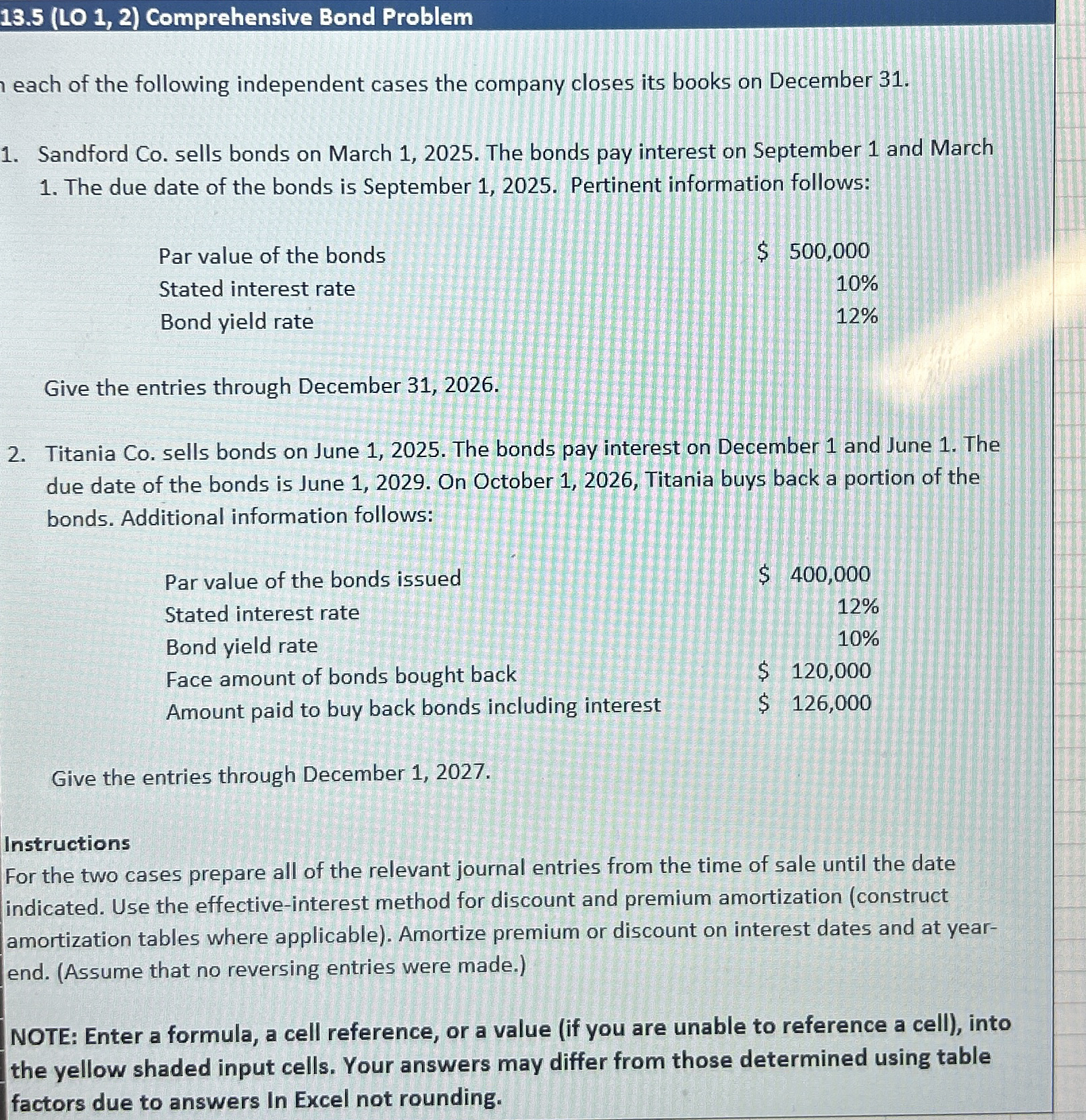

Question: 1 3 . 5 ( LO 1 , 2 ) Comprehensive Bond Problem each of the following independent cases the company closes its books on

LO Comprehensive Bond Problem

each of the following independent cases the company closes its books on December

Sandford Co sells bonds on March The bonds pay interest on September and March The due date of the bonds is September Pertinent information follows:

Par value of the bonds

Stated interest rate

$

Bond yield rate

Give the entries through December

Titania Co sells bonds on June The bonds pay interest on December and June The due date of the bonds is June On October Titania buys back a portion of the bonds. Additional information follows:

Par value of the bonds issued

tableStated interest rate,Bond yield rate,Face amount of bonds bought back,$Amount paid to buy back bonds including interest,$

Give the entries through December

Instructions

For the two cases prepare all of the relevant journal entries from the time of sale until the date indicated. Use the effectiveinterest method for discount and premium amortization construct amortization tables where applicable Amortize premium or discount on interest dates and at yearend. Assume that no reversing entries were made.

NOTE: Enter a formula, a cell reference, or a value if you are unable to reference a cell into the yellow shaded input cells. Your answers may differ from those determined using table factors due to answers In Excel not rounding.anford La

Caloulation of issue price using Excel'sFV function

Schedule of Bond Discount Amortization

Effective Interest Method

Bonds Sold to Yield

tableDatetableCashPaidtableInterestExpensetableBondDiscounttableCarryingValue W

tableDebit,Credit

table$WTill,,

table

table

table

tableItitania Co

Calculation of issue price using Excel's PV Function

Schedule of Bond Premium Amortization

Effective Interest Method

Bonds Sold to Yield

tableDatetableCashFaidtableInterestExpensetableBondFremiumtableCarryingValueJun $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock