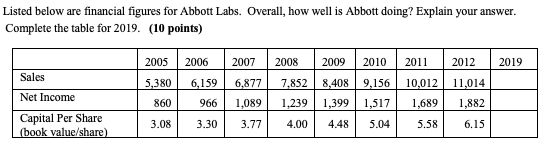

Question: 1) 2) Listed below are financial figures for Abbott Labs. Overall, how well is Abbott doing? Explain your answer. Complete the table for 2019. (10

1)

2)

Listed below are financial figures for Abbott Labs. Overall, how well is Abbott doing? Explain your answer. Complete the table for 2019. (10 points) 2019 Sales Net Income 2005 5,380 860 3.08 2006 6,159 966 3.30 2007 2008 6,877 7,852 1,089 1,239 3.774.00 2009 8,408 1,399 4.48 2010 9,156 1,517 5.04 2011 10,012 | 1,689 5.58 2012 11,014 1,882 6.15 Capital Per Share book value/share) In a perfectly competitive industry the market price is $12. A firm is currently producing 50 units of output; average total cost is $10, marginal cost is $15, and average variable cost is $7. Given this information, explain why you would advise a profit maximizing or a cost reduction scheme for this firm? Include with your answer a cost curve graph of your analysis. Explain your answer in terms of market power. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts