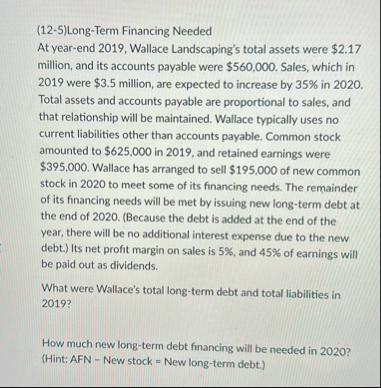

Question: ( 1 2 - 5 ) Long - Term Financing Needed At year - end 2 0 1 9 , Wallace Landscaping's total assets were

LongTerm Financing Needed

At yearend Wallace Landscaping's total assets were $ million, and its accounts payable were $ Sales, which in were $ million, are expected to increase by in Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to $ in and retained earnings were $ Wallace has arranged to sell $ of new common stock in to meet some of its financing needs. The remainder of its financing needs will be met by issuing new longterm debt at the end of Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt. Its net profit margin on sales is and of earnings will be paid out as dividends.

What were Wallace's total longterm debt and total liabilities in

How much new longterm debt financing will be needed in

Hint: AFN New stock New longterm debt.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock