Question: 1- ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 2- ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 3- (Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine.

1- ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2-

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

3-

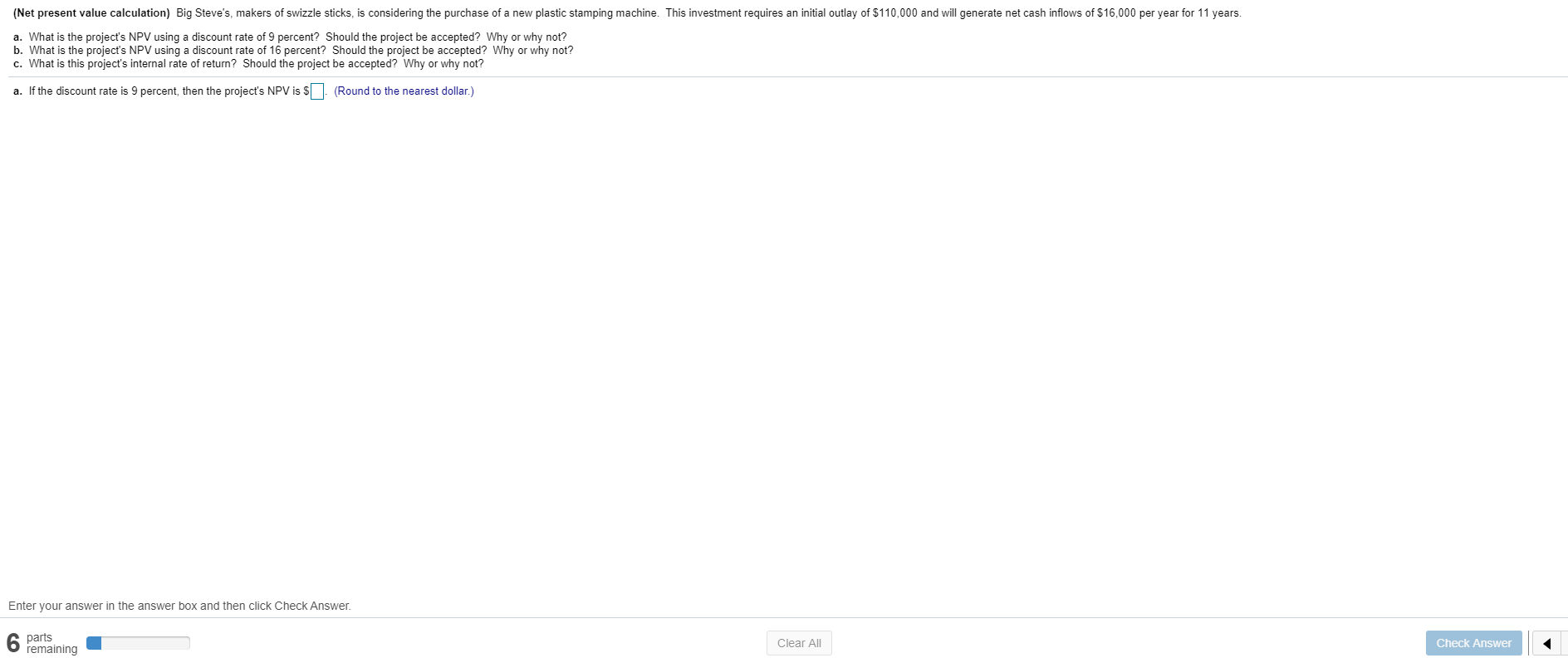

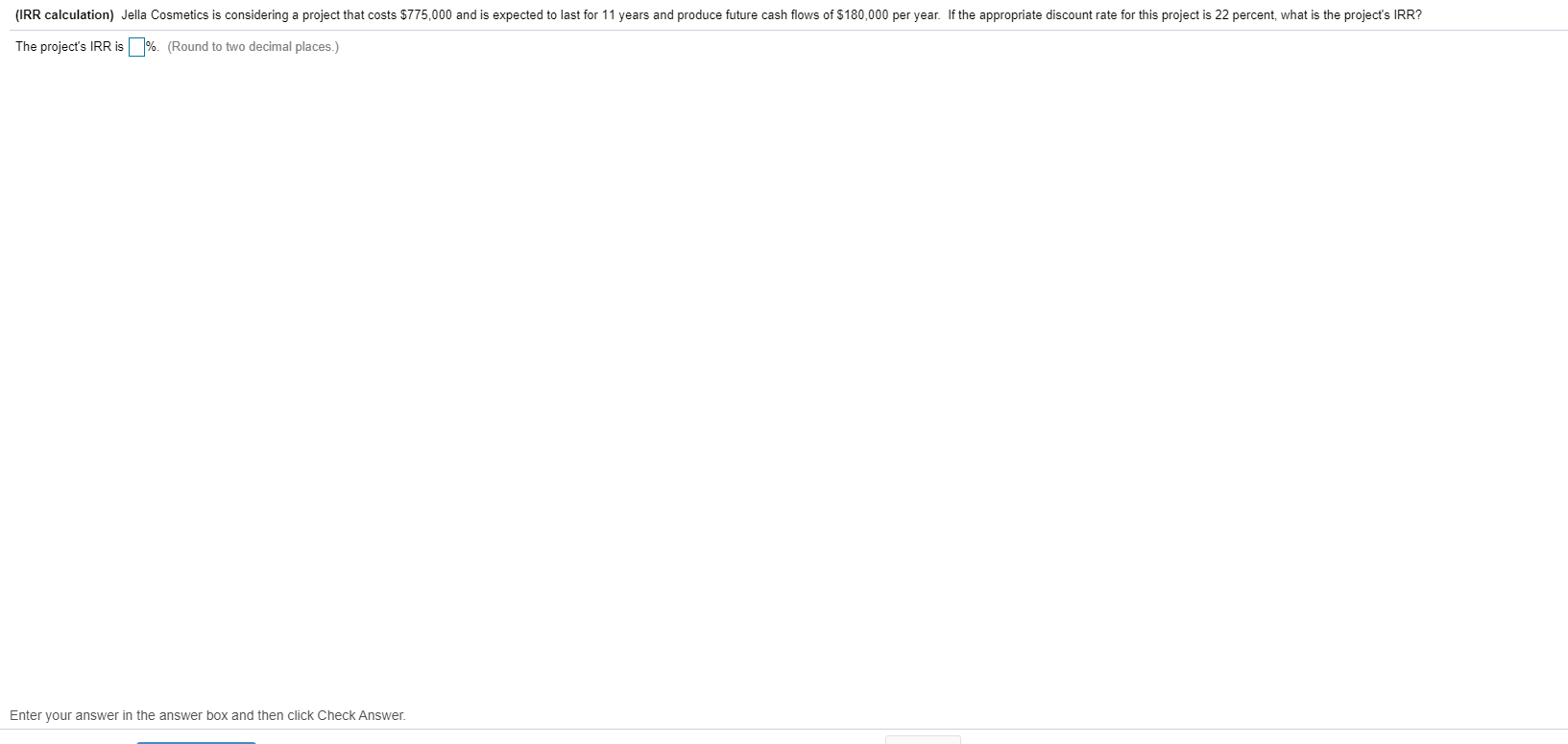

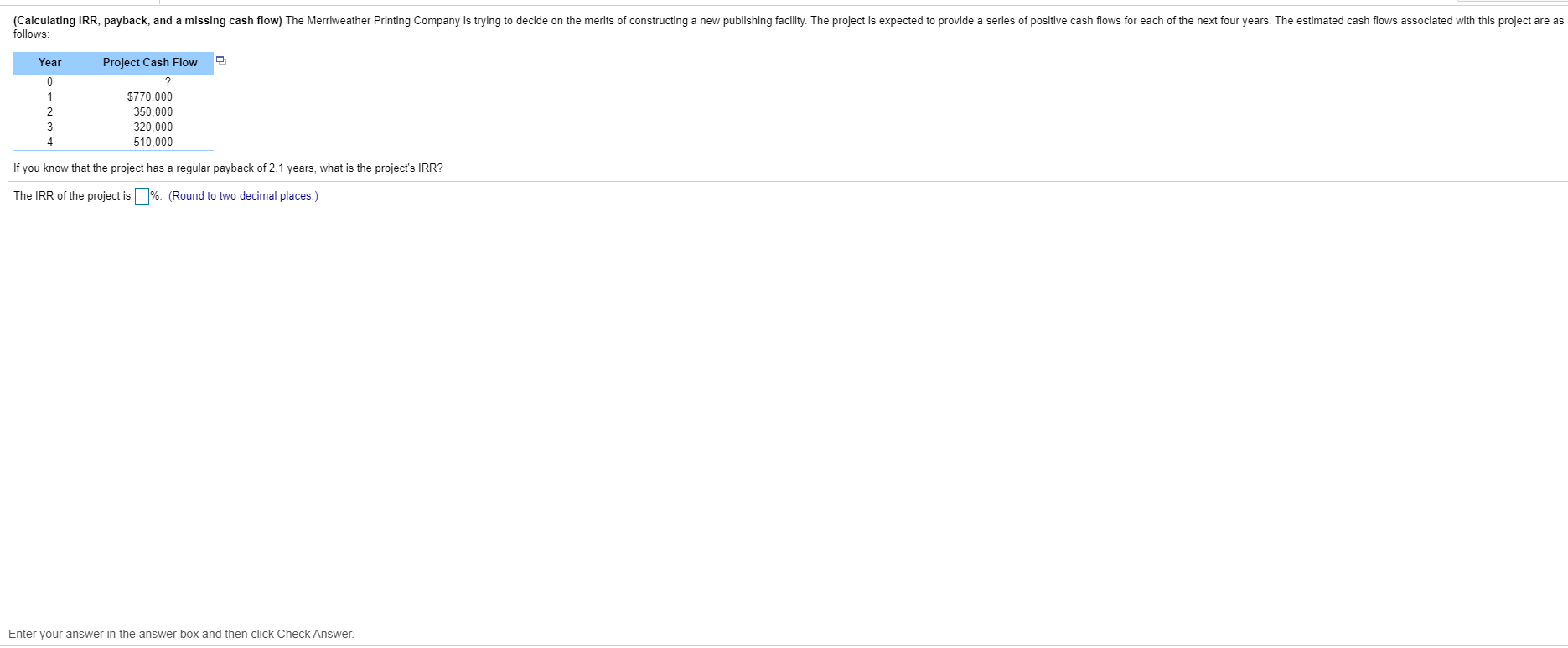

(Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $110,000 and will generate net cash inflows of $16,000 per year for 11 years. a. What is the project's NPV using a discount rate of 9 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 16 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not? a. If the discount rate is 9 percent, then the project's NPV is $ (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer. parts remaining Clear All Check Answer (IRR calculation) Jella Cosmetics is considering a project that costs $775,000 and is expected to last for 11 years and produce future cash flows of $180,000 per year. If the appropriate discount rate for this project is 22 percent, what is the project's IRR? The project's IRR is % (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer. (Calculating IRR, payback, and a missing cash flow) The Merriweather Printing Company is trying to decide on the merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each of the next four years. The estimated cash flows associated with this project are as follows: Year Project Cash Flow 0 1 2 3 4 $770,000 350,000 320,000 510.000 If you know that the project has a regular payback of 2.1 years, what is the project's IRR? The IRR of the project is %. (Round to two decimal places.) Enter your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts