Question: 1 23 2 4 56 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

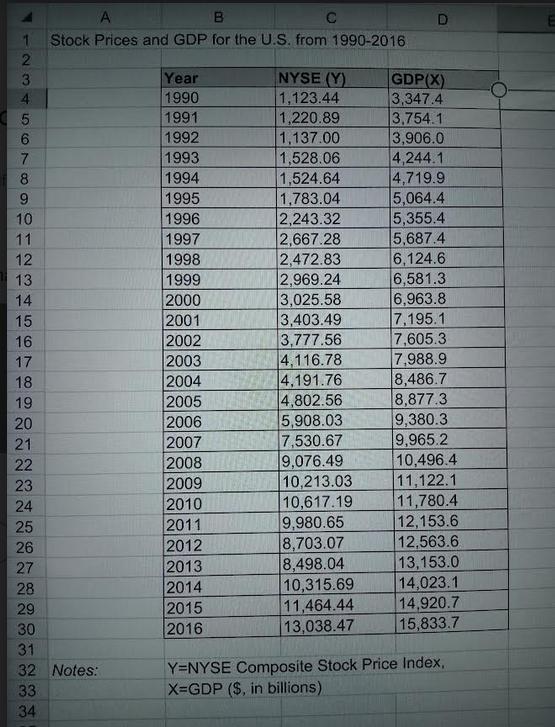

1 23 2 4 56 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 A B C Stock Prices and GDP for the U.S. from 1990-2016 29 30 31 32 Notes: 33 34 Year 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 NYSE (Y) 1,123.44 1,220.89 1,137.00 1,528.06 1,524.64 1,783.04 2,243.32 2,667.28 2,472.83 2,969.24 3,025.58 3,403.49 3,777.56 4,116.78 4,191.76 4,802.56 5,908.03 7,530.67 9,076.49 10,213.03 10,617.19 9,980.65 8,703.07 8,498.04 10,315.69 11,464.44 13,038.47 GDP(X) 3,347.4 3,754.1 3,906.0 4,244.1 4,719.9 5,064.4 5,355.4 5,687.4 6,124.6 6,581.3 6,963.8 7,195.1 7,605.3 7,988.9 8,486.7 8,877.3 9,380.3 9,965.2 10,496.4 11,122.1 11,780.4 12,153.6 12,563.6 13,153.0 14,023.1 14,920.7 15,833.7 Y=NYSE Composite Stock Price Index, X=GDP ($, in billions) QUESTION 3 Consider the data given in Table 2 relating to stock prices and GDP for the period 1980 - 2006. a. b. C. d. e. f. Estimate the OLS regression Y =B + BX + U (5 Marks) Find out if there is first-order autocorrelation in the data on the basis of the d statistic. (1 Marks) If there is, use the d value to estimate the autocorrelation parameter p. (2 Marks) Using this estimate of p, transform the data per the generalized difference equation (10.14- refer textbook note or slides), and estimate this equation by OLS (1) by dropping the first observation and (2) by including the first observation. (10 Marks) Repeat part (d), but estimate p from the residuals as shown in Eq. (10.20- refer textbook note or slides). Using this estimate of p, estimate the generalized difference equation (10.14- refer textbook note or slides). (10 Marks) Compare the results of regressions obtained in parts (d) and (e). What conclusions can you draw? Is there autocorrelation in the transformed regressions? How do you know? (2 Marks) (TOTAL: 80 MARKS)

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Allow us to consider the issue wherein we have a yvariable and xfactors generally estimated as a period series For instance we could have y as the mon... View full answer

Get step-by-step solutions from verified subject matter experts