Question: 1. (20 points) Interpretation - top-down beta You run a regression of the monthly returns of a US firm on the S&P 500 Index

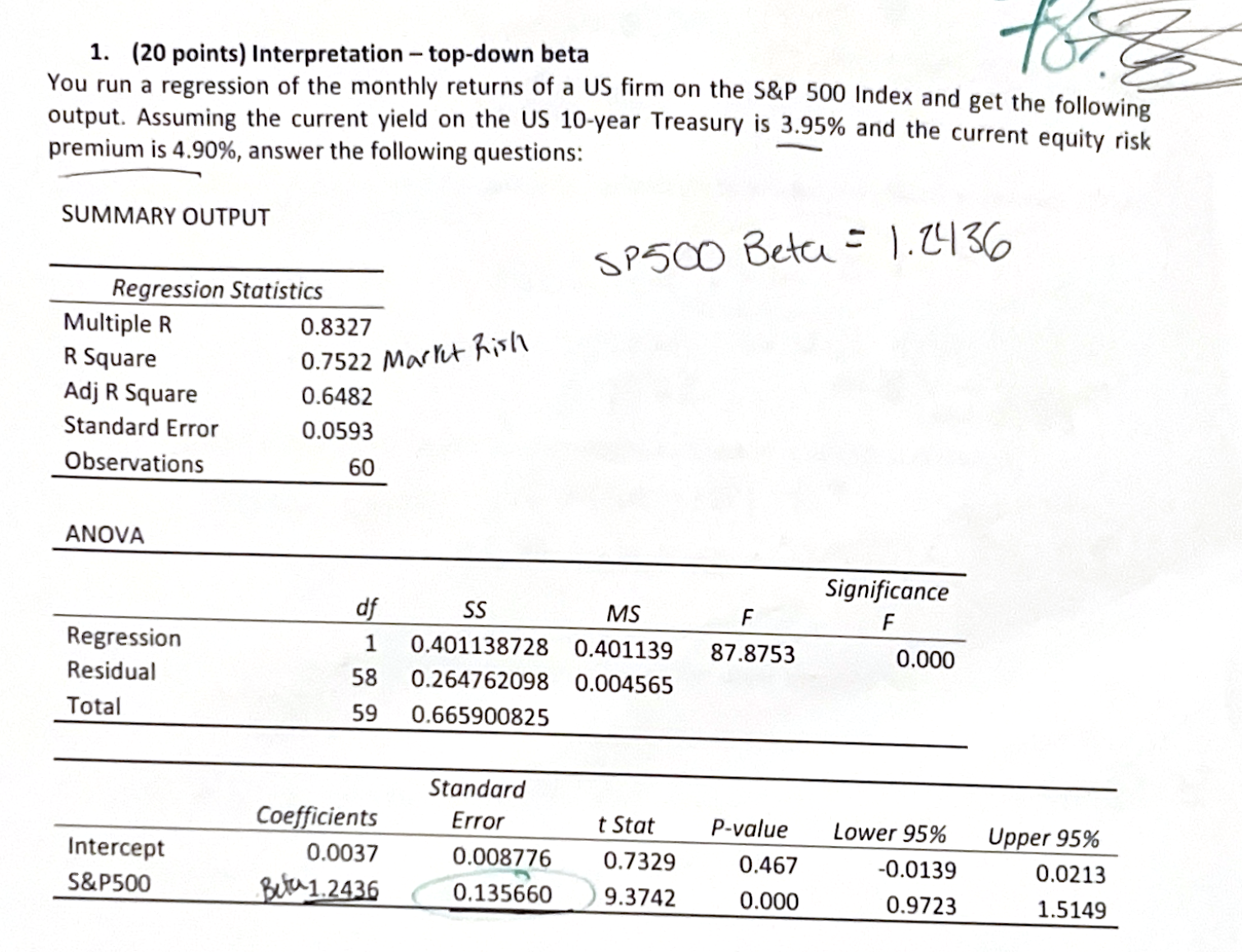

1. (20 points) Interpretation - top-down beta You run a regression of the monthly returns of a US firm on the S&P 500 Index and get the following output. Assuming the current yield on the US 10-year Treasury is 3.95% and the current equity risk premium is 4.90%, answer the following questions: SUMMARY OUTPUT Regression Statistics 0.8327 0.7522 Market Rish Multiple R R Square Adj R Square 0.6482 Standard Error 0.0593 Observations 60 ANOVA = SP500 Beta 1.2436 df SS MS F Significance F Regression 1 0.401138728 0.401139 87.8753 0.000 Residual 58 0.264762098 0.004565 Total 59 0.665900825 Standard Coefficients Error t Stat P-value Lower 95% Upper 95% Intercept 0.0037 0.008776 0.7329 0.467 -0.0139 0.0213 S&P500 Beta 1.2436 0.135660 9.3742 0.000 0.9723 1.5149

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts