Question: 1. 2. 3. R = a + BiRM + ei where R; is the excess return for security i and RM is the market's excess

1. 2.

2. 3.

3.

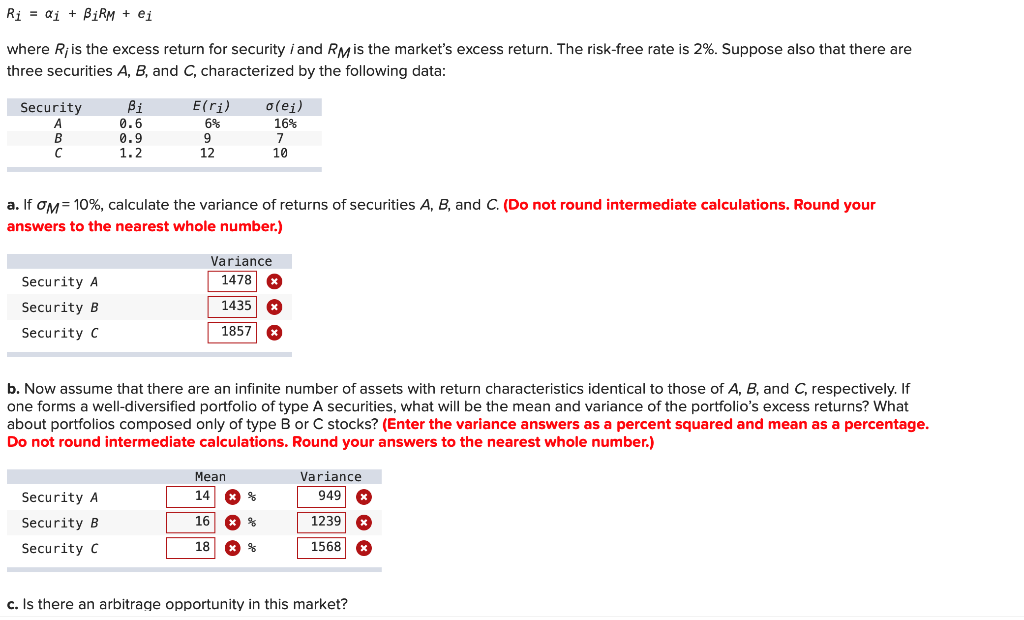

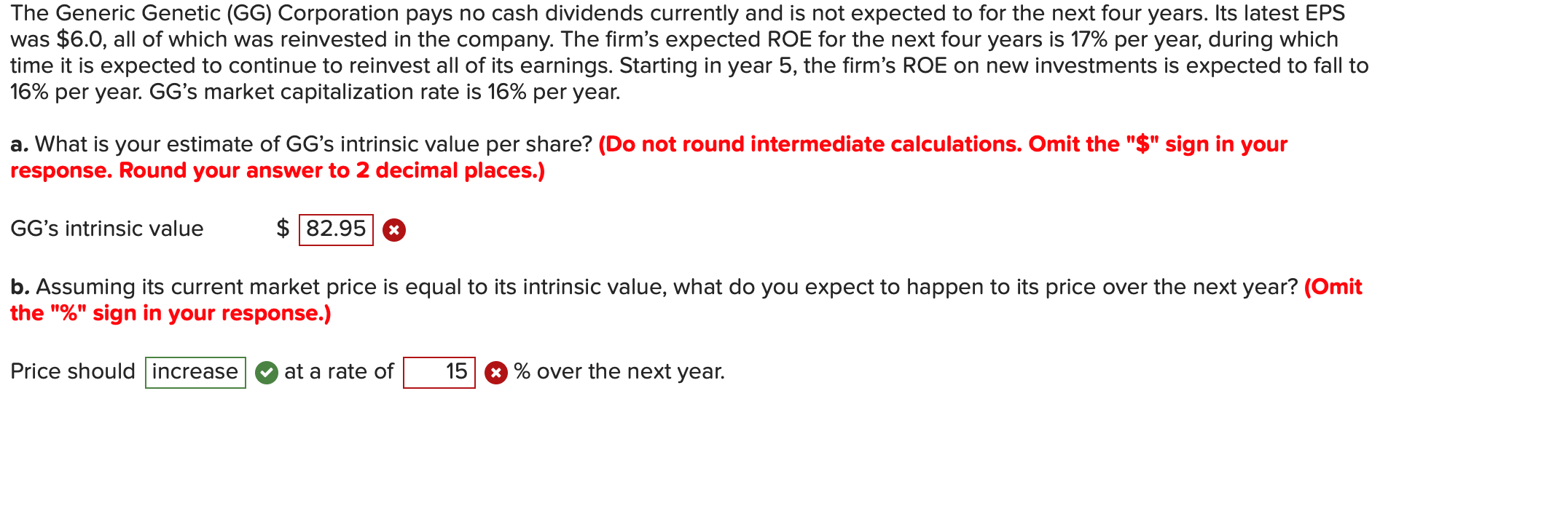

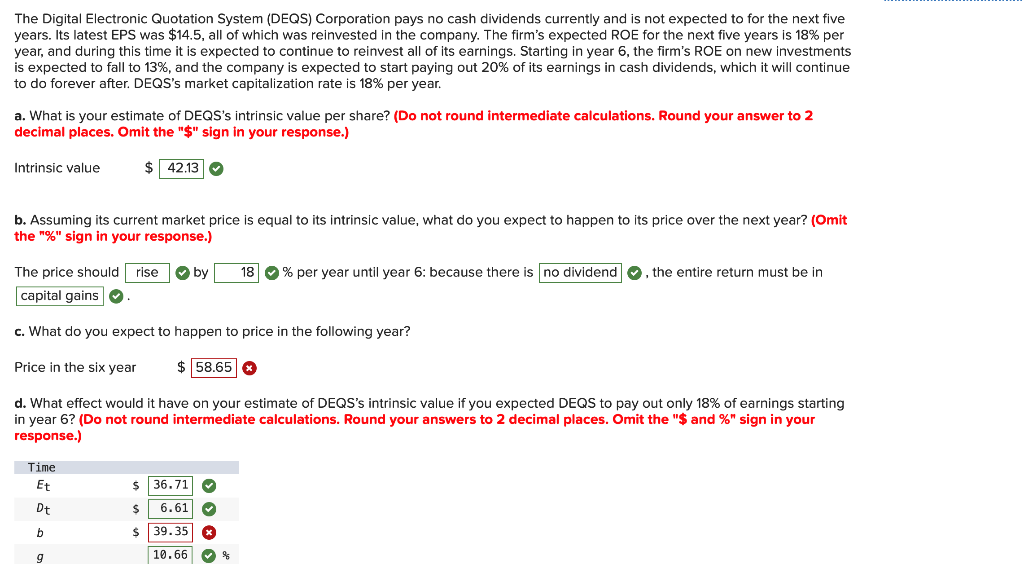

R = a + BiRM + ei where R; is the excess return for security i and RM is the market's excess return. The risk-free rate is 2%. Suppose also that there are three securities A, B, and C, characterized by the following data: Security A B C Security A Security B Security C Bi 0.6 0.9 1.2 E(ri) 6% Security A Security B Security C 9 12 a. If OM= 10%, calculate the variance of returns of securities A, B, and C. (Do not round intermediate calculations. Round your answers to the nearest whole number.) Variance 1478 1435 1857 x b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. If one forms a well-diversified portfolio of type A securities, what will be the mean and variance of the portfolio's excess returns? What about portfolios composed only of type B or C stocks? (Enter the variance answers as a percent squared and mean as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number.) Mean 14 16 18 o(ei) 16% 7 10 % % 3 x Variance 949 1239 1568 c. Is there an arbitrage opportunity in this market? The Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to for the next four years. Its latest EPS was $6.0, all of which was reinvested in the company. The firm's expected ROE for the next four years is 17% per year, during which time it is expected to continue to reinvest all of its earnings. Starting in year 5, the firm's ROE on new investments is expected to fall to 16% per year. GG's market capitalization rate is 16% per year. a. What is your estimate of GG's intrinsic value per share? (Do not round intermediate calculations. Omit the "$" sign in your response. Round your answer to 2 decimal places.) GG's intrinsic value $ 82.95 X b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? (Omit the "%" sign in your response.) Price should increase at a rate of 15 % over the next year. The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $14.5, all of which was reinvested in the company. The firm's expected ROE for the next five years is 18% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments is expected to fall to 13%, and the company is expected to start paying out 20% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 18% per year. a. What is your estimate of DEQS's intrinsic value per share? (Do not round intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) $ 42.13 Intrinsic value b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? (Omit the "%" sign in your response.) The price should rise by capital gains c. What do you expect to happen to price in the following year? Price in the six year d. What effect would it have on your estimate of DEQS's intrinsic value if you expected DEQS to pay out only 18% of earnings starting in year 6? (Do not round intermediate calculations. Round your answers to 2 decimal places. Omit the "$ and %" sign in your response.) Time Et Dt b g $ 58.65 $36.71 S 6.61 $ 39.35 10.66 % 18 % per year until year 6: because there is no dividend the entire return must be in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts