Question: 1. 2. 3. Pinder Co issues a 5-year 6% p.a. semi-annual coupon bond with a face value of $1,000. At issue, the effective annual bond

1.

2.  3.

3.

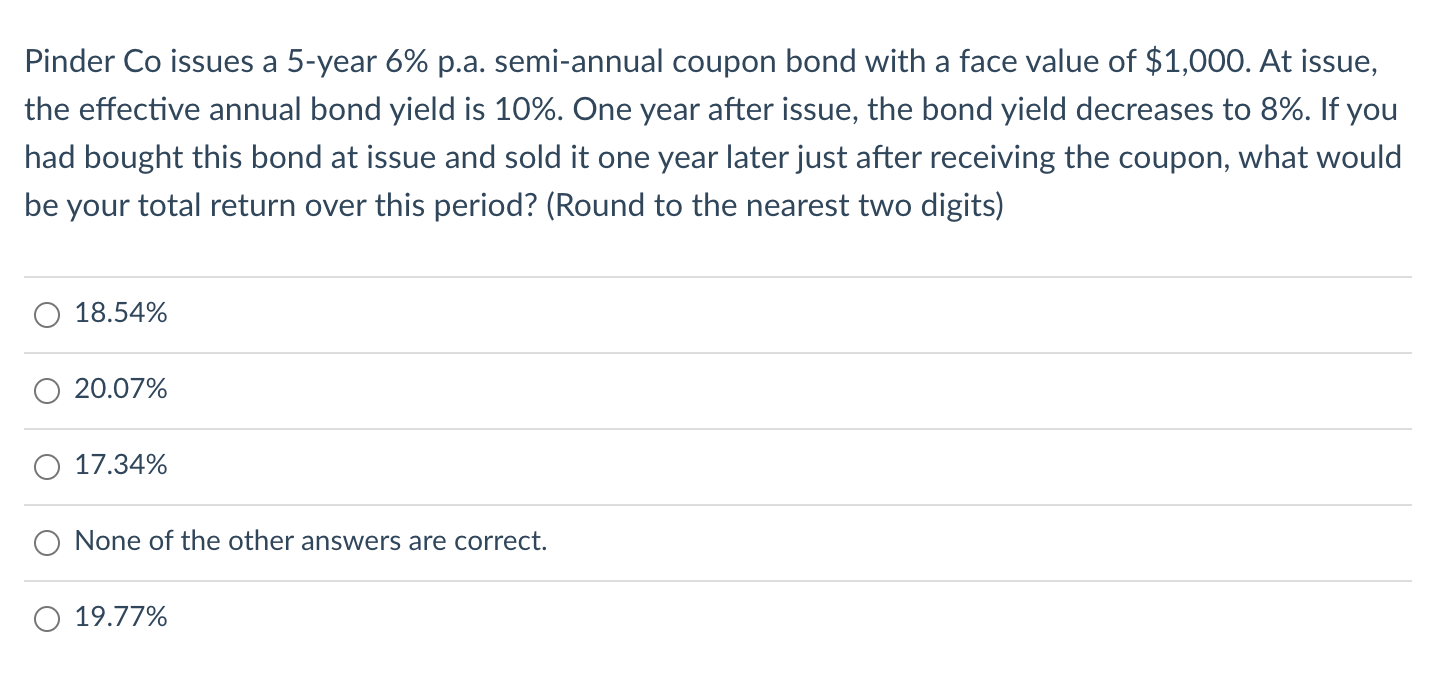

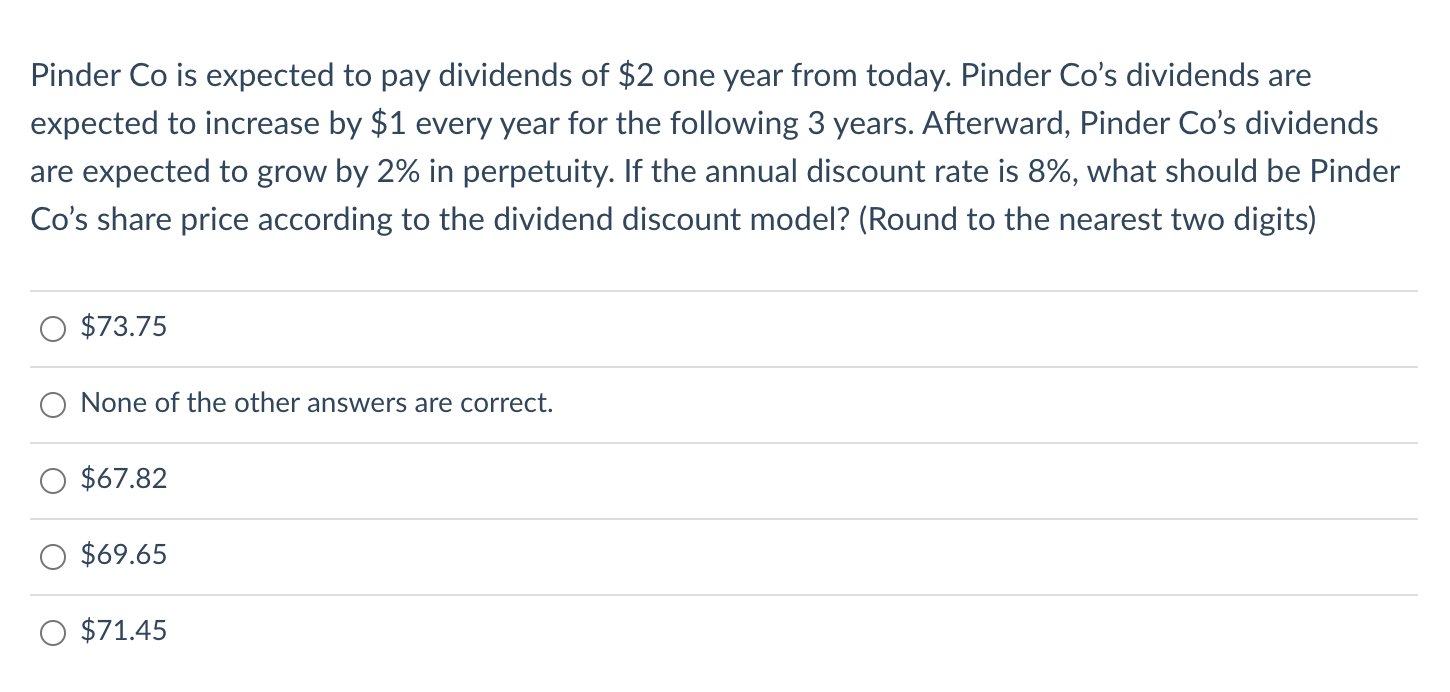

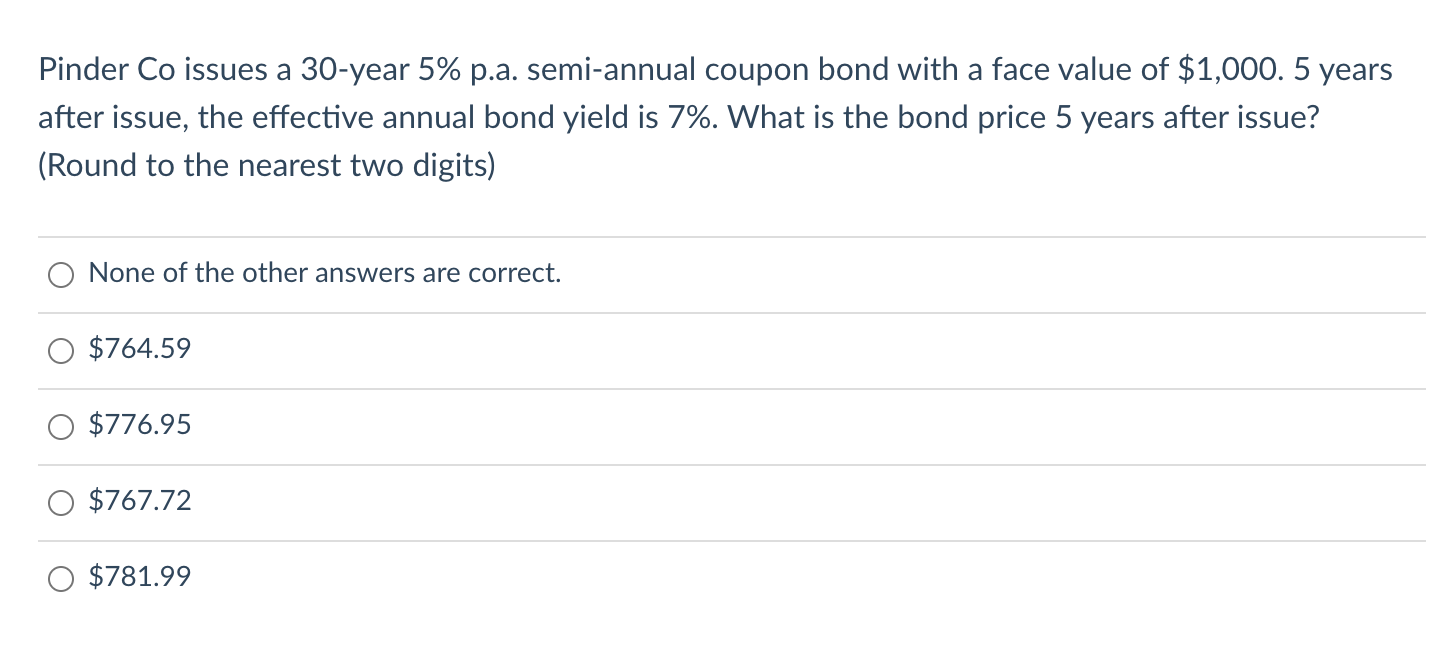

Pinder Co issues a 5-year 6% p.a. semi-annual coupon bond with a face value of $1,000. At issue, the effective annual bond yield is 10%. One year after issue, the bond yield decreases to 8%. If you had bought this bond at issue and sold it one year later just after receiving the coupon, what would be your total return over this period? (Round to the nearest two digits) 18.54% 20.07% O 17.34% None of the other answers are correct. O 19.77% Pinder Co is expected to pay dividends of $2 one year from today. Pinder Co's dividends are expected to increase by $1 every year for the following 3 years. Afterward, Pinder Co's dividends are expected to grow by 2% in perpetuity. If the annual discount rate is 8%, what should be Pinder Co's share price according to the dividend discount model? (Round to the nearest two digits) $73.75 None of the other answers are correct. $67.82 $69.65 O $71.45 Pinder Co issues a 30-year 5% p.a. semi-annual coupon bond with a face value of $1,000. 5 years after issue, the effective annual bond yield is 7%. What is the bond price 5 years after issue? (Round to the nearest two digits) None of the other answers are correct. $764.59 $776.95 $767.72 O $781.99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts