Question: C. Compute the annualized Jensen's alpha. What does this value tell you about management's ability at Textron? D. What proportion of Textron's can be attributable

C. Compute the annualized Jensen's alpha. What does this value tell you about management's ability at Textron?

D. What proportion of Textron's can be attributable to market risk? What proportion of this Textron's risk is diversifiable?

E. What would an investor in Textron require as a rate of return (cost of equity)?

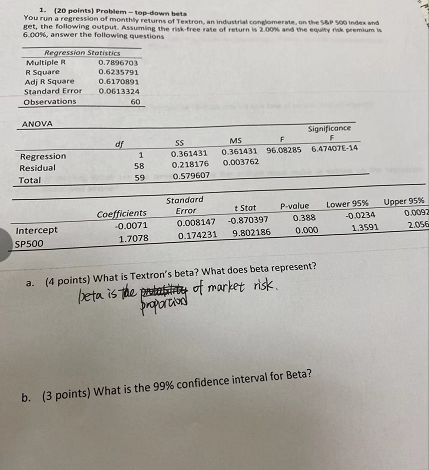

1. (20 points) Problem - top-down beta You run a regression of monthly returns of Textron, an industrial conglomerate, on the SAP Index get the following output. Assuming the risk tree rate of return is 2.00% and the wind premium is 6.00M, answer the following questions Regression Statistics Multiple R 0.7896703 R Square 0.6235791 Adj R Square 0.6170891 Standard Error 0.0613324 Observations 60 ANOVA df Significance MS F F 0.361431 96.08285 6.47407E-14 0.003762 Regression Residual Total SS 0.361431 0.2 18176 0.579607 1 58 59 Standard Error 0.008147 0.174231 Coefficients -0.0071 1.7078 t Stat -0.870397 9.802186 P-value 0.388 0.000 Lower 95% Upper 95% -0.0234 0.0092 1.3591 2.056 Intercept SP500 (4 points) What is Textron's beta? What does beta represent? beta is the probability of market risk. proportion b. (3 points) What is the 99% confidence interval for Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts