Question: Question 1 View Policies Current Attempt in Progress In January 2022, the management of Oriole Company concludes that it has sufficient cash to purchase some

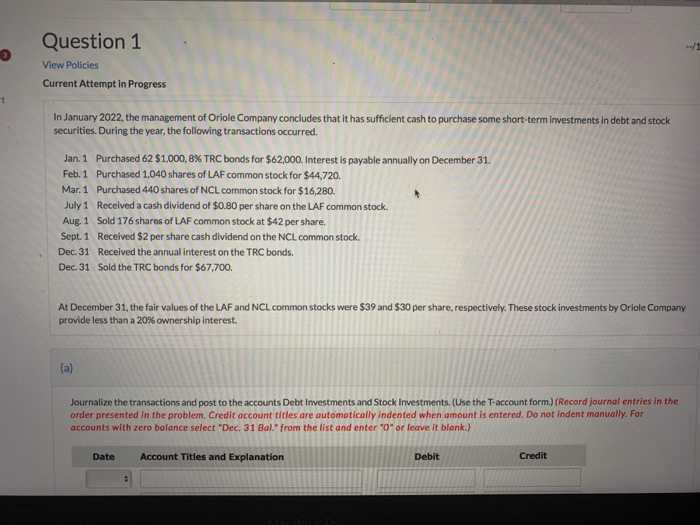

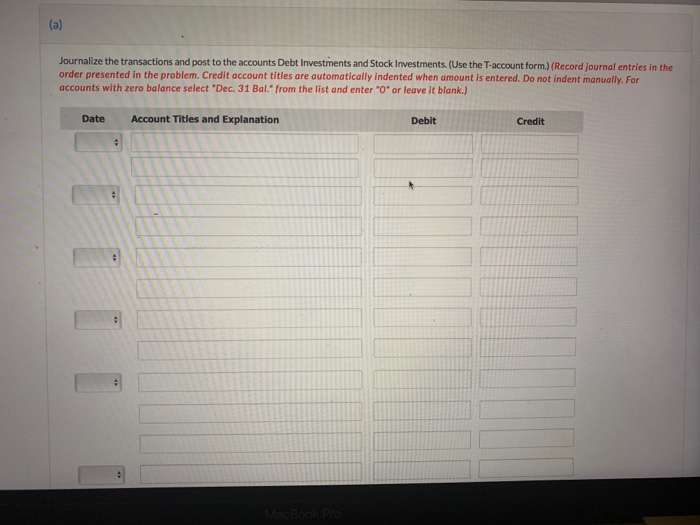

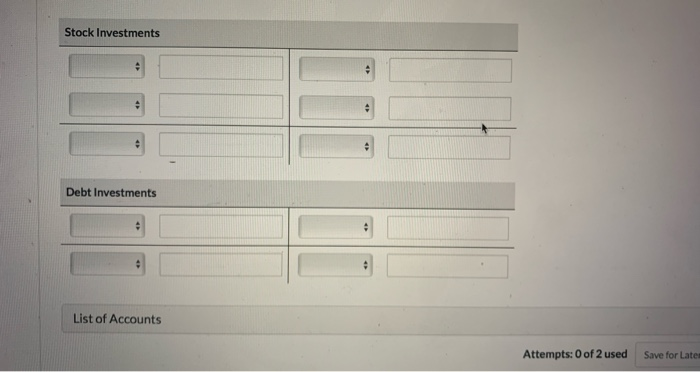

Question 1 View Policies Current Attempt in Progress In January 2022, the management of Oriole Company concludes that it has sufficient cash to purchase some short-term investments in debt and stock securities. During the year, the following transactions occurred. Jan. 1 Purchased 62 $1,000,8% TRC bonds for $62,000. Interest is payable annually on December 31 Feb. 1 Purchased 1,040 shares of LAF common stock for $44.720. Mar. 1 Purchased 440 shares of NCL common stock for $16,280. July 1 Received a cash dividend of $0.80 per share on the LAF common stock. Aug. 1 Sold 176 shares of LAF common stock at $42 per share. Sept. 1 Received $2 per share cash dividend on the NCL common stock, Dec. 31 Received the annual interest on the TRC bonds. Dec. 31 Sold the TRC bonds for $67,700. At December 31, the fair values of the LAF and NCL common stocks were $39 and $30 per share, respectively. These stock investments by Oriole Company provide less than a 20% ownership interest. Journalize the transactions and post to the accounts Debt Investments and Stock Investments. (Use the T-account form.) (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. For accounts with zero balance select "Dec. 31 Bal." from the list and enter "0" or leave it blank.) Date Account Titles and Explanation Debit Credit Stock Investments Debt Investments List of Accounts Attempts: 0 of 2 used Save for Late

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts