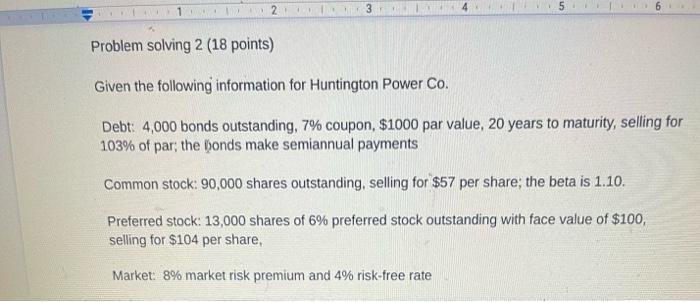

Question: 1 2 3 5 Problem solving 2 (18 points) Given the following information for Huntington Power Co. Debt: 4,000 bonds outstanding, 7% coupon, $1000 par

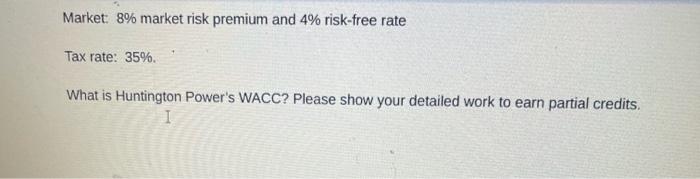

1 2 3 5 Problem solving 2 (18 points) Given the following information for Huntington Power Co. Debt: 4,000 bonds outstanding, 7% coupon, $1000 par value, 20 years to maturity, selling for 103% of par; the Donds make semiannual payments Common stock: 90,000 shares outstanding, selling for $57 per share the beta is 1.10. Preferred stock: 13,000 shares of 6% preferred stock outstanding with face value of $100, selling for $104 per share, Market: 8% market risk premium and 4% risk-free rate Market: 8% market risk premium and 4% risk-free rate Tax rate: 35% What is Huntington Power's WACC? Please show your detailed work to earn partial credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts