Question: 1) (25 points) An investor is faced with the problem of choosing among 2 investment opportunities that have the following deterministic cash flow streams and

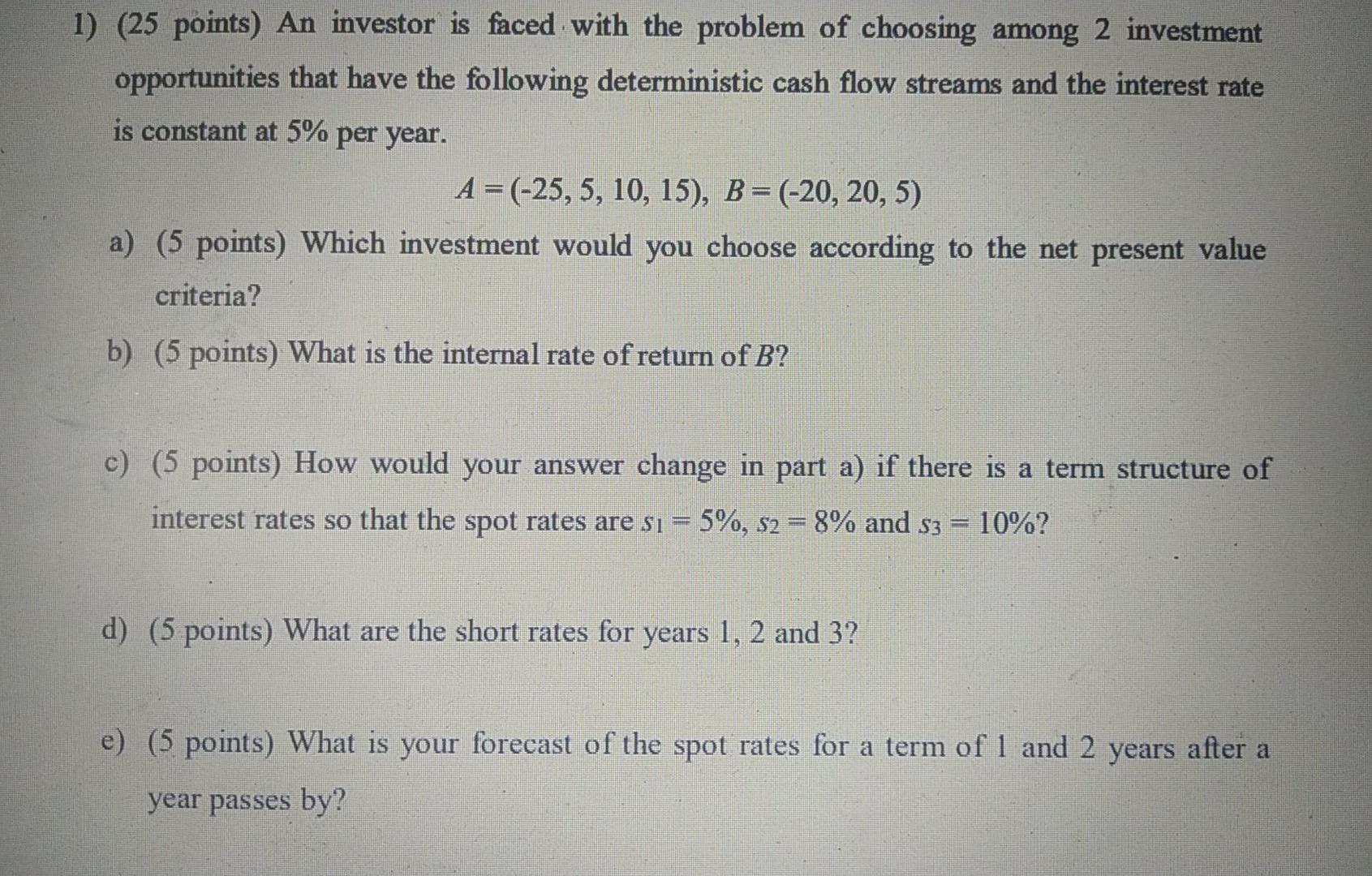

1) (25 points) An investor is faced with the problem of choosing among 2 investment opportunities that have the following deterministic cash flow streams and the interest rate is constant at 5% per year. A=(-25, 5, 10, 15), B=(-20, 20, 5) a) (5 points) Which investment would you choose according to the net present value criteria? b) (5 points) What is the internal rate of return of B? c) (5 points) How would your answer change in part a) if there is a term structure of interest rates so that the spot rates are si = 5%, 52 = 8% and s3 = 10%? d) (5 points) What are the short rates for years 1, 2 and 3? e) (5 points) What is your forecast of the spot rates for a term of 1 and 2 years after a year passes by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts