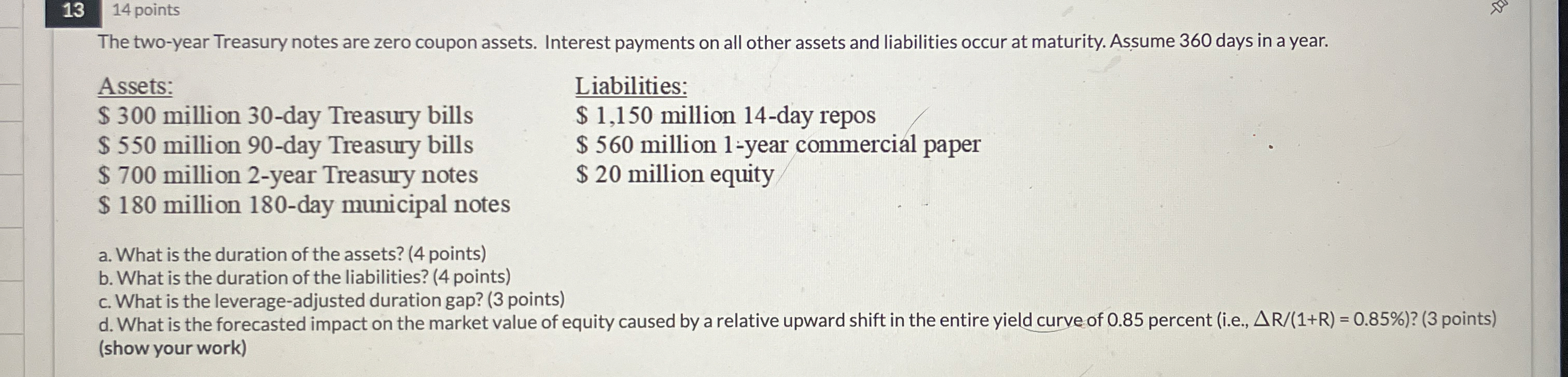

Question: 1 3 1 4 points The two - year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at

points

The twoyear Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume days in a year.

Assets:

$ million day Treasury bills

$ million day Treasury bills

$ million year Treasury notes

$ million day municipal notes

a What is the duration of the assets? points

b What is the duration of the liabilities? points

c What is the leverageadjusted duration gap? points

d What is the forecasted impact on the market value of equity caused by a relative upward shift in the entire yield curve of percent ie points

Liabilities:

$ million day repos

$ million year commercial paper

$ million equity

show your work

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock