Question: 1 3 . 1 7 Values for the NASDAQ Composite index during the 1 , 5 0 0 days preceding March 1 0 , 2

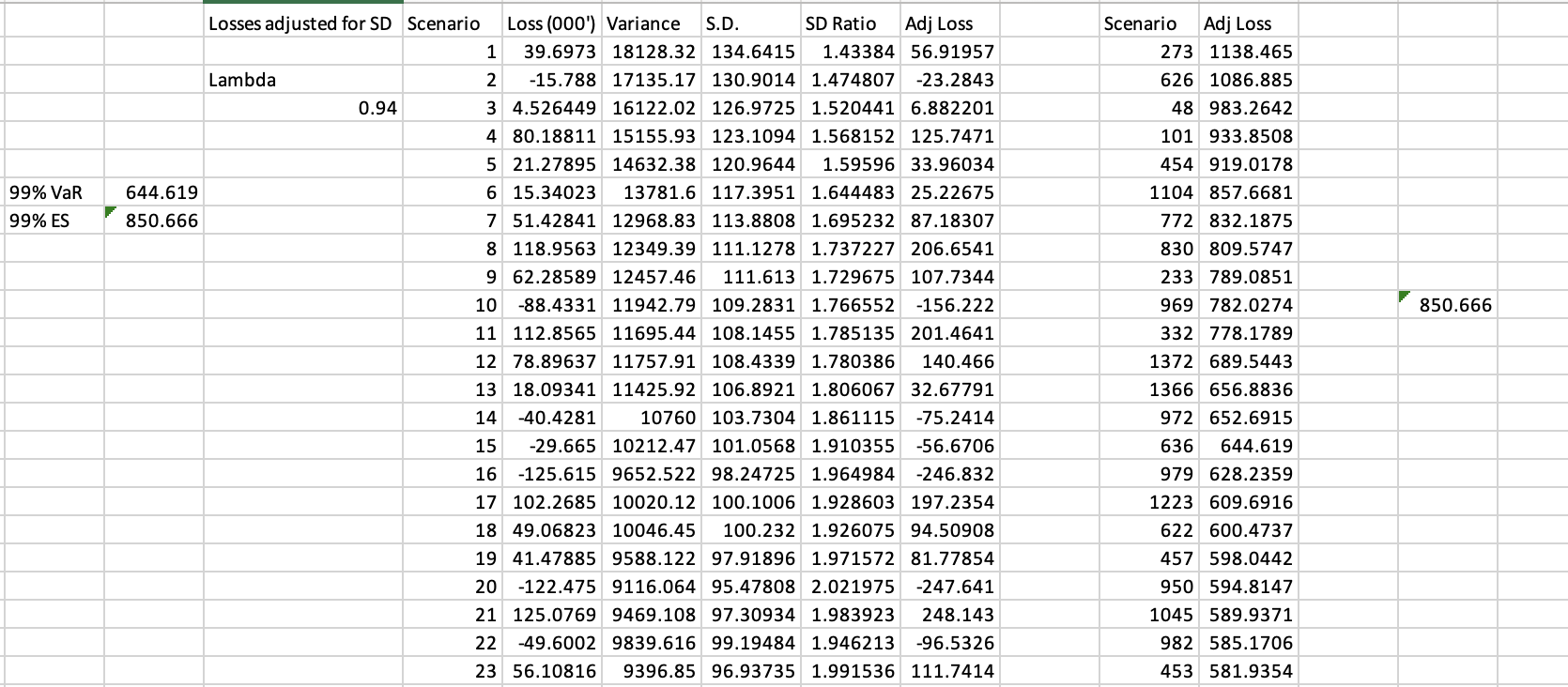

Values for the NASDAQ Composite index during the days preceding March can be downloaded from the authors website. Calculate the oneday VaR and oneday ES on March for a $ million portfolio invested in the index using: a The volatilityscaling procedures in Sections and with Section talks about Market Variable Movements are adjusted for volatility, whereas Section talks about Losses are adjusted for loss standard deviation I found out the answers are the same for both parts, which I believe should not be the case. I have attached a screenshot for your reference

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock