Question: 1 2 nower eblow * e ner Ditrences: management has the poritive intent and ablity to hold the bonds untl matarty. The maket interest rabe

nower

eblow

e

ner

Ditrences: management has the poritive intent and ablity to hold the bonds untl matarty. The maket interest rabe bleith mas ins for bonds of similar risk and maturty. TavverNF paid $ milion for the bonds. The compary will recelve inserett ir m mually on dune

Aequired: at The eflective narket rite.

A what anourt whi TarnerUNF report its investment in the December balanoe sheet?

Suppose Moody bond rating agency downgraded the rak rabing of the bonds moblvating TannerUn sell the investent on January for $ milion. Reppere the joumal enty to recond the sale.

Cemplete thile evestion by antering veur anwwers in the table below.

Smel and ehloctere maviet rate.

thine lineta

Journal entry worksheet

pevert

sayeet

nhine

NTH

Thenemen

Compliete This questien by enteriseg yeur anwwers in the tabe belew,

leme and efloctlve maviet rate.

Premimeat

Journal entry worksheet

len

then lien

Remer

Hepolite:

Ane nelerl now

Thins line

Jeurnal entry werksheet

I

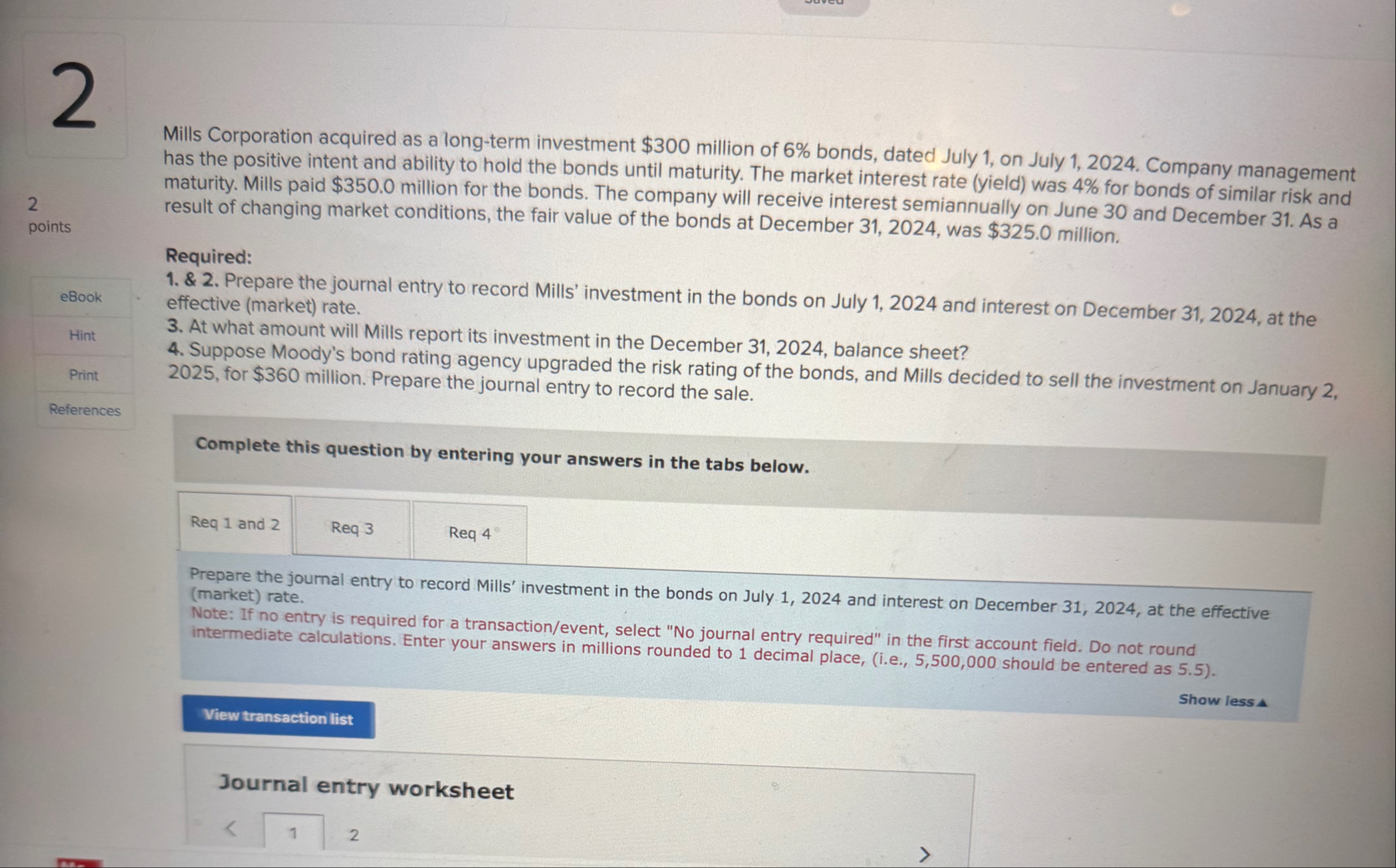

Mills Corporation acquired as a longterm investment $ million of bonds, dated July on July Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate yield was for bonds of similar risk and maturity. Mills paid $ million for the bonds. The company will receive interest semiannually on June and December As a result of changing market conditions, the fair value of the bonds at December was $ million.

points

eBook

Hint

Print

References

Required:

nower

eblow

e

ner

Ditrences: management has the poritive intent and ablity to hold the bonds untl matarty. The maket interest rabe bleith mas ins for bonds of similar risk and maturty. TavverNF paid $ milion for the bonds. The compary will recelve inserett ir m mually on dune

Aequired: at The eflective narket rite.

A what anourt whi TarnerUNF report its investment in the December balanoe sheet?

Suppose Moody bond rating agency downgraded the rak rabing of the bonds moblvating TannerUn sell the investent on January for $ milion. Reppere the joumal enty to recond the sale.

Cemplete thile evestion by antering veur anwwers in the table below.

Smel and ehloctere maviet rate.

thine lineta

Journal entry worksheet

pevert

sayeet

nhine

NTH

Thenemen

Compliete This questien by enteriseg yeur anwwers in the tabe belew,

leme and efloctlve maviet rate.

Premimeat

Journal entry worksheet

len

then lien

Remer

Hepolite:

Ane nelerl now

Thins line

Jeurnal entry werksheet

I

Mills Corporation acquired as a longterm investment $ million of bonds, dated July on July Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate yield was for bonds of similar risk and maturity. Mills paid $ million for the bonds. The company will receive interest semiannually on June and December As a result of changing market conditions, the fair value of the bonds at December was $ million.

points

eBook

Hint

Print

References

Required:

nower

eblow

e

ner

Ditrences: management has the poritive intent and ablity to hold the bonds untl matarty. The maket interest rabe bleith mas ins for bonds of similar risk and maturty. TavverNF paid $ milion for the bonds. The compary will recelve inserett ir m mually on dune

Aequired: at The eflective narket rite.

A what anourt whi TarnerUNF report its investment in the December balanoe sheet?

Suppose Moody bond rating agency downgraded the rak rabing of the bonds moblvating TannerUn sell the investent on January for $ milion. Reppere the joumal enty to recond the sale.

Cemplete thile evestion by antering veur anwwers in the table below.

Smel and ehloctere maviet rate.

thine lineta

Journal entry worksheet

pevert

sayeet

nhine

NTH

Thenemen

Compliete This questien by enteriseg yeur anwwers in the tabe belew,

leme and efloctlve maviet rate.

Premimeat

Journal entry worksheet

len

then lien

Remer

Hepolite:

Ane nelerl now

Thins line

Jeurnal entry werksheet

I

Mills Corporation acquired as a longterm investment $ million of bonds, dated July on July Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate yield was for bonds of similar risk and maturity. Mills paid $ million for the bonds. The company will receive interest semiannually on June and December As a result of changing market conditions, the fair value of the bonds at December was $ million.

points

eBook

Hint

Print

References

Required:

nower

eblow

e

ner

Ditrences: management has the poritive intent and ablity to hold the bonds untl matarty. The maket interest rabe bleith mas ins for bonds of similar risk and maturty. TavverNF paid $ milion for the bonds. The compary will recelve inserett ir m mually on dune

Aequired: at The eflective narket rite.

A what anourt whi TarnerUNF report its investment in the December balanoe sheet?

Suppose Moody bond rating agency downgraded the rak rabing of the bonds moblvating TannerUn sell the investent on January for $ milion. Reppere the joumal enty to recond the sale.

Cemplete thile evestion by antering veur anwwers in the table below.

Smel and ehloctere maviet rate.

thine lineta

Journal entry worksheet

pevert

sayeet

nhine

NTH

Thenemen

Compliete This questien by enteriseg yeur anwwers in the tabe belew,

leme and efloctlve maviet rate.

Premimeat

Journal entry worksheet

len

then lien

Remer

Hepolite:

Ane nelerl now

Thins line

Jeurnal entry werksheet

I

Mills Corporation acquired as a longterm investment $ million of bonds, dated July on July Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate yield was for bonds of similar risk and maturity. Mills paid $ million for the bonds. The company will receive interest semiannually on June and December As a result of changing market conditions, the fair value of the bonds at December was $ million.

points

eBook

Hint

Print

References

Required:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock