Question: 1 2 Consider a two-state outcome for the following problem: 3 4 5 Current stock price 6 Exercise price 7 Discount rate 8 Price

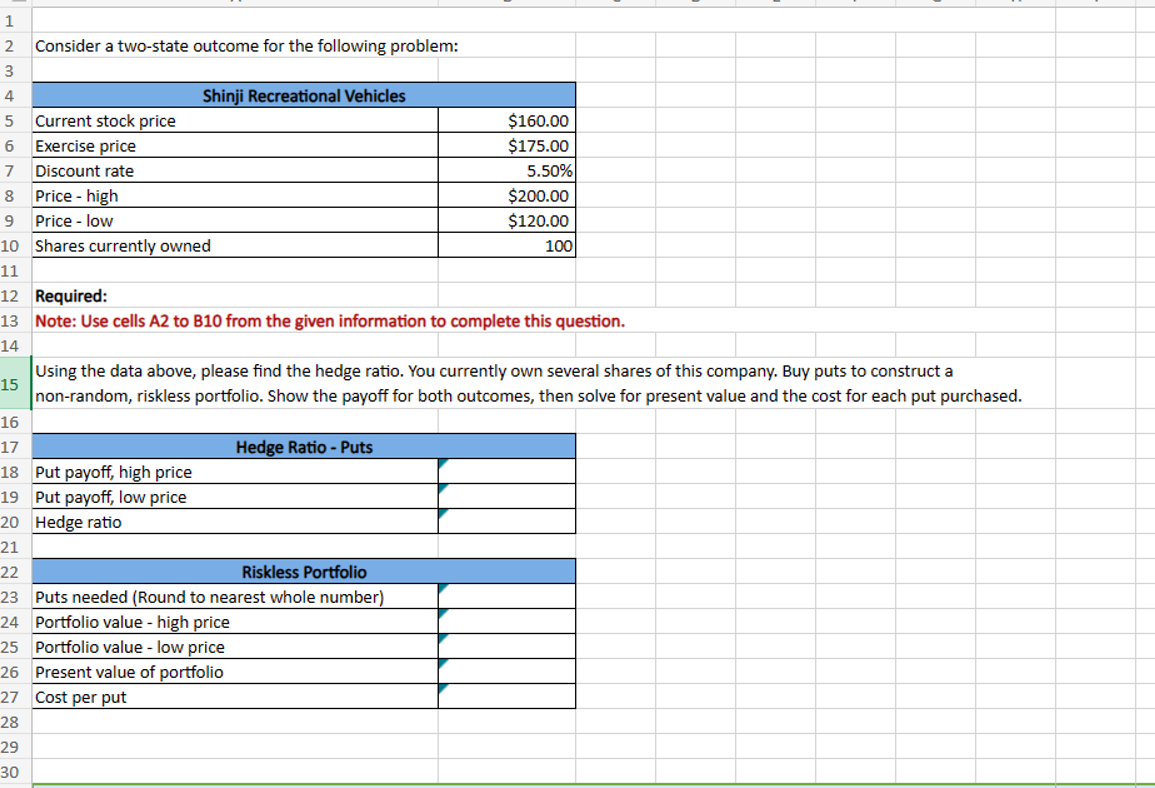

1 2 Consider a two-state outcome for the following problem: 3 4 5 Current stock price 6 Exercise price 7 Discount rate 8 Price - high 9 Price - low Shinji Recreational Vehicles $160.00 $175.00 5.50% $200.00 $120.00 10 Shares currently owned 11 12 Required: 100 13 Note: Use cells A2 to B10 from the given information to complete this question. 14 15 16 Using the data above, please find the hedge ratio. You currently own several shares of this company. Buy puts to construct a non-random, riskless portfolio. Show the payoff for both outcomes, then solve for present value and the cost for each put purchased. 17 Hedge Ratio - Puts 18 Put payoff, high price 19 Put payoff, low price 20 Hedge ratio 21 22 Riskless Portfolio 23 Puts needed (Round to nearest whole number) 24 Portfolio value - high price 25 Portfolio value - low price 26 Present value of portfolio 27 Cost per put 28 29 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts