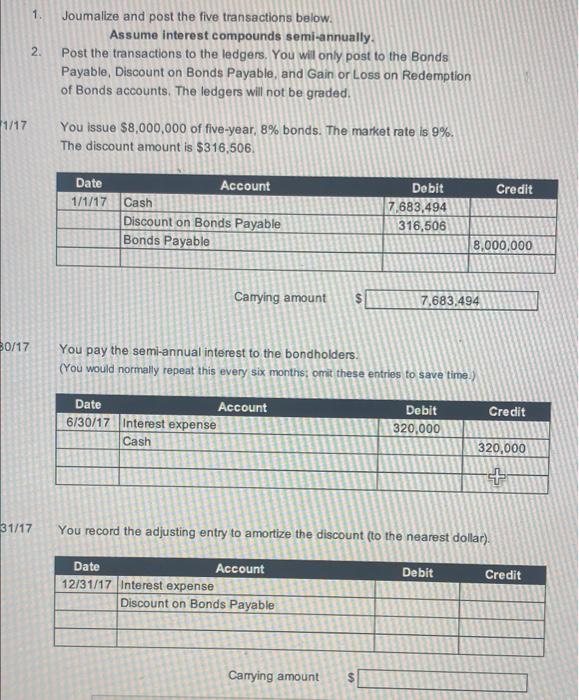

Question: 1. 2. Joumalize and post the five transactions below. Assume interest compounds semi-annually. Post the transactions to the ledgers. You will only post to the

1. 2. Joumalize and post the five transactions below. Assume interest compounds semi-annually. Post the transactions to the ledgers. You will only post to the Bonds Payable, Discount on Bonds Payable, and Gain or Loss on Redemption of Bonds accounts. The ledgers will not be graded, 1/17 You issue $8,000,000 of five-year, 8% bonds. The market rate is 9%. The discount amount is $316,506 Date 1/1/17 Credit Account Cash Discount on Bonds Payable Bonds Payable Debit 7.683,494 316,506 8,000,000 Camying amount $ 7,683,494 B0/17 You pay the semi-annual interest to the bondholders. (You would normally repeat this every six months; omit these entries to save time.) Credit Date Account 6/30/17 Interest expense Cash Debit 320,000 320,000 + 31/17 You record the adjusting entry to amortize the discount (to the nearest dollar). Debit Credit Date Account 12/31/17 Interest expense Discount on Bonds Payable Carrying amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts