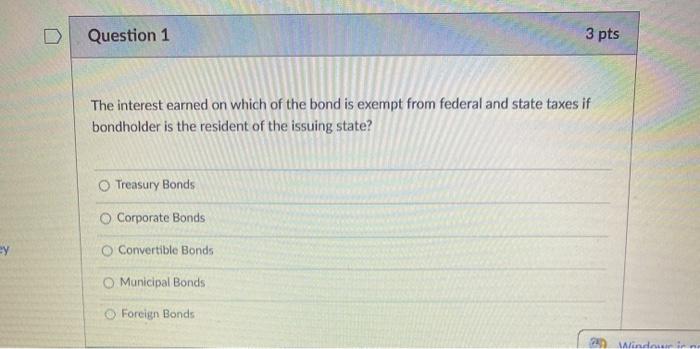

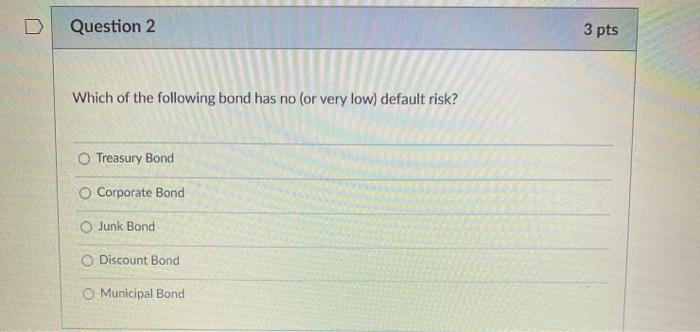

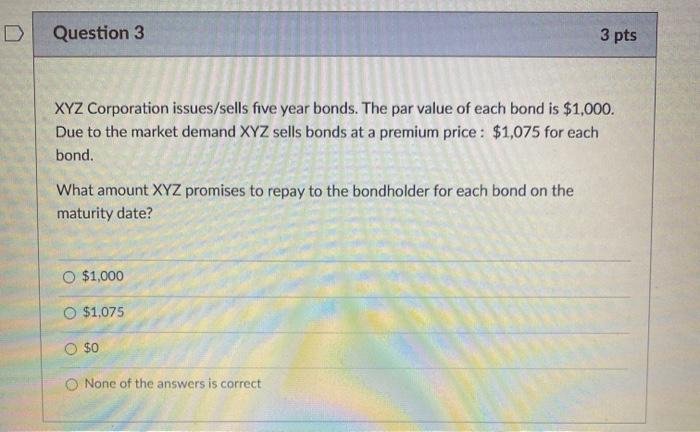

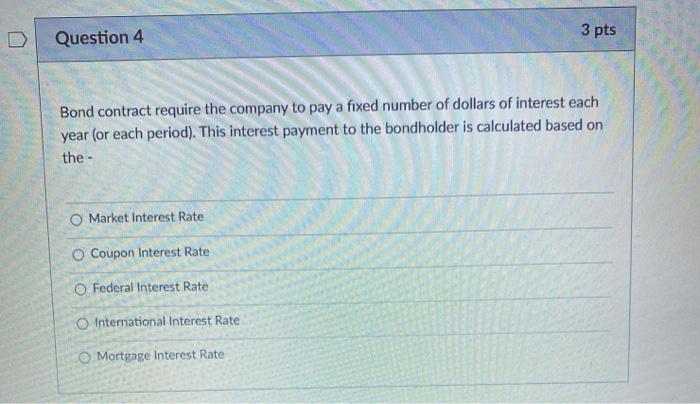

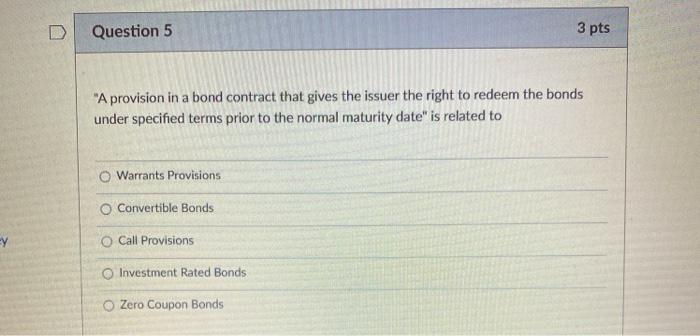

Question 1 3 pts The interest earned on which of the bond is exempt from federal and state taxes if bondholder is the resident of the issuing state? Treasury Bonds O Corporate Bonds ey Convertible Bonds O Municipal Bonds Foreign Bonds 27 Windoen in Question 2 3 pts Which of the following bond has no (or very low) default risk? O Treasury Bond O Corporate Bond O Junk Bond Discount Bond Municipal Bond Question 3 3 pts XYZ Corporation issues/sells five year bonds. The par value of each bond is $1,000. Due to the market demand XYZ sells bonds at a premium price: $1,075 for each bond. What amount XYZ promises to repay to the bondholder for each bond on the maturity date? O $1,000 $1,075 O $0 None of the answers is correct 3 pts Question 4 Bond contract require the company to pay a fixed number of dollars of interest each year (or each period). This interest payment to the bondholder is calculated based on the- O Market Interest Rate Coupon Interest Rate O Federal Interest Rate O International Interest Rate Mortgage Interest Rate D Question 5 3 pts "A provision in a bond contract that gives the issuer the right to redeem the bonds under specified terms prior to the normal maturity date" is related to O Warrants Provisions O Convertible Bonds Ey O Call Provisions Investment Rated Bonds Zero Coupon Bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts