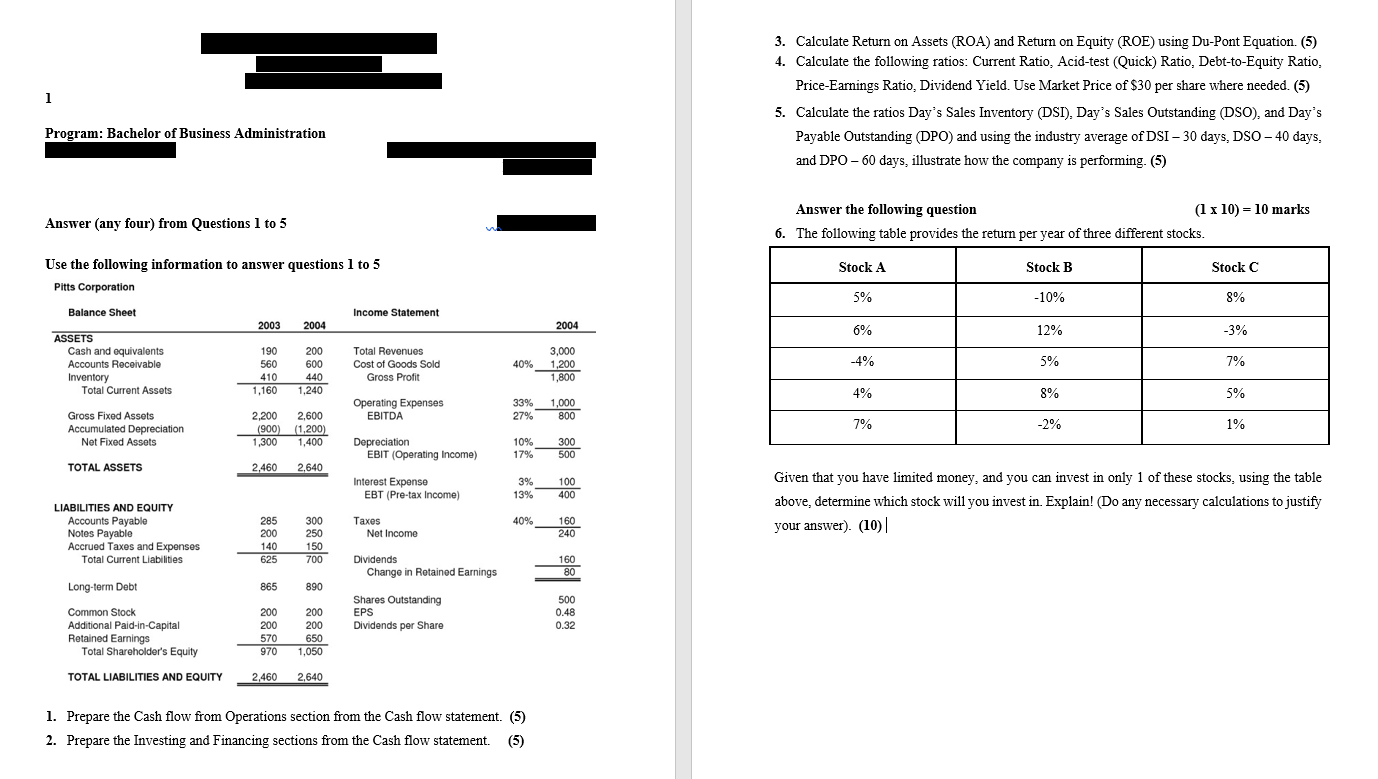

Question: 1 3. Calculate Return on Assets (ROA) and Return on Equity (ROE) using Du-Pont Equation (5) 4. Calculate the following ratios: Current Ratio, Acid-test (Quick)

1 3. Calculate Return on Assets (ROA) and Return on Equity (ROE) using Du-Pont Equation (5) 4. Calculate the following ratios: Current Ratio, Acid-test (Quick) Ratio, Debt-to-Equity Ratio, Price-Earnings Ratio, Dividend Yield. Use Market Price of $30 per share where needed. (5) 5. Calculate the ratios Day's Sales Inventory (DSI). Day's Sales Outstanding (DSO), and Day's Payable Outstanding (DPO) and using the industry average of DSI 30 days, DSO-40 days, and DPO - 60 days, illustrate how the company is performing. (5) Program: Bachelor of Business Administration Answer (any four) from Questions 1 to 5 Answer the following question (1 x 10) = 10 marks 6. The following table provides the return per year of three different stocks. Use the following information to answer questions 1 to 5 Pitts Corporation Stock A Stock B Stock C 5% -10% 8% Balance Sheet Income Statement 2003 2004 2004 6% 12% -3% ASSETS Cash and equivalents Accounts Receivable Inventory Total Current Assets 40% Total Revenues Cost of Goods Sold Gross Profit -4% 190 560 410 1,160 3,000 1,200 1,800 5% 200 600 440 1,240 7% 4% 8% 5% Operating Expenses EBITDA 33% 27% 1,000 800 Gross Fixed Assets Accumulated Depreciation Net Fixed Assets 2,200 2,600 (900) (1,200) 1,300 1,400 7% -2% 1% Depreciation EBIT (Operating Income) 10% 17% 300 500 TOTAL ASSETS 2,460 2,640 Interest Expenso EBT (Pre-tax Income) ) 3% 13% 100 400 Given that you have limited money, and you can invest in only 1 of these stocks, using the table above, determine which stock will you invest in. Explain! (Do any necessary calculations to justify your answer). (10) LIABILITIES AND EQUITY Accounts Payable Notes Payable Accrued Taxes and Expenses Total Current Liabilities Taxes Net Income 40% 160 240 285 200 140 625 300 250 150 700 Dividends Change in Retained Earnings 160 80 Long-term Debt 865 890 500 0.48 0.32 Common Stock Additional Paid-in-Capital Retained Earnings Total Shareholder's Equity 200 200 570 970 Shares Outstanding EPS Dividends per Share 200 200 650 1,050 TOTAL LIABILITIES AND EQUITY 2,460 2,640 1. Prepare the Cash flow from Operations section from the Cash flow statement. (5) 2. Prepare the Investing and Financing sections from the Cash flow statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts