Question: 1) (20 points; 5 points for each part) You are an active portfolio manager. You received the following information regarding the expected market excess returns,

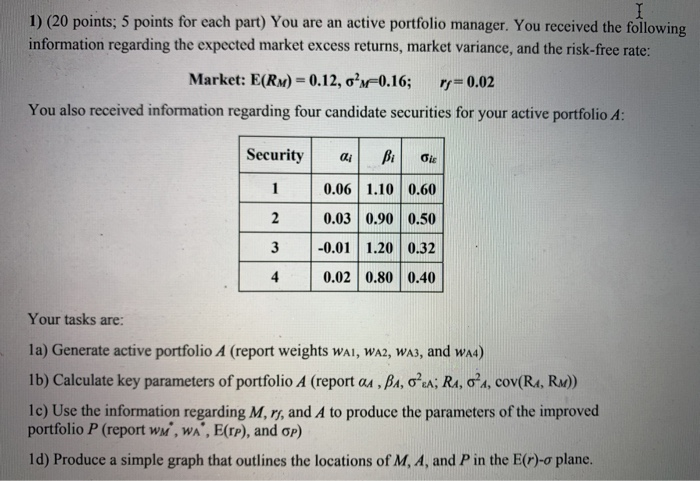

1) (20 points; 5 points for each part) You are an active portfolio manager. You received the following information regarding the expected market excess returns, market variance, and the risk-free rate: Market: E(RM) = 0.12, or-0.16; ry=0.02 You also received information regarding four candidate securities for your active portfolio A: Security ai Bi 0.06 1.10 0.60 0.03 0.90 0.50 -0.01 1.20 0.32 0.02 0.80 0.40 Your tasks are: la) Generate active portfolio A (report weights WAI, WA2, WA3, and waa) 1b) Calculate key parameters of portfolio A (report , BA, oza; RA, oA, cov(RA, Rx)) 1c) Use the information regarding M, rs, and A to produce the parameters of the improved portfolio P (report WM, WA, E(TP), and op) 1d) Produce a simple graph that outlines the locations of M, A, and P in the E(r)-o plane

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts