Question: Need all answers in excel formulas, which is confusing m as some calculations are needed before that step.... Calculate the Holding Period Return for the

Need all answers in excel formulas, which is confusing m as some calculations are needed before that step....

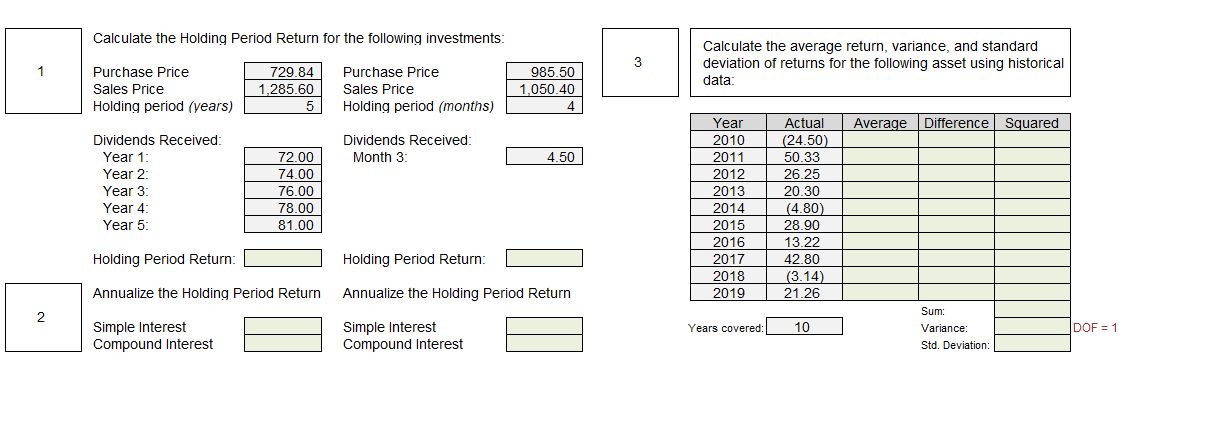

Calculate the Holding Period Return for the following investments: 3 Calculate the average return, variance, and standard deviation of returns for the following asset using historical data 1 Purchase Price Sales Price Holding period (years) 729.84 1,285.60 5 Purchase Price Sales Price Holding period (months) 985.50 1,050.40 4 Average Difference Squared Dividends Received: Month 3: 4.50 Dividends Received: Year 1 Year 2 Year 3 Year 4 Year 5 72.00 74.00 76.00 78.00 81.00 Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Actual (24.50) 50.33 26.25 20.30 (4.80) 28.90 13.22 42.80 (3.14) 21.26 Holding Period Return Holding Period Return: Annualize the Holding Period Return Annualize the Holding Period Return 2 Years covered: 10 Simple Interest Compound Interest DOF = 1 Sum: Variance: Std. Deviation: Simple Interest Compound Interest Calculate the Holding Period Return for the following investments: 3 Calculate the average return, variance, and standard deviation of returns for the following asset using historical data 1 Purchase Price Sales Price Holding period (years) 729.84 1,285.60 5 Purchase Price Sales Price Holding period (months) 985.50 1,050.40 4 Average Difference Squared Dividends Received: Month 3: 4.50 Dividends Received: Year 1 Year 2 Year 3 Year 4 Year 5 72.00 74.00 76.00 78.00 81.00 Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Actual (24.50) 50.33 26.25 20.30 (4.80) 28.90 13.22 42.80 (3.14) 21.26 Holding Period Return Holding Period Return: Annualize the Holding Period Return Annualize the Holding Period Return 2 Years covered: 10 Simple Interest Compound Interest DOF = 1 Sum: Variance: Std. Deviation: Simple Interest Compound Interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts