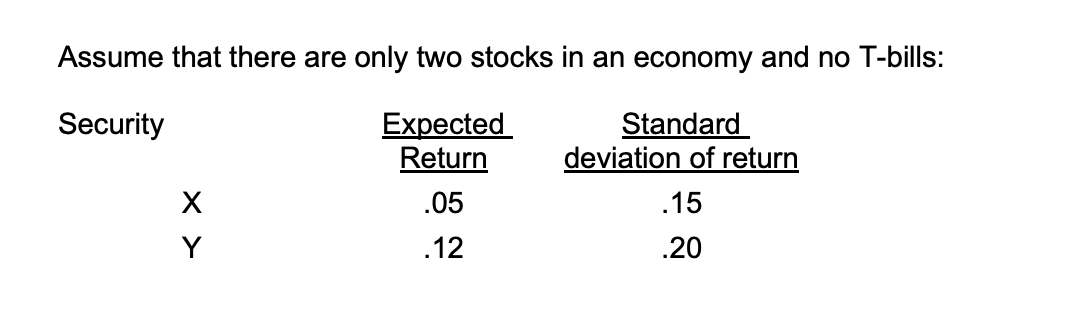

Question: PLEASE SHOW YOUR WORK Assume that there are only two stocks in an economy and no T-bills: Security Expected Return Standard deviation of return .05

PLEASE SHOW YOUR WORK

PLEASE SHOW YOUR WORK

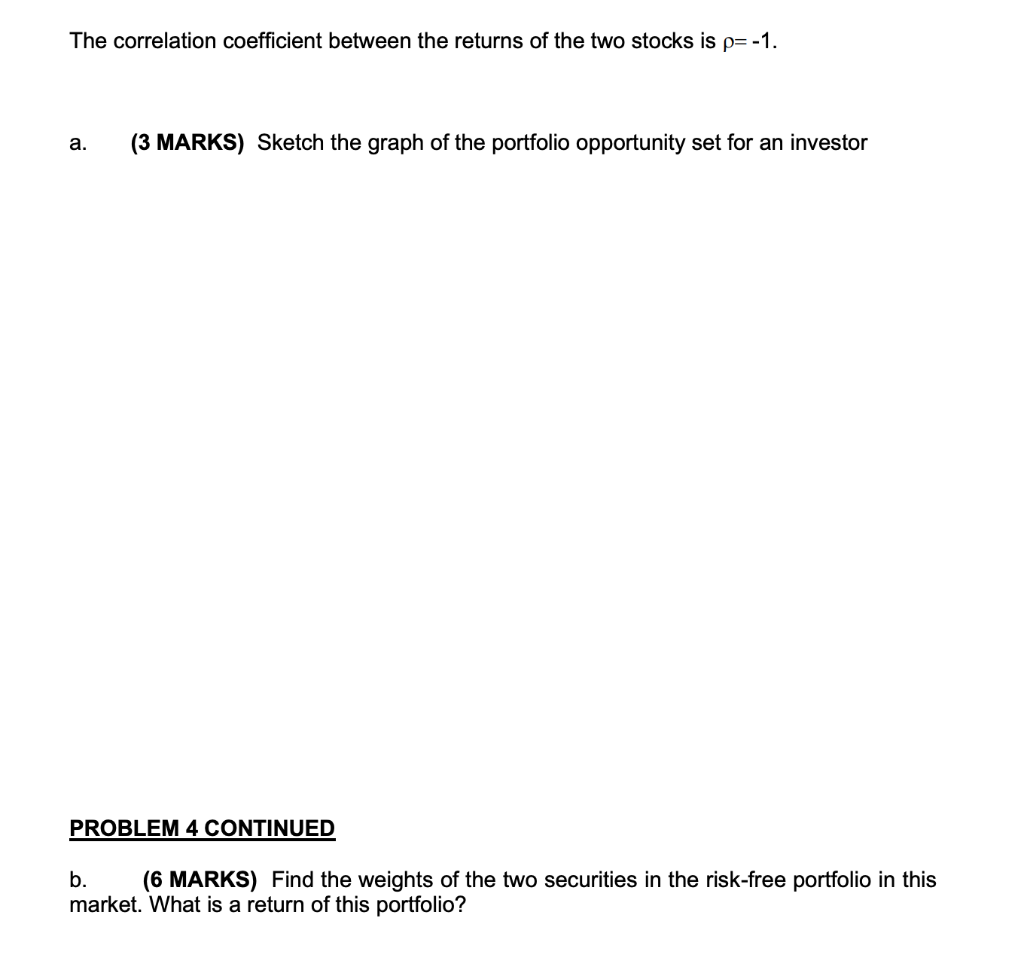

Assume that there are only two stocks in an economy and no T-bills: Security Expected Return Standard deviation of return .05 .15 .12 .20 X Y The correlation coefficient between the returns of the two stocks is p= -1. a. (3 MARKS) Sketch the graph of the portfolio opportunity set for an investor PROBLEM 4 CONTINUED b. (6 MARKS) Find the weights of the two securities in the risk-free portfolio in this market. What is a return of this portfolio? C. (6 MARKS) Consider an investor who has a coefficient of risk aversion equal to 2. What is the weight of the risk-free portfolio found in question b in his/her optimal portfolio in this economy? What is an expected return and standard deviation of return of this portfolio? Assume that there are only two stocks in an economy and no T-bills: Security Expected Return Standard deviation of return .05 .15 .12 .20 X Y The correlation coefficient between the returns of the two stocks is p= -1. a. (3 MARKS) Sketch the graph of the portfolio opportunity set for an investor PROBLEM 4 CONTINUED b. (6 MARKS) Find the weights of the two securities in the risk-free portfolio in this market. What is a return of this portfolio? C. (6 MARKS) Consider an investor who has a coefficient of risk aversion equal to 2. What is the weight of the risk-free portfolio found in question b in his/her optimal portfolio in this economy? What is an expected return and standard deviation of return of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts