Question: 1. 2. 3. Please show work for all three questions. Thank you for your help Azero-coupon bond has a par value of $1,000 and a

1.

2.

3.

Please show work for all three questions. Thank you for your help

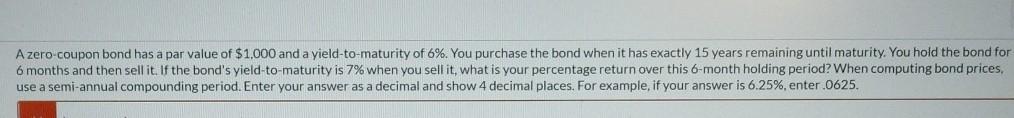

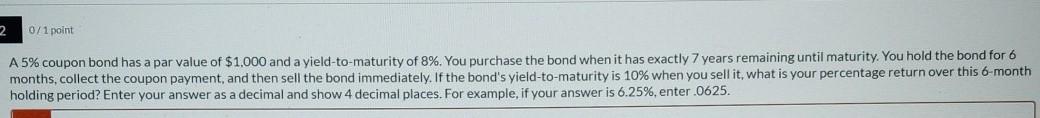

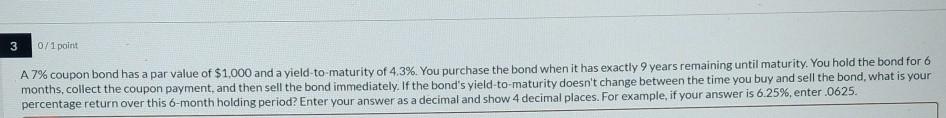

Azero-coupon bond has a par value of $1,000 and a yield-to-maturity of 6%. You purchase the bond when it has exactly 15 years remaining until maturity. You hold the bond for 6 months and then sell it. If the bond's yield-to-maturity is 7% when you sell it, what is your percentage return over this 6-month holding period? When computing bond prices, use a semi-annual compounding period. Enter your answer as a decimal and show 4 decimal places. For example, if your answer is 6.25%, enter.0625. 2 0/1 point A5% coupon bond has a par value of $1,000 and a yield-to-maturity of 8%. You purchase the bond when it has exactly 7 years remaining until maturity. You hold the bond for 6 months, collect the coupon payment, and then sell the bond immediately. If the bond's yield-to-maturity is 10% when you sell it, what is your percentage return over this 6-month holding period? Enter your answer as a decimal and show 4 decimal places. For example, if your answer is 6.25%, enter.0625. 3 071 point A 7% coupon bond has a par value of $1,000 and a yield-to-maturity of 4,3%. You purchase the bond when it has exactly 9 years remaining until maturity. You hold the bond for 6 months, collect the coupon payment, and then sell the bond immediately. If the bond's yield-to-maturity doesn't change between the time you buy and sell the bond, what is your percentage return over this 6-month holding period? Enter your answer as a decimal and show 4 decimal places. For example, if your answer is 6.25%, enter.0625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts