Question: 1 2 Current Attempt in Progress In January 2022, the management of Blossom Company concludes that it has sufficient cash to permit some short-term Investments

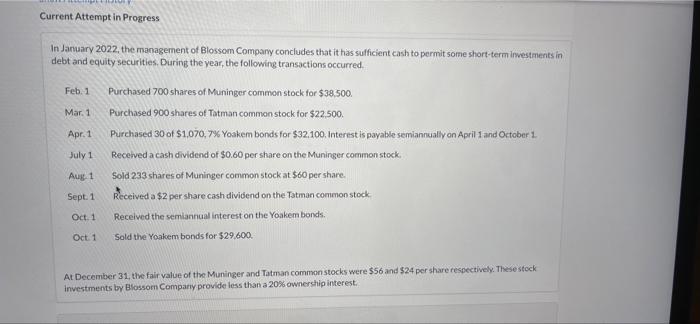

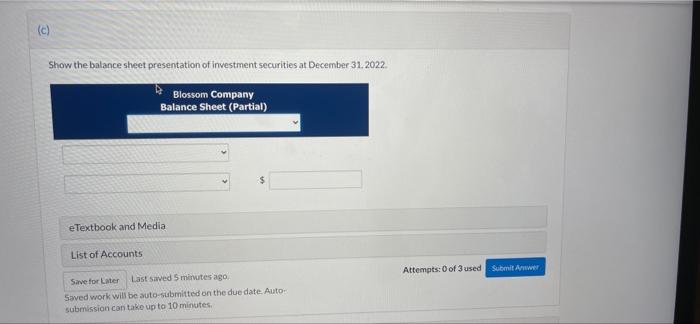

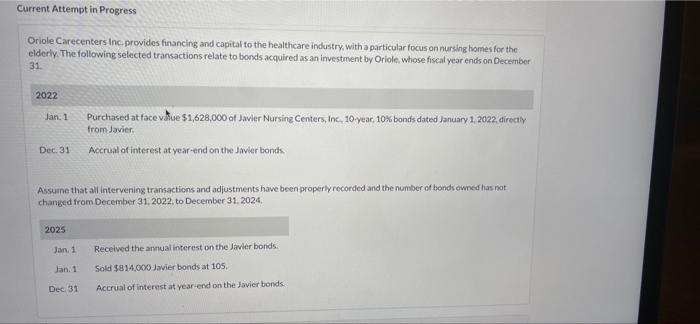

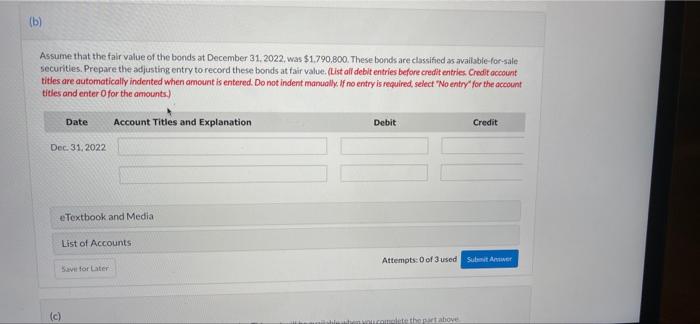

Current Attempt in Progress In January 2022, the management of Blossom Company concludes that it has sufficient cash to permit some short-term Investments in debt and equity securities. During the year, the following transactions occurred. Feb. 1 Mar. 1 Apr. 1 July 1 Purchased 700 shares of Muninger common stock for $38.500. Purchased 900 shares of Tatman common stock for $22.500. Purchased 30 of $1.070,7% Yoakem bonds for $32.100, Interest is payable semiannually on April 1 and October 1 Received a cash dividend of $0.60 per share on the Muninger common stock Sold 233 shares of Muninger common stock at $60 per share. Received a $2 per share cash dividend on the Tatman common stock Received the semiannual interest on the Yoakem bonds. Sold the Yoakem bonds for $29.600. Aug 1 Sept. 1 Oct. 1 Oct 1 At December 31, the fair value of the Muninger and Tatman common stocks were $56 and $24 per share respectively. These stock investments by Blossom Company provide less than a 20% ownership interest. (c) Show the balance sheet presentation of investment securities at December 31, 2022 Blossom Company Balance Sheet (Partial) e Textbook and Media List of Accounts Attempts: 0 of 3 used Submit Awe Save for Later Last saved 5 minutes ago Saved work will be auto-submitted on the due date. Auto submission can take up to 10 minutes Current Attempt in Progress Oriole Carecenters Inc. provides financing and capital to the healthcare industry, with a particular focus on nursing homes for the elderly. The following selected transactions relate to bonds acquired as an investment by Oriole, whose fiscal year ends on December 31 2022 Jan. 1 Purchased at face vue $1,628,000 of Javier Nursing Centers, Inc, 10-year, 10% bonds dated January 1, 2022. directly from Javier Dec. 31 Accrual of interest at year-end on the Javier bonds. Assume that all intervening transactions and adjustments have been properly recorded and the number of boncs owned has not changed from December 31, 2022, to December 31, 2024 2025 Jan, 1 Received the annual interest on the Javier bonds. Jan 1 Sold $814,000 Javier bonds at 105 Dec 31 Accrual of interest at year-end on the Javier bonds. (b) Assume that the fair value of the bonds at December 31, 2022 was $1.790,800. These bonds are classified as available for sale Securities. Prepare the adjusting entry to record these bonds at fair value. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec 31, 2022 e Textbook and Media List of Accounts Attempts: 0 of 3 used SubmAE Save for Later (c) .conto the bove

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts