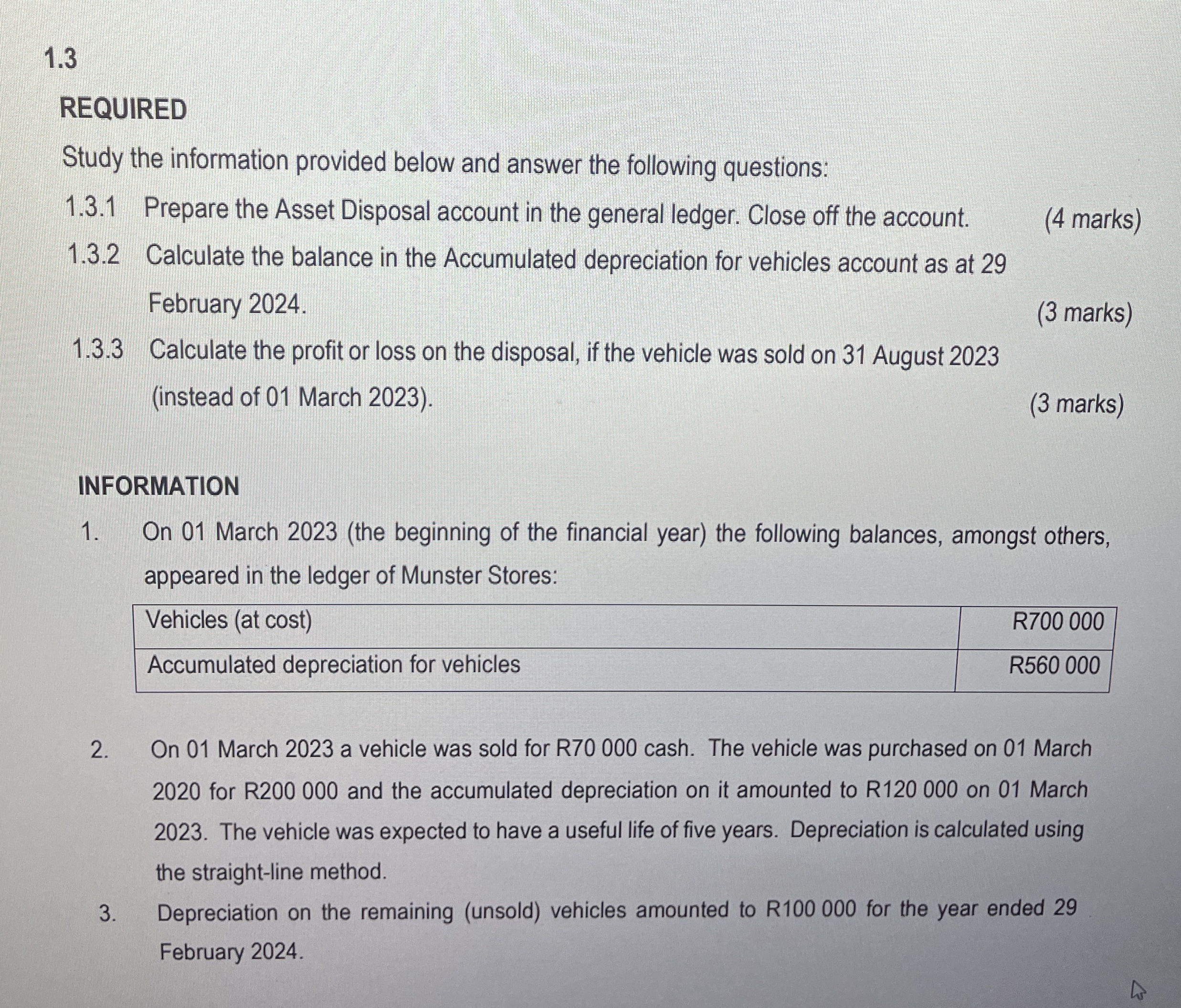

Question: 1 . 3 REQUIRED Study the information provided below and answer the following questions: 1 . 3 . 1 Prepare the Asset Disposal account in

REQUIRED

Study the information provided below and answer the following questions:

Prepare the Asset Disposal account in the general ledger. Close off the account.

marks

Calculate the balance in the Accumulated depreciation for vehicles account as at February

marks

Calculate the profit or loss on the disposal, if the vehicle was sold on August instead of March

marks

INFORMATION

On March the beginning of the financial year the following balances, amongst others, appeared in the ledger of Munster Stores:

On March a vehicle was sold for R cash. The vehicle was purchased on March for R and the accumulated depreciation on it amounted to R on March The vehicle was expected to have a useful life of five years. Depreciation is calculated using the straightline method.

Depreciation on the remaining unsold vehicles amounted to R for the year ended February

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock