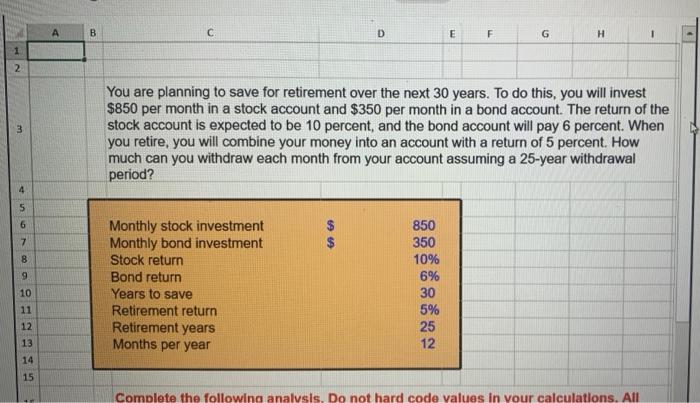

Question: 1 2 m 4 55 6 7 8 9 10 11 12 13 14 15 A B C D F G H You are planning

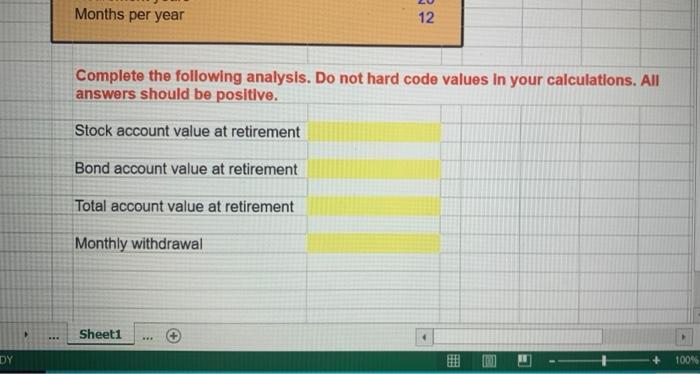

1 2 m 4 55 6 7 8 9 10 11 12 13 14 15 A B C D F G H You are planning to save for retirement over the next 30 years. To do this, you will invest $850 per month in a stock account and $350 per month in a bond account. The return of the stock account is expected to be 10 percent, and the bond account will pay 6 percent. When you retire, you will combine your money into an account with a return of 5 percent. How much can you withdraw each month from your account assuming a 25-year withdrawal period? 850 Monthly stock investment Monthly bond investment 350 Stock return 10% Bond return 6% Years to save 30 Retirement return 5% Retirement years 25 Months per year 12 Complete the following analysis. Do not hard code values in your calculations. All 6959 4 DY Months per year 12 Complete the following analysis. Do not hard code values in your calculations. All answers should be positive. Stock account value at retirement Bond account value at retirement Total account value at retirement Monthly withdrawal Sheet1 *** 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts