Question: 1. 2. 3. If the correlation between two stocks is between -0.95 and 0.95, it is possible to create a portfolio with a standard deviation

1.

2.

3.

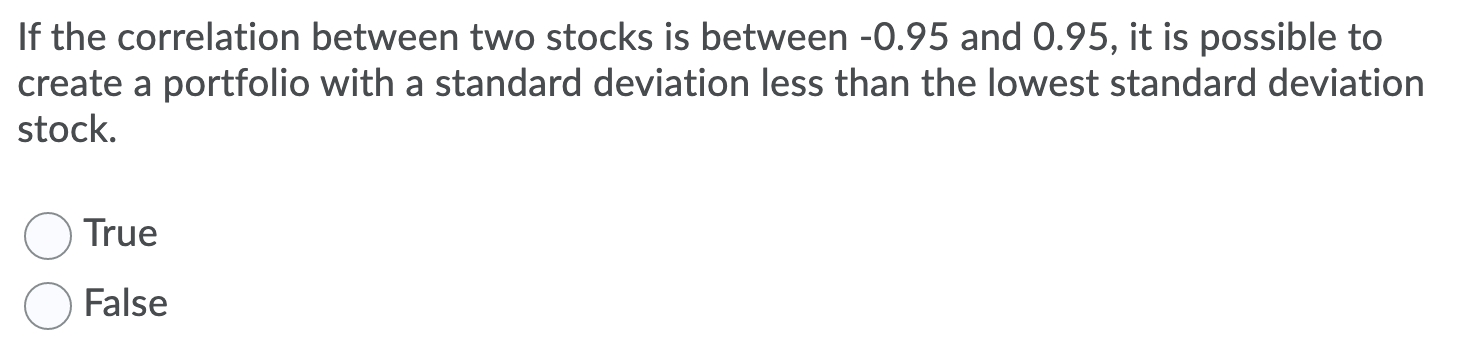

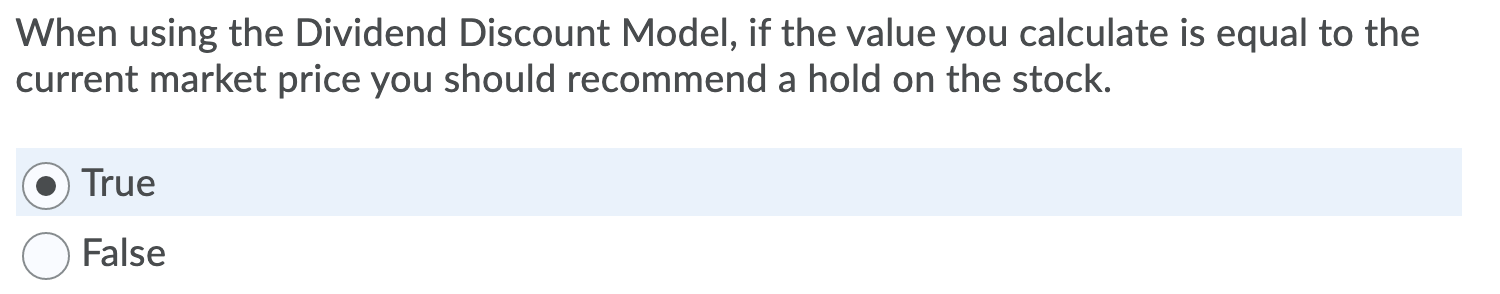

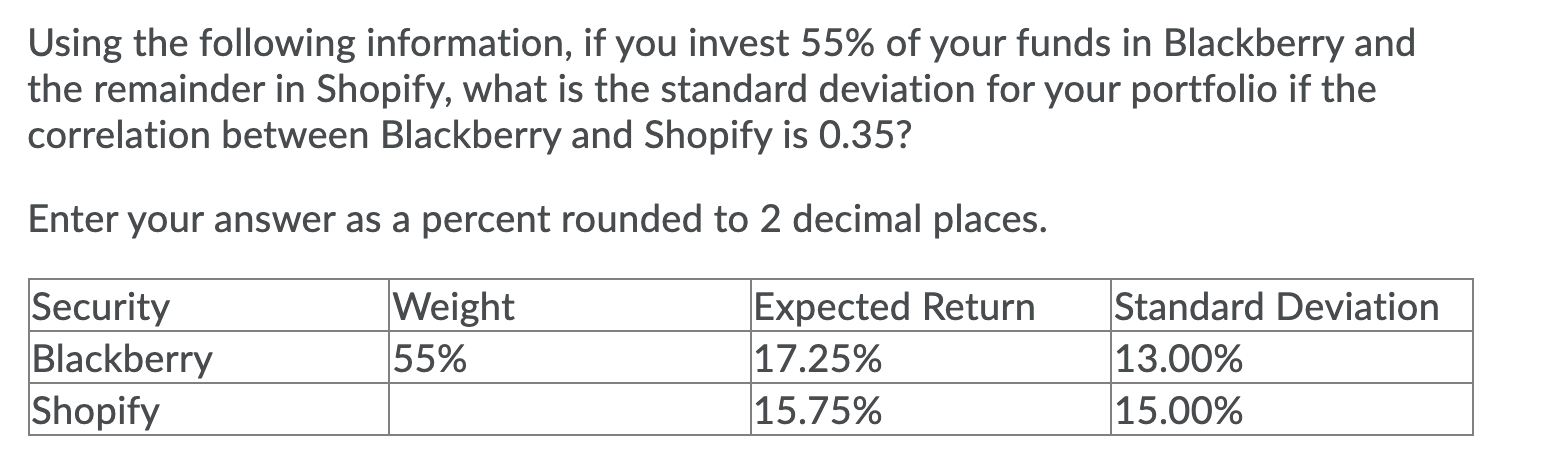

If the correlation between two stocks is between -0.95 and 0.95, it is possible to create a portfolio with a standard deviation less than the lowest standard deviation stock. True False When using the Dividend Discount Model, if the value you calculate is equal to the current market price you should recommend a hold on the stock. True False Using the following information, if you invest 55% of your funds in Blackberry and the remainder in Shopify, what is the standard deviation for your portfolio if the correlation between Blackberry and Shopify is 0.35? Enter your answer as a percent rounded to 2 decimal places. Security Blackberry Shopify Weight 55% Expected Return 17.25% 15.75% Standard Deviation 13.00% 15.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts