Question: 1. 2.For the case presented in question 1.1, at what level of demand (in pounds) per year would these two alternatives be equal? Note: please

1.

2.For the case presented in question 1.1, at what level of demand (in pounds) per year would these two alternatives be equal? Note: please change the total cost of ocean to $825,000.

3.For the case presented in question 1.1, at what level of demand (in pounds) per year would these two alternatives be equal? Note: please change the total cost of ocean to $825,000.

4.For the case presented in question 1.1, which alternative would you recommend be in place to accommodate future demand growth? What additional factors should be considered? Note: please change the total cost of ocean to $825,000.

5.For the following case, calculate the financial impact of increasing order fill rates to 98% from 92%.

6.

For the case presented in question 2.1, develop a strategic profit model of both the old and modified systems that reflects the suggested adjustments.

7.

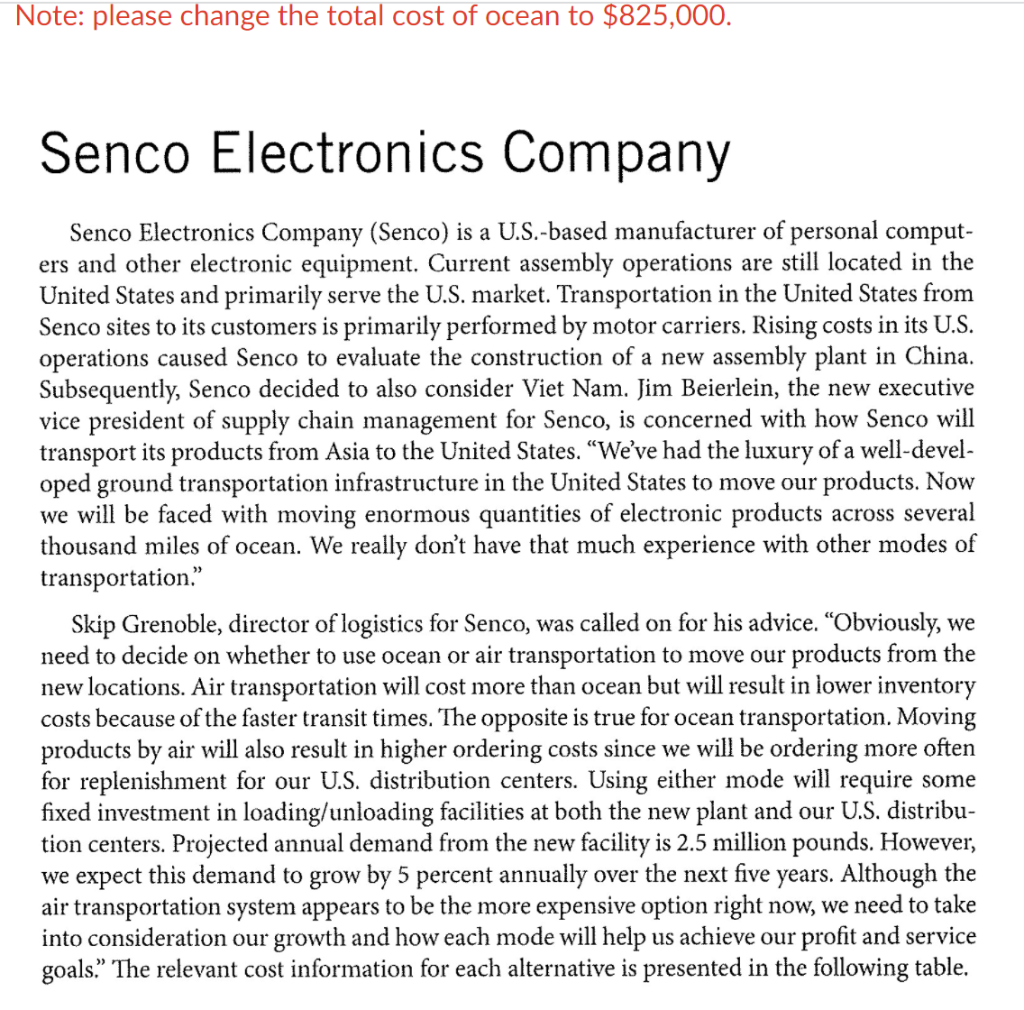

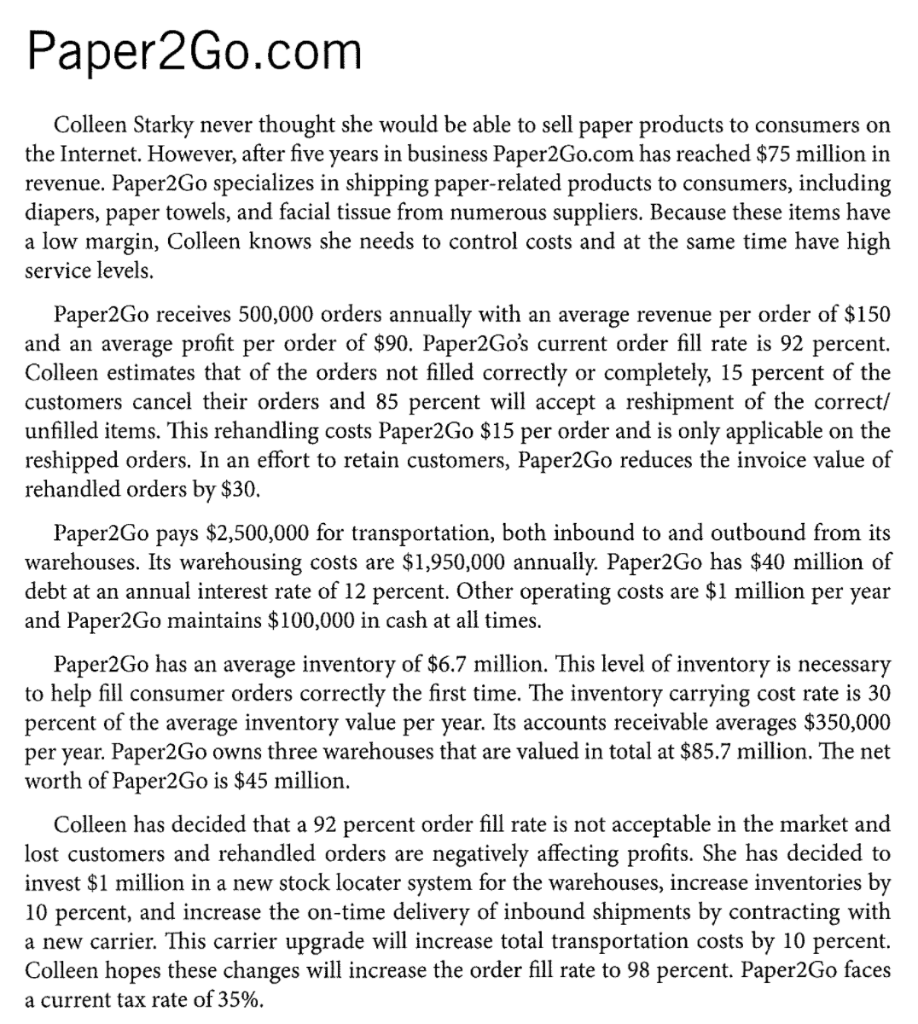

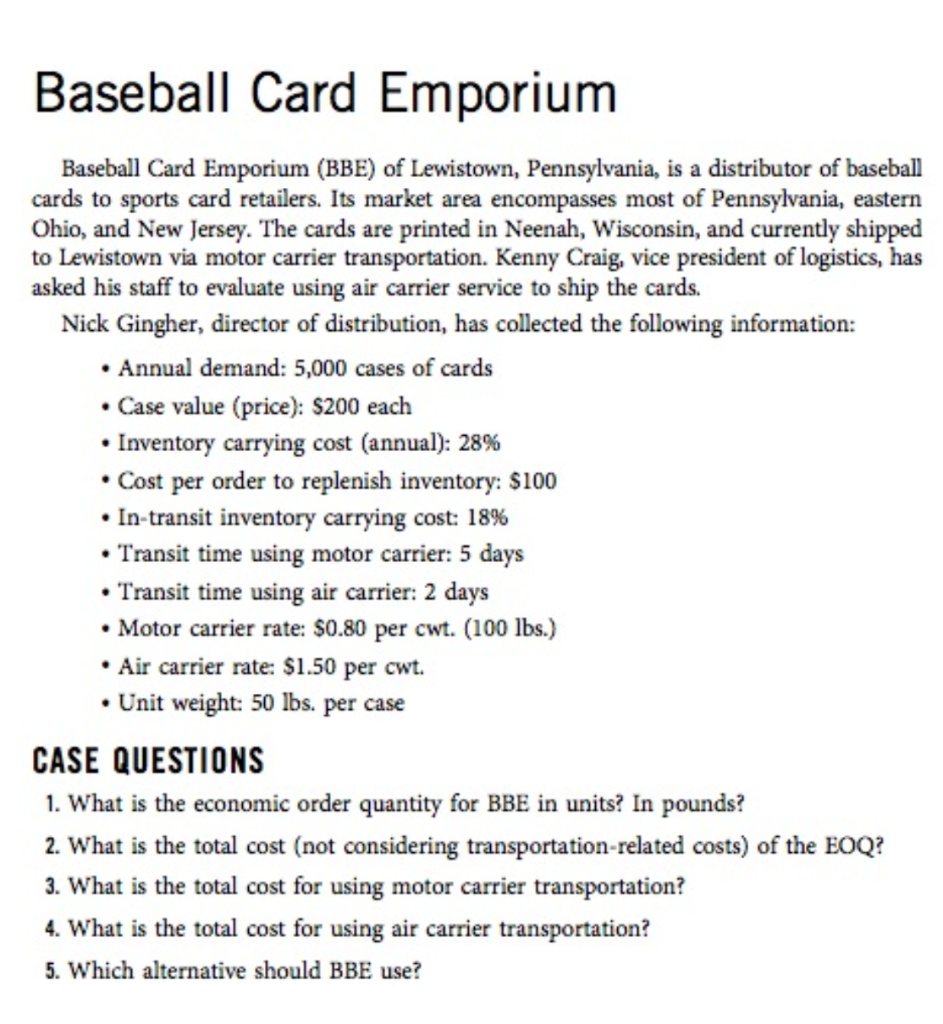

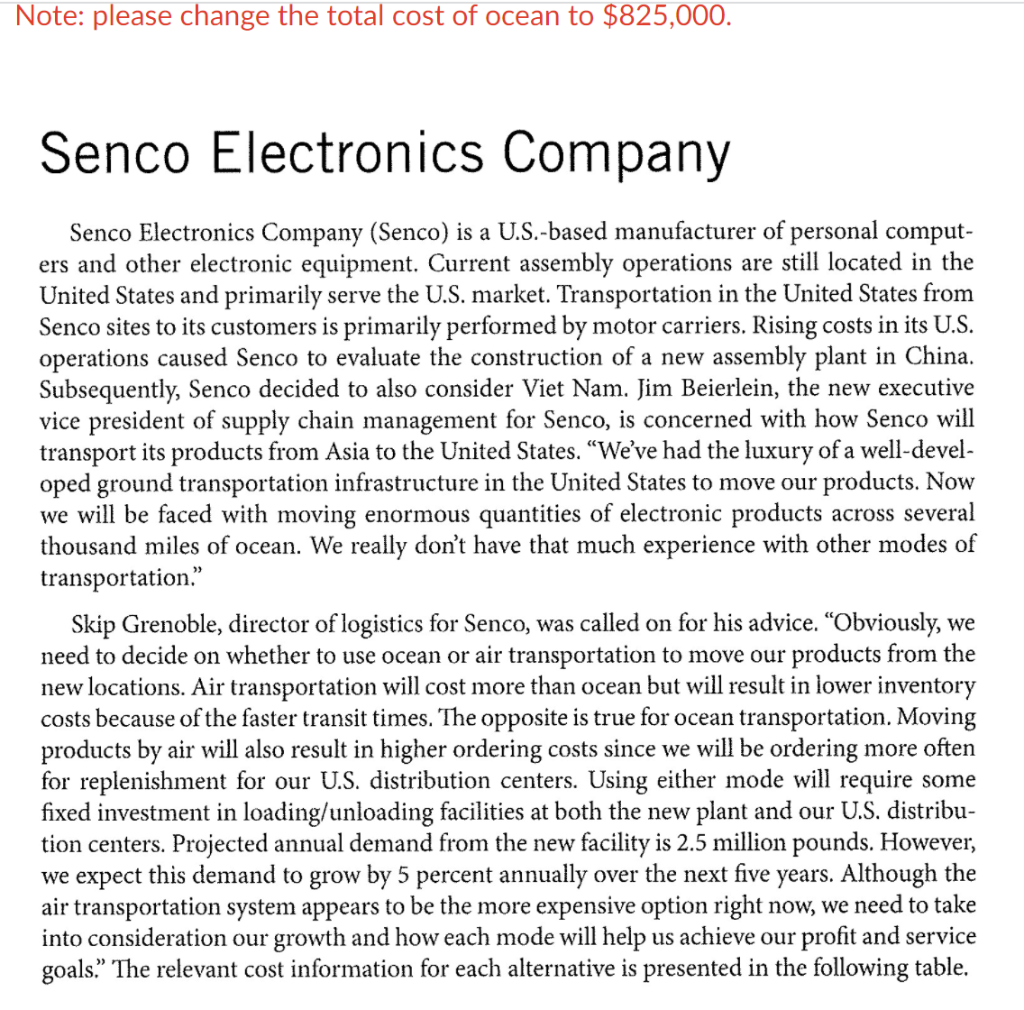

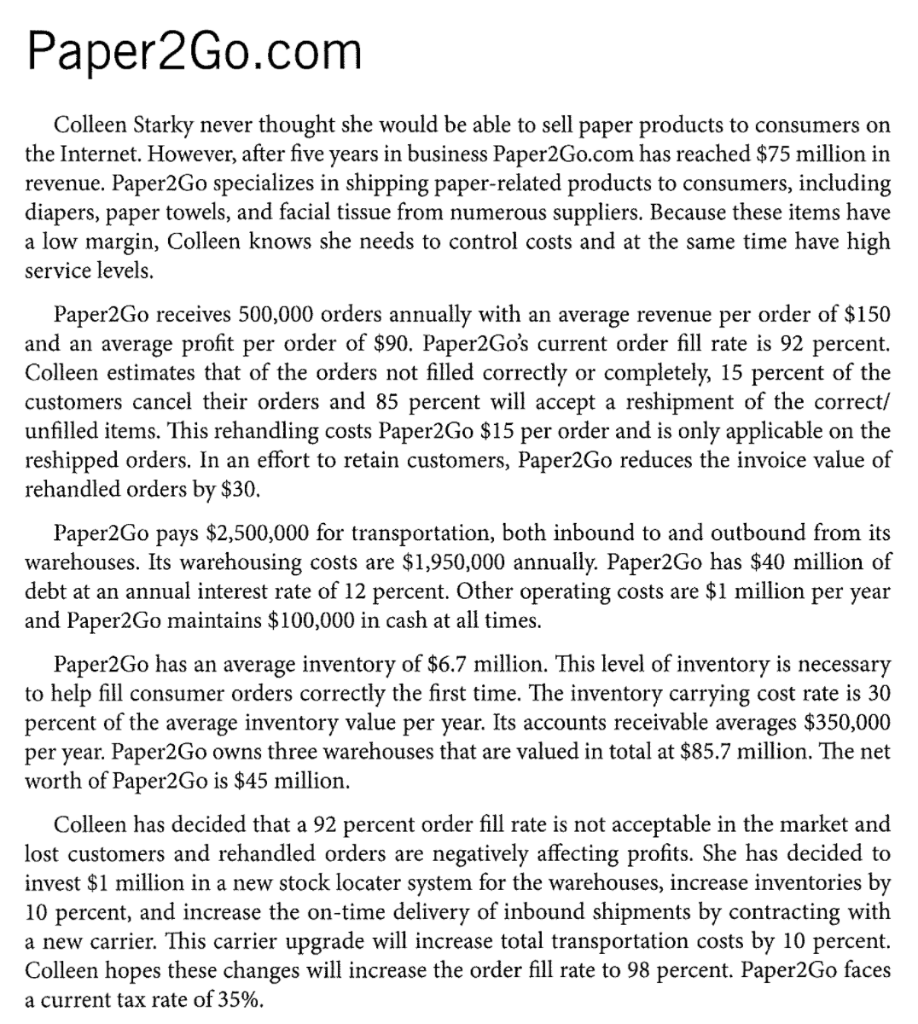

Note: please change the total cost of ocean to $825,000. Senco Electronics Company Senco Electronics Company (Senco) is a U.S.-based manufacturer of personal comput- ers and other electronic equipment. Current assembly operations are still located in the United States and primarily serve the U.S. market. Transportation in the United States from Senco sites to its customers is primarily performed by motor carriers. Rising costs in its U.S. operations caused Senco to evaluate the construction of a new assembly plant in China. Subsequently, Senco decided to also consider Viet Nam. Jim Beierlein, the new executive vice president of supply chain management for Senco, is concerned with how Senco will transport its products from Asia to the United States. We've had the luxury of a well-devel- oped ground transportation infrastructure in the United States to move our products. Now we will be faced with moving enormous quantities of electronic products across several thousand miles of ocean. We really don't have that much experience with other modes of transportation. Skip Grenoble, director of logistics for Senco, was called on for his advice. Obviously, we need to decide on whether to use ocean or air transportation to move our products from the new locations. Air transportation will cost more than ocean but will result in lower inventory costs because of the faster transit times. The opposite is true for ocean transportation. Moving products by air will also result in higher ordering costs since we will be ordering more often for replenishment for our U.S. distribution centers. Using either mode will require some fixed investment in loading/unloading facilities at both the new plant and our U.S. distribu- tion centers. Projected annual demand from the new facility is 2.5 million pounds. However, we expect this demand to grow by 5 percent annually over the next five years. Although the air transportation system appears to be the more expensive option right now, we need to take into consideration our growth and how each mode will help us achieve our profit and service goals." The relevant cost information for each alternative is presented in the following table. OCEAN AIR Total Transportation costs $150,000 $290,000 Inventory costs 48,000 23,000 Carrying Handling 20,000 22,000 Ordering 7,000 15,000 Fixed cost 600,000 450,000 Total costs $823,000 $800,000 If you were Skip Grenoble, which alternative would you advise Jim Beierlein to implement? What criteria would you use to arrive at your decision? Paper2Go.com Colleen Starky never thought she would be able to sell paper products to consumers on the Internet. However, after five years in business Paper2Go.com has reached $75 million in revenue. Paper2Go specializes in shipping paper-related products to consumers, including diapers, paper towels, and facial tissue from numerous suppliers. Because these items have a low margin, Colleen knows she needs to control costs and at the same time have high service levels. Paper2Go receives 500,000 orders annually with an average revenue per order of $150 and an average profit per order of $90. Paper2Go's current order fill rate is 92 percent. Colleen estimates that of the orders not filled correctly or completely, 15 percent of the customers cancel their orders and 85 percent will accept a reshipment of the correct/ unfilled items. This rehandling costs Paper2Go $15 per order and is only applicable on the reshipped orders. In an effort to retain customers, Paper2Go reduces the invoice value of rehandled orders by $30. Paper2Go pays $2,500,000 for transportation, both inbound to and outbound from its warehouses. Its warehousing costs are $1,950,000 annually. Paper2Go has $40 million of debt at an annual interest rate of 12 percent. Other operating costs are $1 million per year and Paper2Go maintains $ 100,000 in cash at all times. Paper2Go has an average inventory of $6.7 million. This level of inventory is necessary to help fill consumer orders correctly the first time. The inventory carrying cost rate is 30 percent of the average inventory value per year. Its accounts receivable averages $350,000 per year. Paper2Go owns three warehouses that are valued in total at $85.7 million. The net worth of Paper2Go is $45 million. Colleen has decided that a 92 percent order fill rate is not acceptable in the market and lost customers and rehandled orders are negatively affecting profits. She has decided to invest $1 million in a new stock locater system for the warehouses, increase inventories by 10 percent, and increase the on-time delivery of inbound shipments by contracting with a new carrier. This carrier upgrade will increase total transportation costs by 10 percent. Colleen hopes these changes will increase the order fill rate to 98 percent. Paper2Go faces a current tax rate of 35%. Paper2Go.com Colleen Starky never thought she would be able to sell paper products to consumers on the Internet. However, after five years in business Paper2Go.com has reached $75 million in revenue. Paper2Go specializes in shipping paper-related products to consumers, including diapers, paper towels, and facial tissue from numerous suppliers. Because these items have a low margin, Colleen knows she needs to control costs and at the same time have high service levels. Paper2Go receives 500,000 orders annually with an average revenue per order of $150 and an average profit per order of $90. Paper2Go's current order fill rate is 92 percent. Colleen estimates that of the orders not filled correctly or completely, 15 percent of the customers cancel their orders and 85 percent will accept a reshipment of the correct/ unfilled items. This rehandling costs Paper2Go $15 per order and is only applicable on the reshipped orders. In an effort to retain customers, Paper2Go reduces the invoice value of rehandled orders by $30. Paper2Go pays $2,500,000 for transportation, both inbound to and outbound from its warehouses. Its warehousing costs are $1,950,000 annually. Paper2Go has $40 million of debt at an annual interest rate of 12 percent. Other operating costs are $1 million per year and Paper2Go maintains $100,000 in cash at all times. Paper2Go has an average inventory of $6.7 million. This level of inventory is necessary to help fill consumer orders correctly the first time. The inventory carrying cost rate is 30 percent of the average inventory value per year. Its accounts receivable averages $350,000 per year. Paper2Go owns three warehouses that are valued in total at $85.7 million. The net worth of Paper2Go is $45 million. Colleen has decided that a 92 percent order fill rate is not acceptable in the market and lost customers and rehandled orders are negatively affecting profits. She has decided to invest $1 million in a new stock locater system for the warehouses, increase inventories by 10 percent, and increase the on-time delivery of inbound shipments by contracting with a new carrier. This carrier upgrade will increase total transportation costs by 10 percent. Colleen hopes these changes will increase the order fill rate to 98 percent. Paper2Go faces a current tax rate of 35%. Baseball Card Emporium Baseball Card Emporium (BBE) of Lewistown, Pennsylvania, is a distributor of baseball cards to sports card retailers. Its market area encompasses most of Pennsylvania, eastern Ohio, and New Jersey. The cards are printed in Neenah, Wisconsin, and currently shipped to Lewistown via motor carrier transportation. Kenny Craig, vice president of logistics, has asked his staff to evaluate using air carrier service to ship the cards. Nick Gingher, director of distribution, has collected the following information: Annual demand: 5,000 cases of cards Case value (price): $200 each Inventory carrying cost (annual): 28% . Cost per order to replenish inventory: $100 In-transit inventory carrying cost: 18% Transit time using motor carrier: 5 days Transit time using air carrier: 2 days Motor carrier rate: $0.80 per cwt. (100 lbs.) Air carrier rate: $1.50 per cwt. Unit weight: 50 lbs. per case CASE QUESTIONS 1. What is the economic order quantity for BBE in units? In pounds? 2. What is the total cost (not considering transportation-related costs) of the EOQ? 3. What is the total cost for using motor carrier transportation? 4. What is the total cost for using air carrier transportation? 5. Which alternative should BBE use