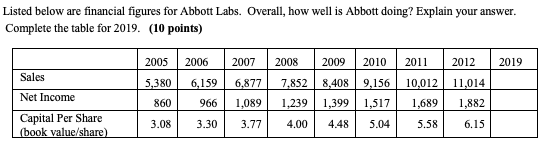

Question: 1) 2) Listed below are financial figures for Abbott Labs. Overall, how well is Abbott doing? Explain your answer. Complete the table for 2019. (10

1)

2)

Listed below are financial figures for Abbott Labs. Overall, how well is Abbott doing? Explain your answer. Complete the table for 2019. (10 points) Sales Net Income Capital Per Share (book value/share) 2005 5,380 860 3.08 2006 2007 2008 2009 2010 2011 2012 2019 6,159 6,877 7,852 8,408 9,156 10,012 11,014 966 1,089 1,239 1,399 1,517 1,689 1,882 3.30 3.77 4.00 4.48 5.04 5.58 6.15 In a perfectly competitive industry the market price is $12. A firm is currently producing 50 units of output; average total cost is $10, marginal cost is $15, and average variable cost is $7. Given this information, explain why you would advise a profit maximizing or a cost reduction scheme for this firm? Include with your answer a cost curve graph of your analysis. Explain your answer in terms of market power. (10 points)

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Lets tackle each part separately Part 1 Financial Analysis of Abbott Labs Task Complete the table for 2019 and analyze Abbotts performance Completing ... View full answer

Get step-by-step solutions from verified subject matter experts