Question: 1. 2. 3. 4. Budget Performance Reports for Cost Centers Partially completed budget performance reports for Delmar Company, a manufacturer of light duty motors, follo

1.

2.

3.

4.

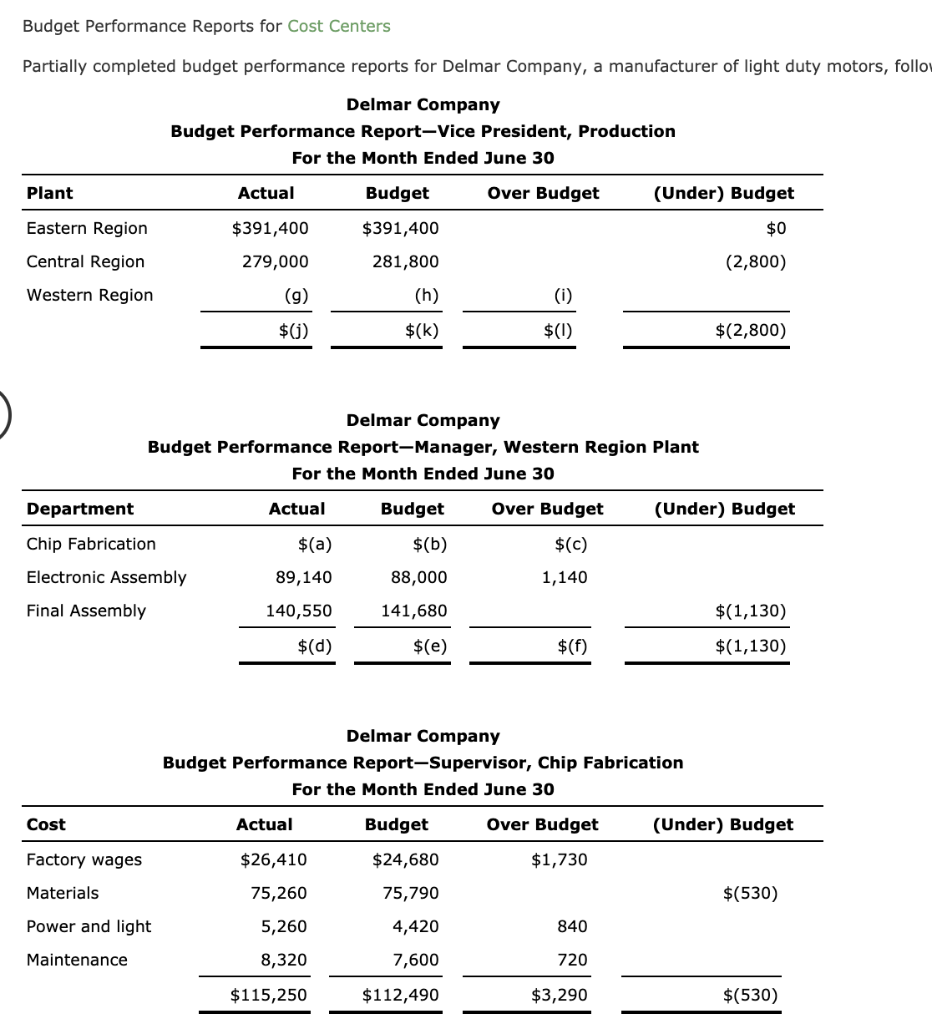

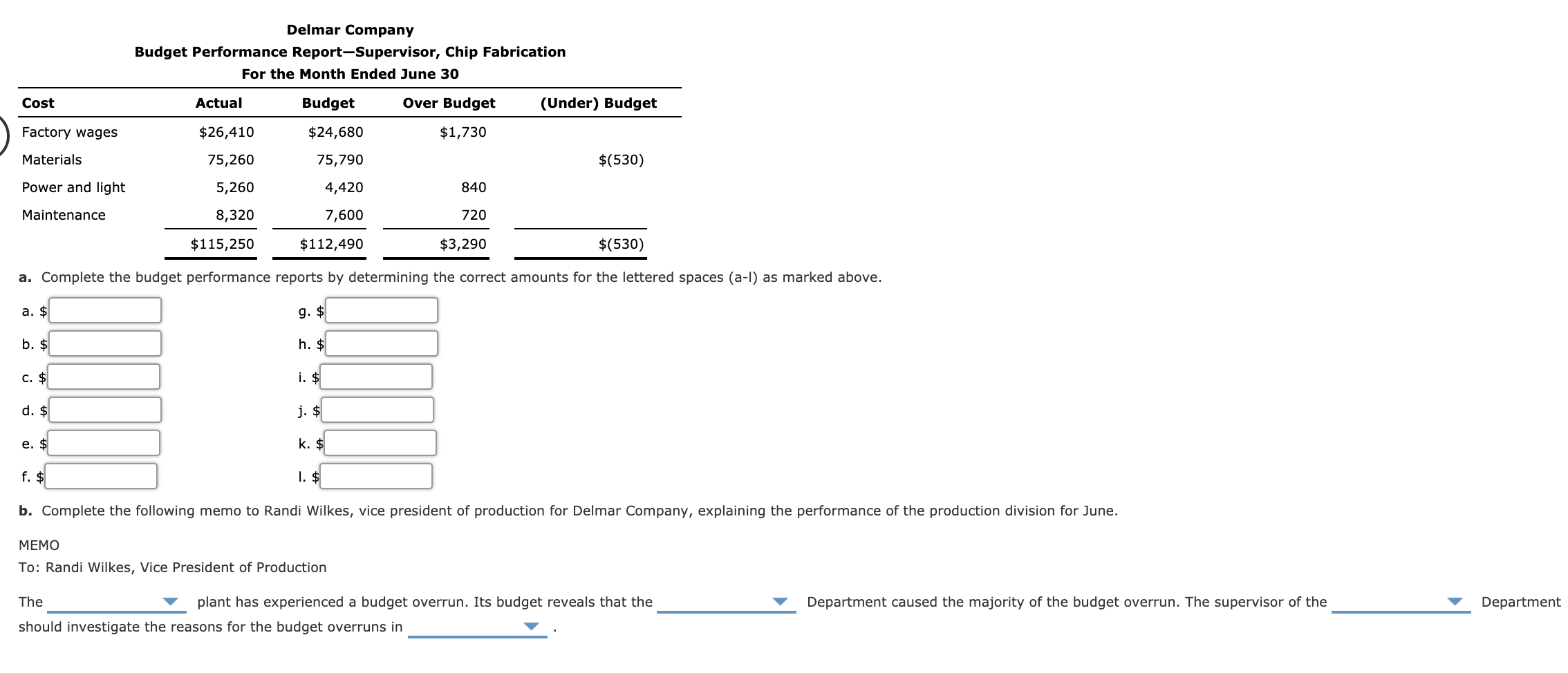

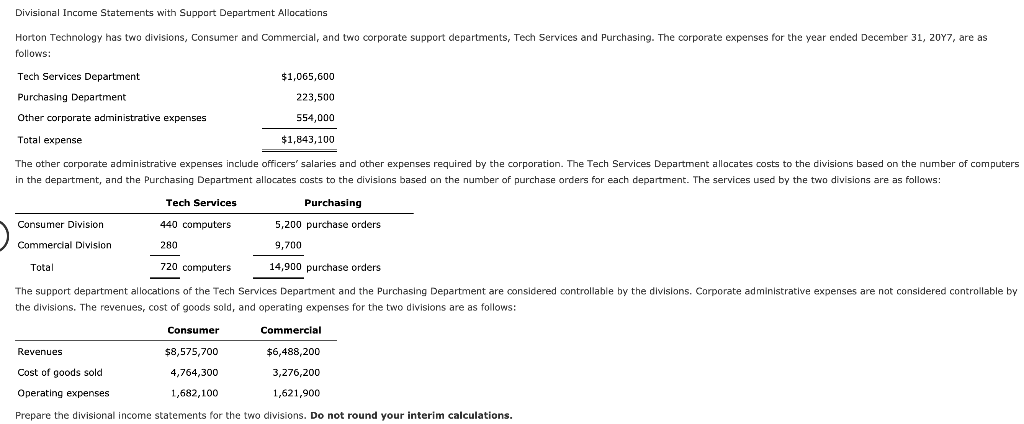

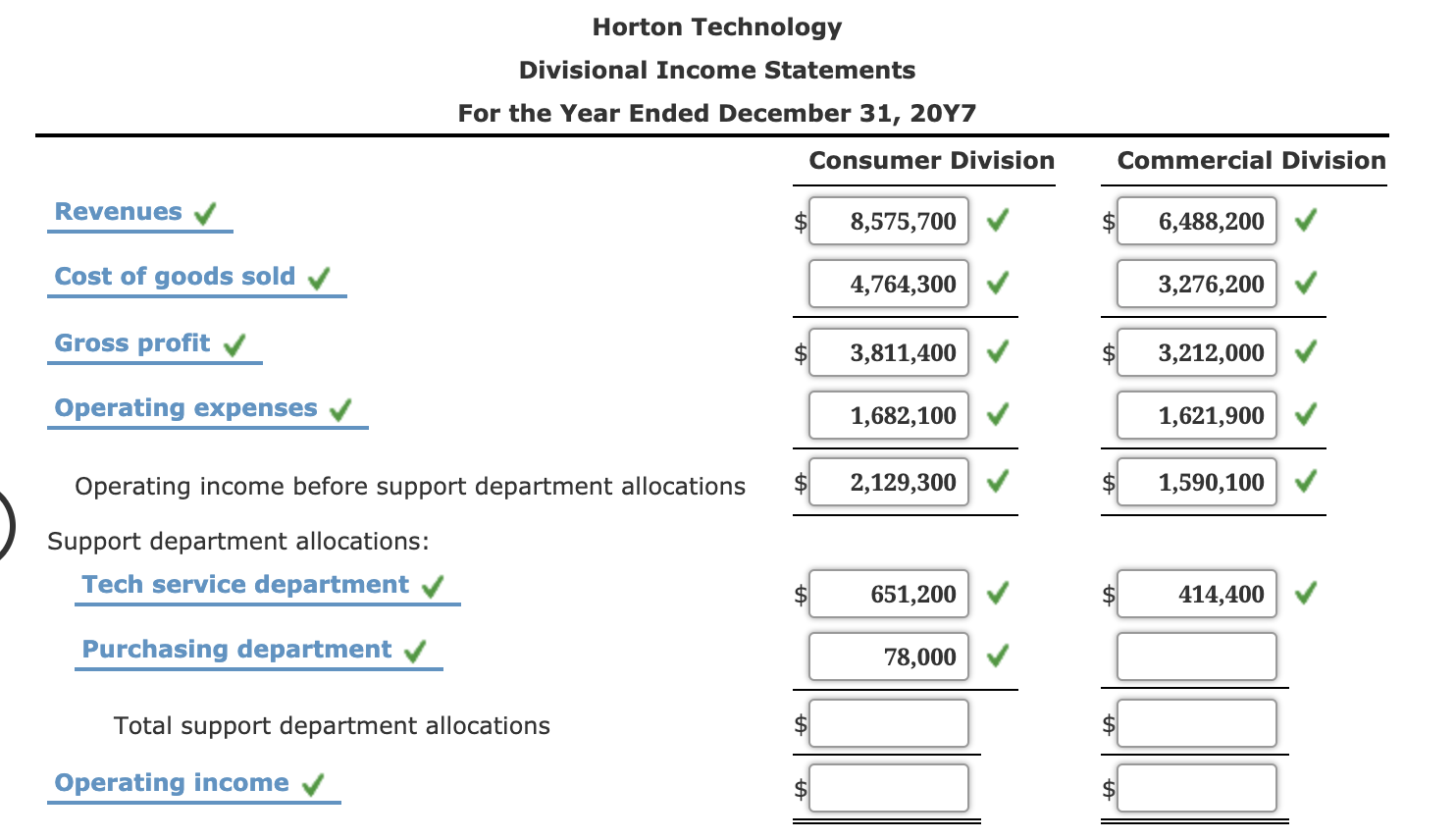

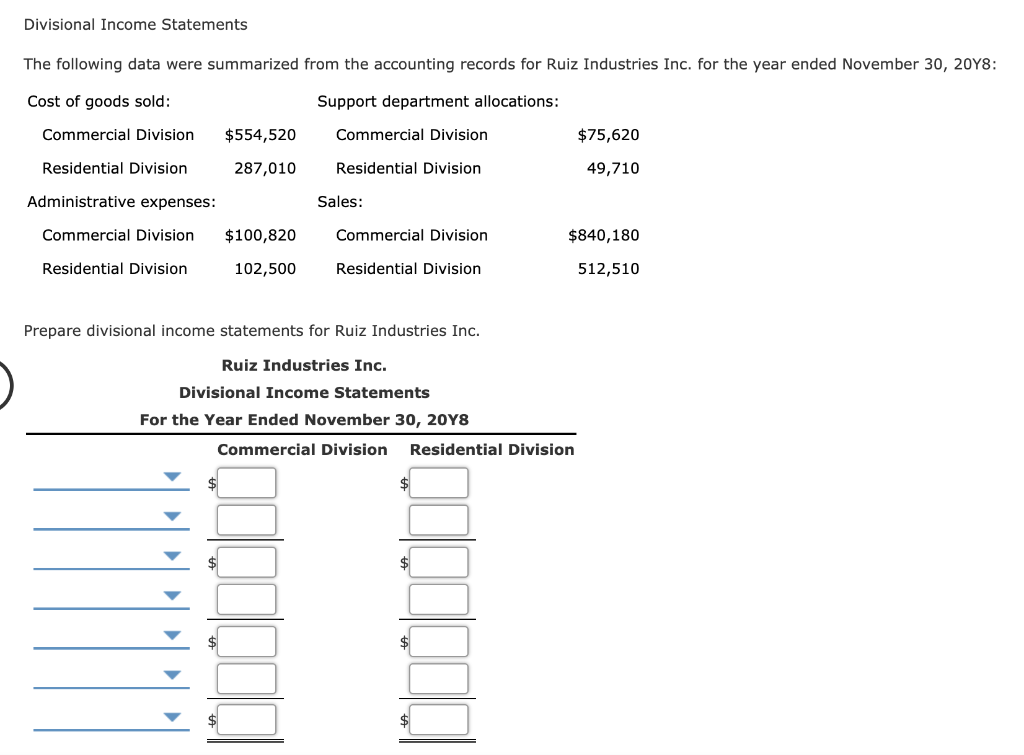

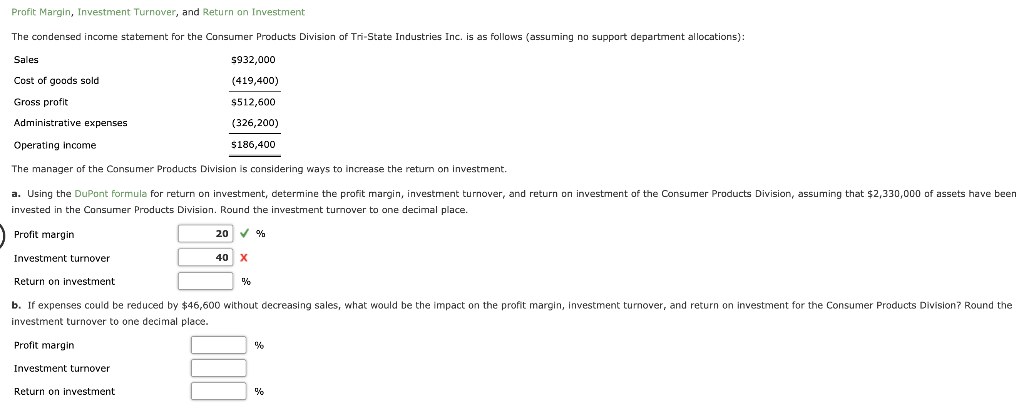

Budget Performance Reports for Cost Centers Partially completed budget performance reports for Delmar Company, a manufacturer of light duty motors, follo Delmar Company Budget Performance Report-Vice President, Production For the Month Ended June 30 Actual Budget Over Budget (Under) Budget Plant Eastern Region $391,400 $391,400 $0 Central Region 279,000 281,800 (2,800) Western Region (9) (h) (i) $G) $(k) $(0) $(2,800) Delmar Company Budget Performance Report-Manager, Western Region Plant For the Month Ended June 30 Department Actual Budget Over Budget (Under) Budget Chip Fabrication $(a) $(b) $(c) Electronic Assembly 89,140 88,000 1,140 Final Assembly 140,550 141,680 $(1,130) $(d) $(e) $(1,130) Delmar Company Budget Performance Report-Supervisor, Chip Fabrication For the Month Ended June 30 Cost Actual Over Budget (Under) Budget Budget $24,680 Factory wages $26,410 $1,730 Materials 75,260 75,790 $(530) Power and light 4,420 840 5,260 8,320 Maintenance 720 7,600 $112,490 $115,250 $3,290 $(530) Delmar Company Budget Performance Report-Supervisor, Chip Fabrication For the Month Ended June 30 Cost Actual Budget Over Budget (Under) Budget Factory wages $1,730 $24,680 75,790 Materials $(530) $26,410 75,260 5,260 8,320 Power and light 4,420 840 Maintenance 7,600 720 $115,250 $112,490 $3,290 $(530) a. Complete the budget performance reports by determining the correct amounts for the lettered spaces (a-I) as marked above. a. $ g. b. $ h. $ c. $ i. $ d. $ j. $ e. $ k. $ f. $ I. $ b. Complete the following memo to Randi Wilkes, vice president of production for Delmar Company, explaining the performance of the production division for June. MEMO To: Randi Wilkes, Vice President of Production Department caused the majority of the budget overrun. The supervisor of the Department The plant has experienced a budget overrun. Its budget reveals that the should investigate the reasons for the budget overruns in Divisional Income Statements with Support Department Allocations Horton Technology has two divisions, Consumer and Commercial, and two corporate support departments, Tech Services and Purchasing. The corporate expenses for the year ended December 31, 2017, are as follows: $1,065,600 Tech Services Department Purchasing Department 223,500 Other corporate administrative expenses 554,000 Total expense $1,843,100 The other corporate administrative expenses include officers' salaries and other expenses required by the corporation. The Tech Services Department allocates costs to the divisions based on the number of computers in the department, and the Purchasing Department allocates costs to the divisions based on the number of purchase orders for each department. The services used by the two divisions are as follows: Tech Services Purchasing Consumer Division 440 computers 5,200 purchase orders Commercial Division 280 9,700 Total 720 computers 14,900 purchase orders The support department allocations of the Tech Services Department and the Purchasing Department are considered controllable by the divisions. Corporate administrative expenses are not considered controllable by the divisions. The revenues, cost of goods sold, and operating expenses for the two divisions are as follows: Consumer Commercial Revenues $8,575,700 4,764,300 Cost of goods sold Operating expenses $6,488,200 3,276,200 1,621,900 1,682,100 Prepare the divisional income statements for the two divisions. Do not round your interim calculations. Horton Technology Divisional Income Statements For the Year Ended December 31, 2047 Consumer Division Commercial Division Revenues 8,575,700 $ 6,488,200 Cost of goods sold 4,764,300 3,276,200 Gross profit 3,811,400 $ 3,212,000 Operating expenses 1,682,100 1,621,900 Operating income before support department allocations 2,129,300 1,590,100 Support department allocations: Tech service department 651,200 414,400 Purchasing department 78,000 Total support department allocations E Operating income Divisional Income Statements The following data were summarized from the accounting records for Ruiz Industries Inc. for the year ended November 30, 2048: Cost of goods sold: Support department allocations: Commercial Division $554,520 Commercial Division $75,620 Residential Division 287,010 Residential Division 49,710 Administrative expenses: Sales: Commercial Division $100,820 Commercial Division $840,180 Residential Division 102,500 Residential Division 512,510 Prepare divisional income statements for Ruiz Industries Inc. Ruiz Industries Inc. Divisional Income Statements For the Year Ended November 30, 20Y8 Commercial Division Residential Division Profit Margin, Investment Turnover, and Return on Investment The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales 5932,000 Cost of goods sold (419,400) Gross profit $512,600 Administrative expenses (326,200) Operating income 5186,400 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $2,330,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin 20 % Investment turnover 40 Return on investment b. If expenses could be reduced by $46,600 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division? Round the investment turnover to one decimal place. Profit margin % Investment turnover ini Return on investment %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts