Question: 1. 2. asap Problem 14-30 Flotation Costs and NPV (LO4,7) Retlaw Corporation (RC) manufactures time-series photographic equipment. It is currently at its target debt-equity ratio

1.

2. asap

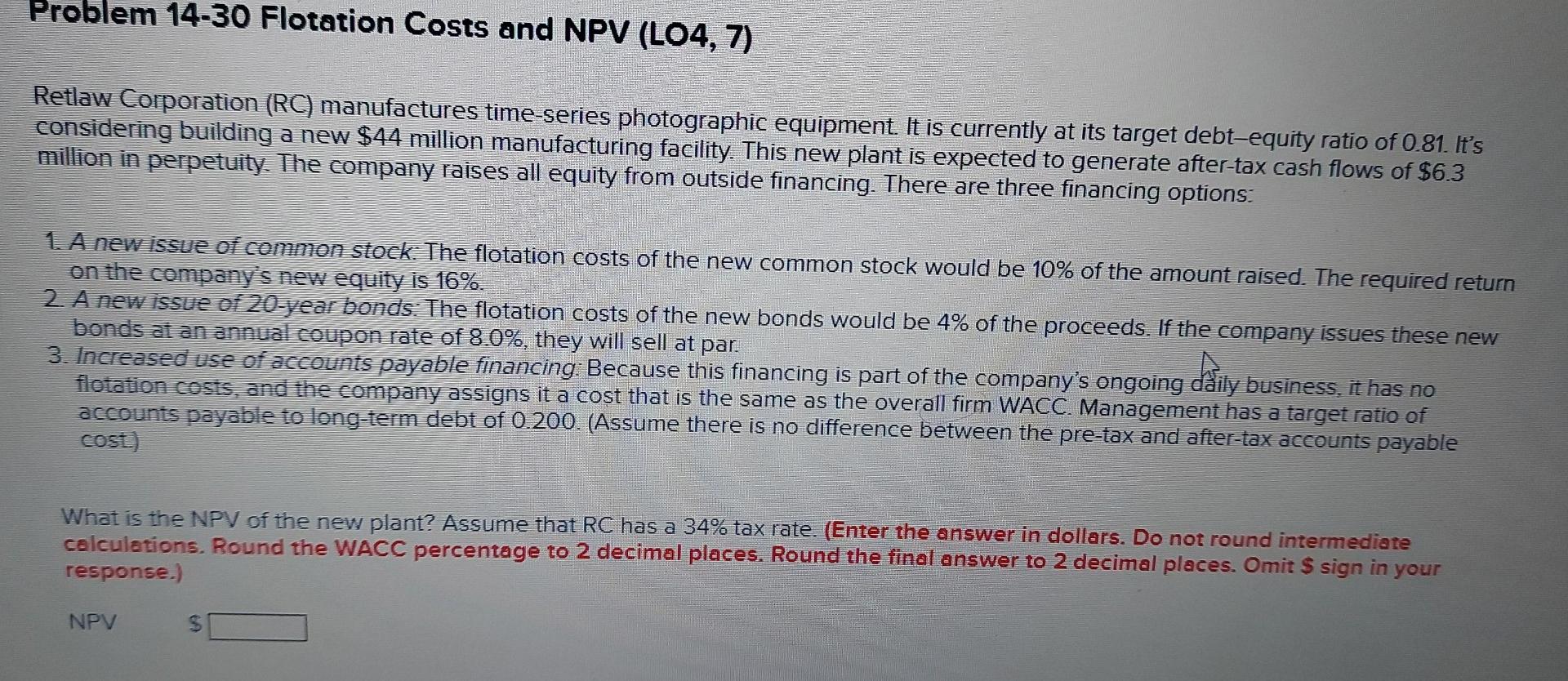

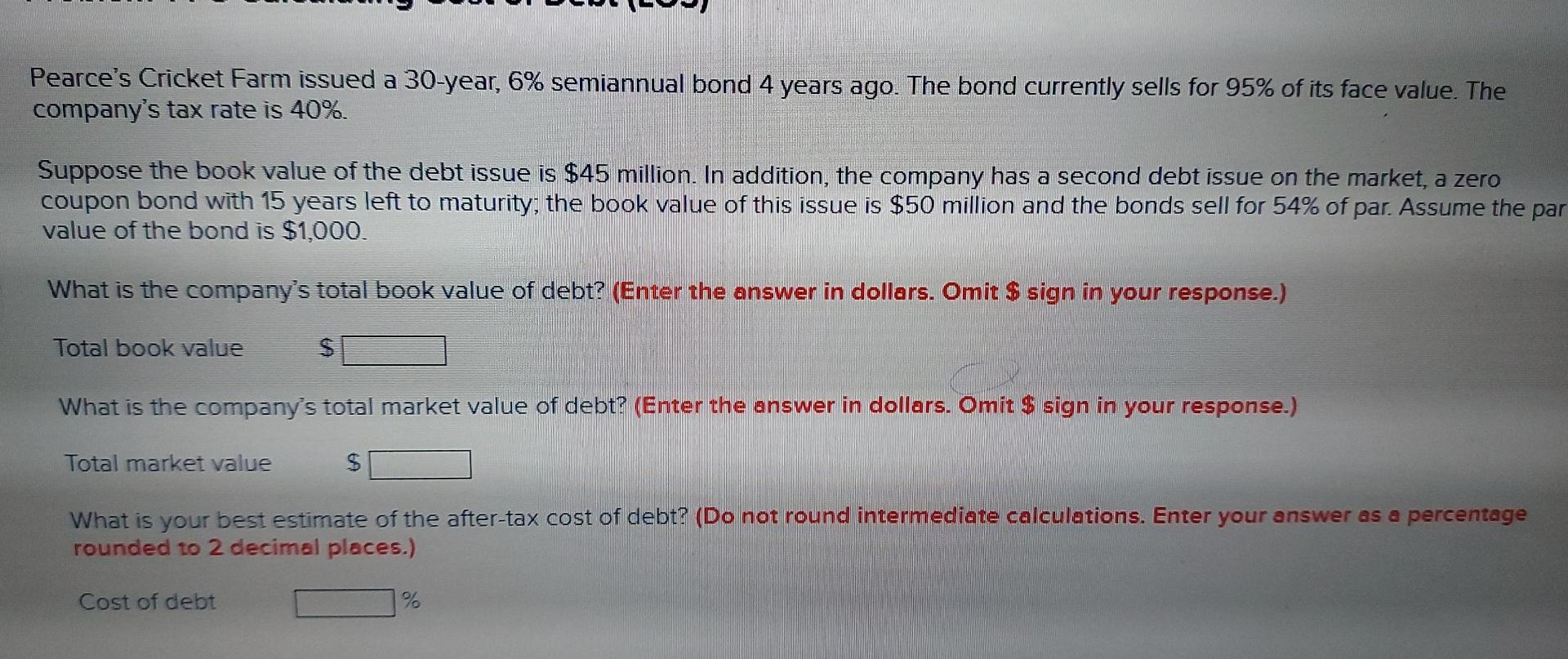

Problem 14-30 Flotation Costs and NPV (LO4,7) Retlaw Corporation (RC) manufactures time-series photographic equipment. It is currently at its target debt-equity ratio of 0.81. It's considering building a new $44 million manufacturing facility. This new plant is expected to generate after-tax cash flows of $6.3 million in perpetuity. The company raises all equity from outside financing. There are three financing options: 1. A new issue of common stock: The flotation costs of the new common stock would be 10% of the amount raised. The required return on the company's new equity is 16%. 2. A new issue of 20-year bonds. The flotation costs of the new bonds would be 4% of the proceeds. If the company issues these new bonds at an annual coupon rate of 8.0%, they will sell at par. 3. Increased use of accounts payable financing: Because this financing is part of the company's ongoing daily business, it has no flotation costs, and the company assigns it a cost that is the same as the overall firm WACC. Management has a target ratio of accounts payable to long-term debt of 0.200. (Assume there is no difference between the pre-tax and after-tax accounts payable cost.) What is the NPV of the new plant? Assume that RC has a 34% tax rate. (Enter the answer in dollars. Do not round intermediate calculations. Round the WACC percentage to 2 decimal places. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV Pearce's Cricket Farm issued a 30-year, 6% semiannual bond 4 years ago. The bond currently sells for 95% of its face value. The company's tax rate is 40% Suppose the book value of the debt issue is $45 million. In addition, the company has a second debt issue on the market, a zero coupon bond with 15 years left to maturity; the book value of this issue is $50 million and the bonds sell for 54% of par. Assume the par value of the bond is $1,000. What is the company's total book value of debt? (Enter the answer in dollars. Omit $ sign in your response.) Total book value What is the company's total market value of debt? (Enter the answer in dollars. Omit $ sign in your response.) Total market value $ What is your best estimate of the after-tax cost of debt? (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places.) Cost of debt %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts