Question: 1 3 . 3 Reserve Prices ( Easier ) : Consider a seller who must sell a single private value good. There are two potential

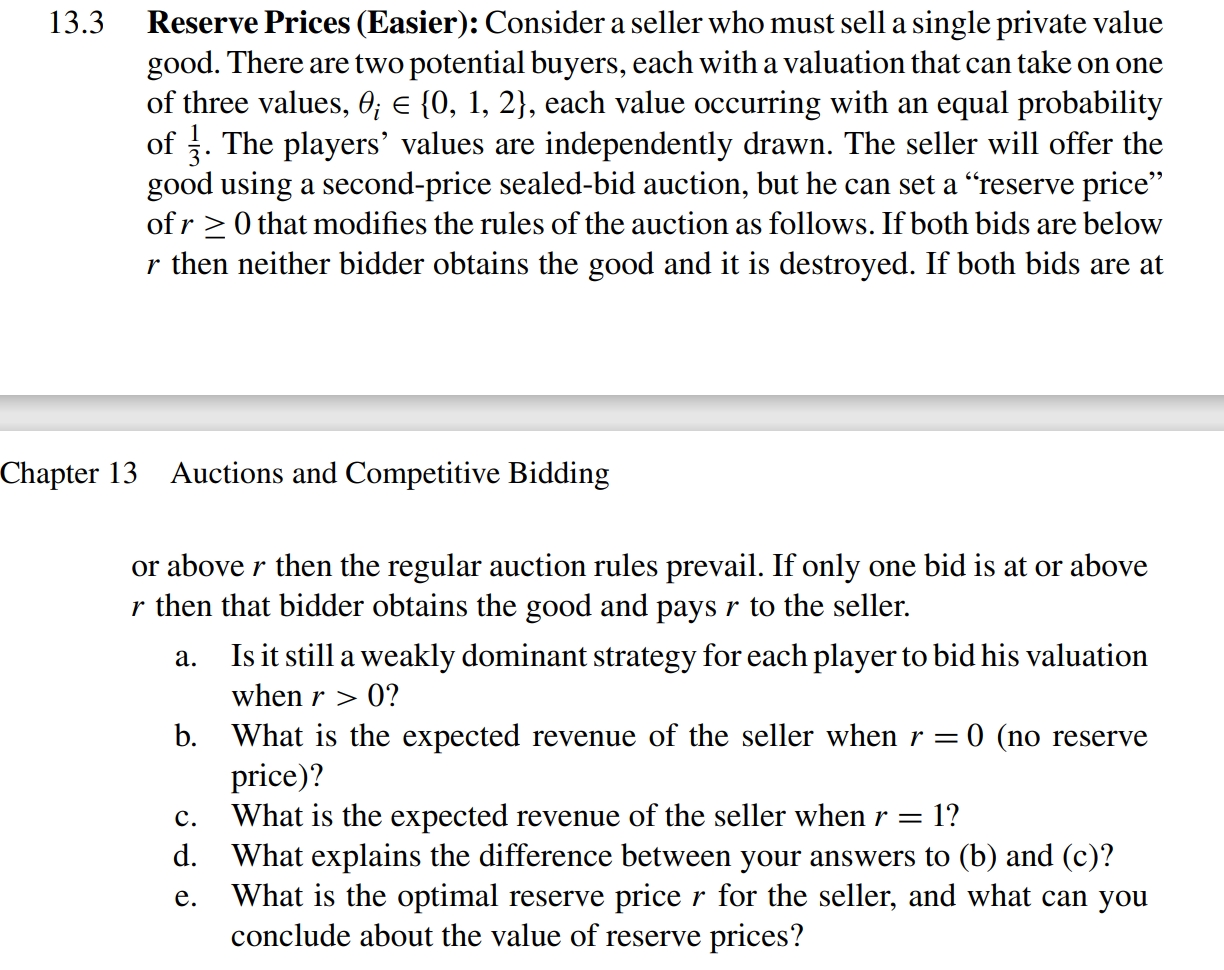

Reserve Prices Easier: Consider a seller who must sell a single private value

good. There are two potential buyers, each with a valuation that can take on one

of three values, thetaiin each value occurring with an equal probability

of The players' values are independently drawn. The seller will offer the

good using a secondprice sealedbid auction, but he can set a "reserve price"

of r that modifies the rules of the auction as follows. If both bids are below

r then neither bidder obtains the good and it is destroyed. If both bids are at

Chapter Auctions and Competitive Bidding

or above r then the regular auction rules prevail. If only one bid is at or above

r then that bidder obtains the good and pays r to the seller.

a Is it still a weakly dominant strategy for each player to bid his valuation

when r

b What is the expected revenue of the seller when rno reserve

price

c What is the expected revenue of the seller when r

d What explains the difference between your answers to b and c

e What is the optimal reserve price r for the seller, and what can you

conclude about the value of reserve prices?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock