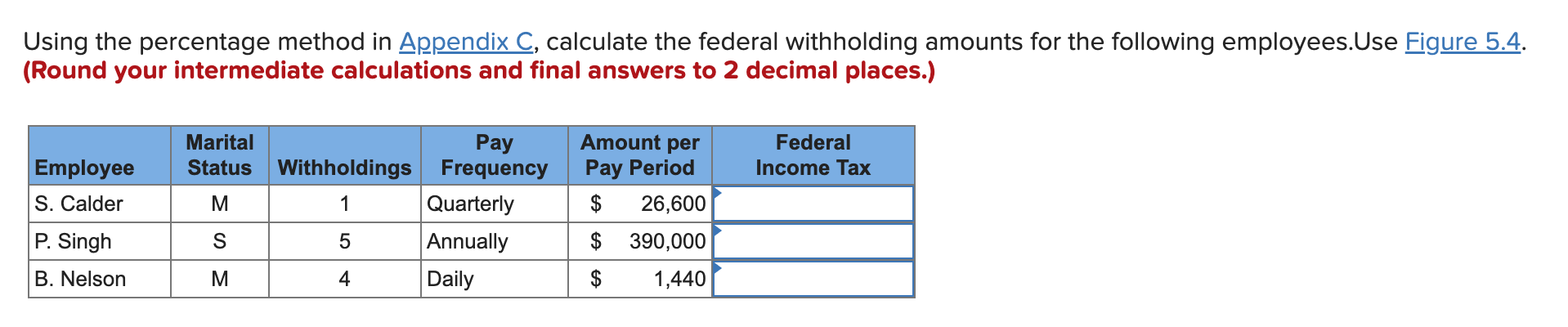

Question: 1. 2. 3. Using the percentage method in Appendix A, calculate the federal withholding amounts for the following employees.Use (Round your intermediate calculations and final

1.

2.

3.

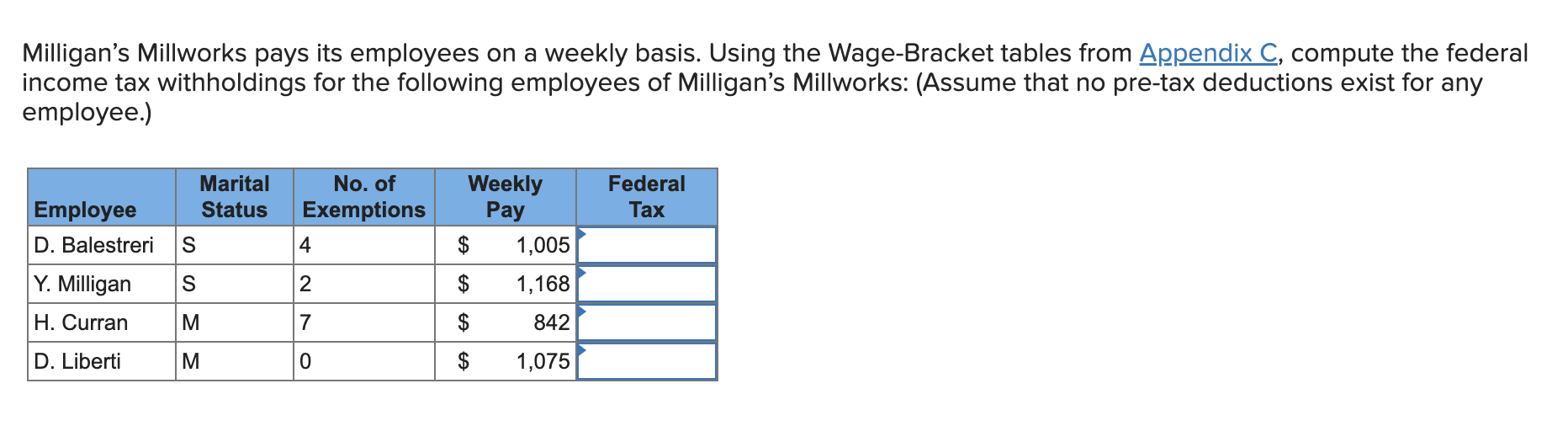

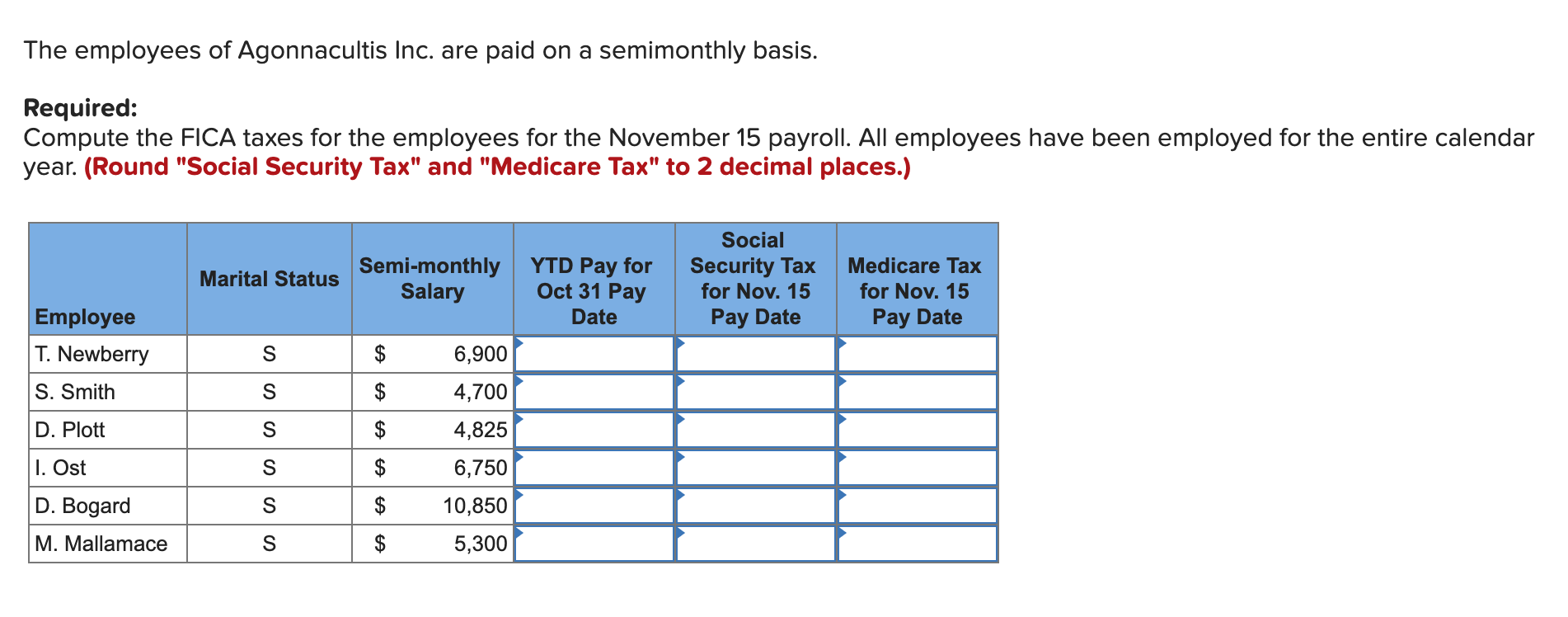

Using the percentage method in Appendix A, calculate the federal withholding amounts for the following employees.Use (Round your intermediate calculations and final answers to 2 decimal places.) Milligan's Millworks pays its employees on a weekly basis. Using the Wage-Bracket tables from compute the federal income tax withholdings for the following employees of Milligan's Millworks: (Assume that no pre-tax deductions exist for any employee.) The employees of Agonnacultis Inc. are paid on a semimonthly basis. Required: Compute the FICA taxes for the employees for the November 15 payroll. All employees have been employed for the entire calendar year. (Round "Social Security Tax" and "Medicare Tax" to 2 decimal places.) Using the percentage method in Appendix A, calculate the federal withholding amounts for the following employees.Use (Round your intermediate calculations and final answers to 2 decimal places.) Milligan's Millworks pays its employees on a weekly basis. Using the Wage-Bracket tables from compute the federal income tax withholdings for the following employees of Milligan's Millworks: (Assume that no pre-tax deductions exist for any employee.) The employees of Agonnacultis Inc. are paid on a semimonthly basis. Required: Compute the FICA taxes for the employees for the November 15 payroll. All employees have been employed for the entire calendar year. (Round "Social Security Tax" and "Medicare Tax" to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts